After its network fees returned to their normal levels, the price of Ethereum (ETH) has moved in a slightly upward fashion, but there is still a strong resistance level it needs to turn into support to make a more significant upward move.

Specifically, pseudonymous cryptocurrency analyst Crypto Tony has noted the optimism surrounding the recent Ethereum price increase but also advised to zoom out, as “we really are not bullish unless we flip $2,000 into support,” according to the tweet and chart pattern analysis he shared on June 2.

As the crypto expert specified, “the clue in the bears control is in the highlighted section. 3 wave up from lows is bearish.” Indeed, according to the chart analysis, Ethereum is currently performing a corrective move up, with “another leg down overall” in the cards.

Ethereum price analysis

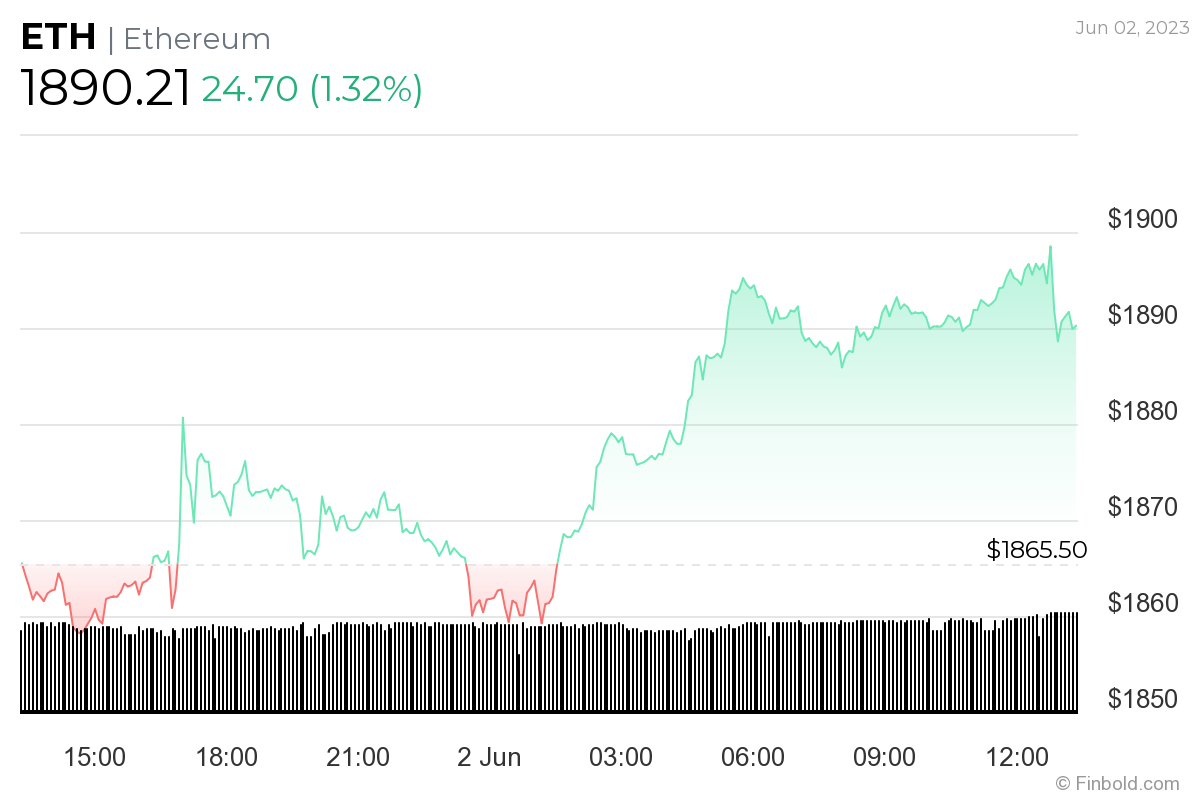

For the moment, Ethereum is changing hands at $1,890.21. This price demonstrates the digital asset’s upward move of 1.32% on the day, whereas, on the weekly chart, it has gained 4.23%, as well as increasing 1.80% in the last month, as the latest data suggests.

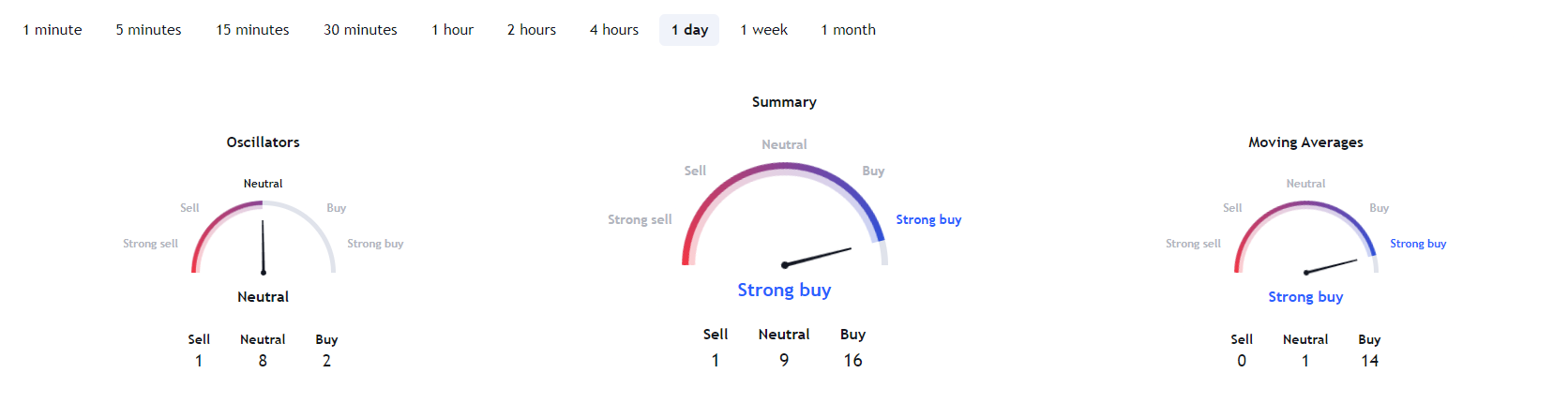

At the same time, the sentiment on the 1-day technical analysis (TA) gauges at the finance and crypto monitoring platform TradingView are exceptionally bullish, suggesting a ‘strong buy’ at 16, as moving averages (MA) point to a ‘strong buy’ at 14, and oscillators remain in the ‘neutral’ area at 8.

Earlier, when Ethereum managed to break above the crucial $1,825 area, crypto market analyst Michaël van de Poppe stressed that it could push the second-largest digital asset by market capitalization toward another major leap to $2,000, as Finbold reported on May 24.

Whether it truly succeeds in flipping this critical level will depend on the further optimistic sentiment around the Ethereum network, contributed by positive developments like the declining average fees and record-breaking staking deposits, as well as the general optimism on the wider crypto and macroeconomic landscape.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com