A large entity has struck down the price of the Ethereum ($ETH)-based indexing protocol The Graph ($GRT), according to crypto analytics firm Santiment.

Santiment says that a whale, likely a crypto exchange, disposed of over $55 million worth of $GRT, and the price has been down ever since.

“The Graph has seen a mid-sized price [correction] after a multi-asset whale disposed of $55.3M worth of $GRT, as picked up by [Santiment] data. Pay attention to the altcoins moving into self-custody, and avoid those showing big inflows to exchanges.”

According to the firm, the whale sold off its $GRT stack at $0.130. At time of writing, The Graph is trading for $0.128.

Santiment says Ethereum itself is also struggling to maintain its price structure as $ETH holders appear to be quick in taking profits, even after a relatively soft rally in the last week.

“Ethereum is getting a large amount of profit-taking transactions after a mild +5% price jump the past week. Typically, we want to see a lot of traders hodling, and if this ratio comes down to Earth, it would be a signal $ETH is on its way to $2,000.”

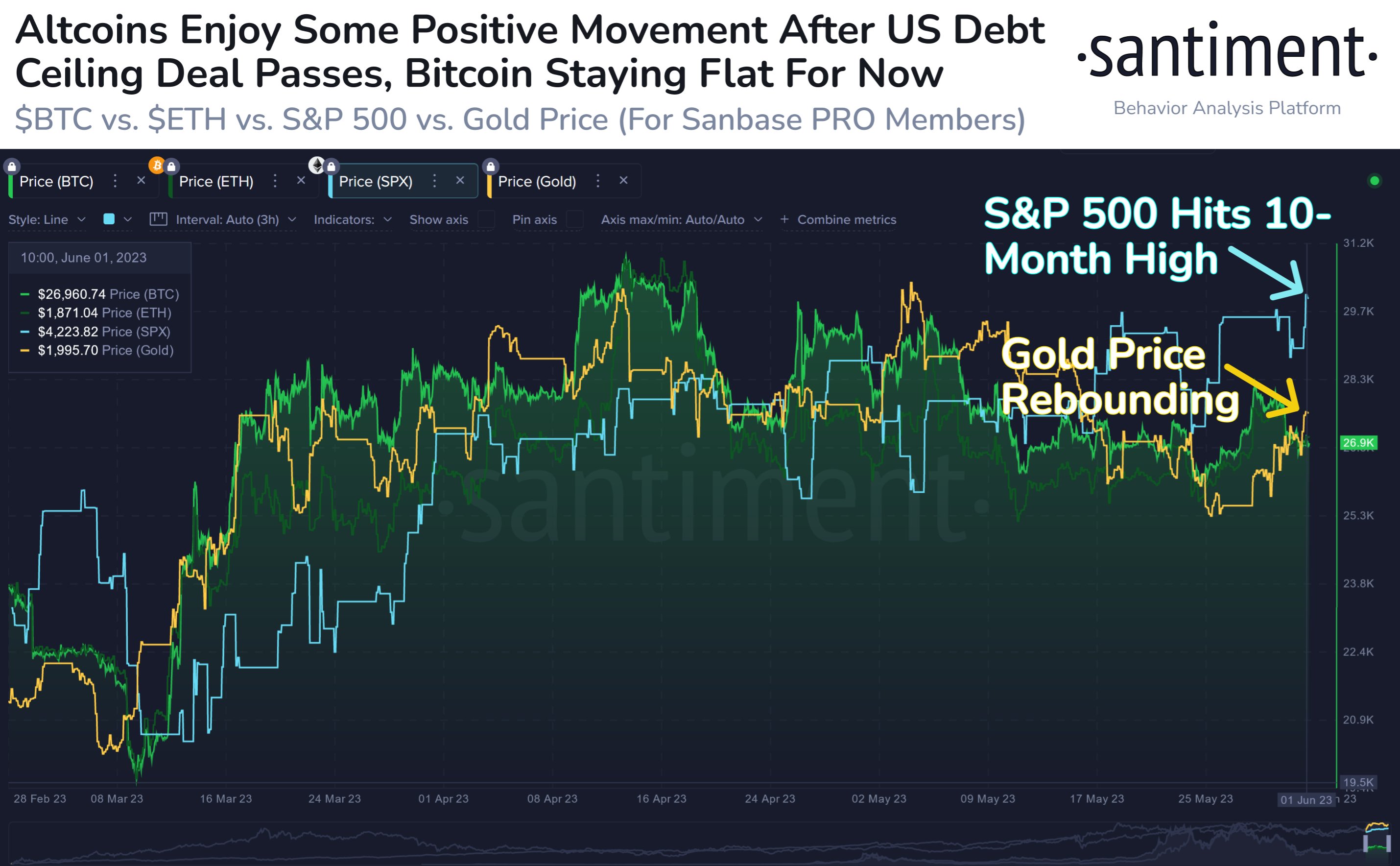

Looking at Bitcoin ($BTC), the firm says the top crypto asset by market cap could be set to play “catch up” with equities and other altcoins in the coming days, especially with the news that the US government has decided to raise the debt ceiling, which has been generally perceived as bullish by analysts.

“The US House has passed a key debt ceiling deal, launching the S&P500 to its highest price since August. Altcoins like LTC, LEO, and FGC have jumped today. With crypto lagging behind equities, there could be some $BTC catch-up time coming soon.”

dailyhodl.com

dailyhodl.com