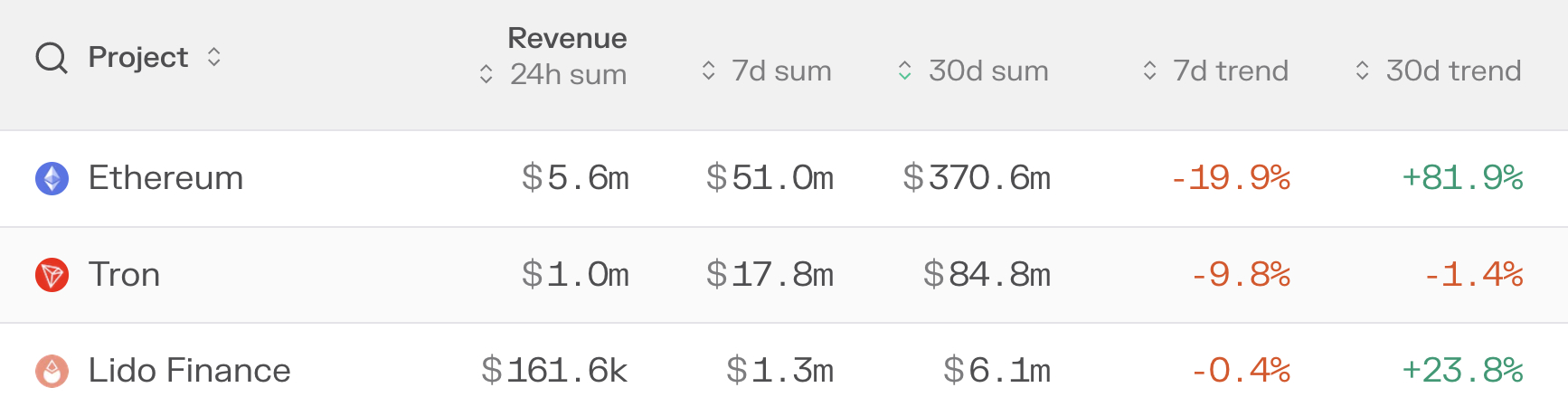

The Ethereum (ETH) network and staking provider Lido Finance (LDO) are among the biggest revenue generators in the world of decentralized finance (DeFi), a ranking by data provider Token Terminal has shown.

In the ranking, Ethereum came in on top with a 30-day revenue generation of $370.6 million as of Monday, while Lido Finance ended up on a third place with $6.1 million.

Justin Sun’s blockchain network Tron (TRX) secured the second place with a 30-day revenue generation of $84.8 million.

The most noteworthy, however, is not the revenue figure itself, but the fact that both Ethereum and Lido Finance has seen its 30-day revenue grow significantly in the past month.

Among all of the best-known DeFi projects, Ethereum and Lido Finance now have the strongest 30-day trend growth in terms of revenue generation, with increases of 81.9% and 23.8%, respectively.

Looking at the longer-term 180-day period, Ethereum’s dominance becomes even stronger, with a whopping $1 billion in revenue collected.

On the 180-day timeframe, Lido Finance came in 6th with $25.1 million in revenue, just behind projects like NFT marketplace OpenSea and the decentralized exchange GMX.

At the time of writing on Monday, the total value locked (TVL) on the entire Ethereum network stood at $27.9 billion, with Lido Finance responsible for almost half of it.

Lido Finance, on its end, had a TVL of $13.1 billion, data from DefiLlama showed.

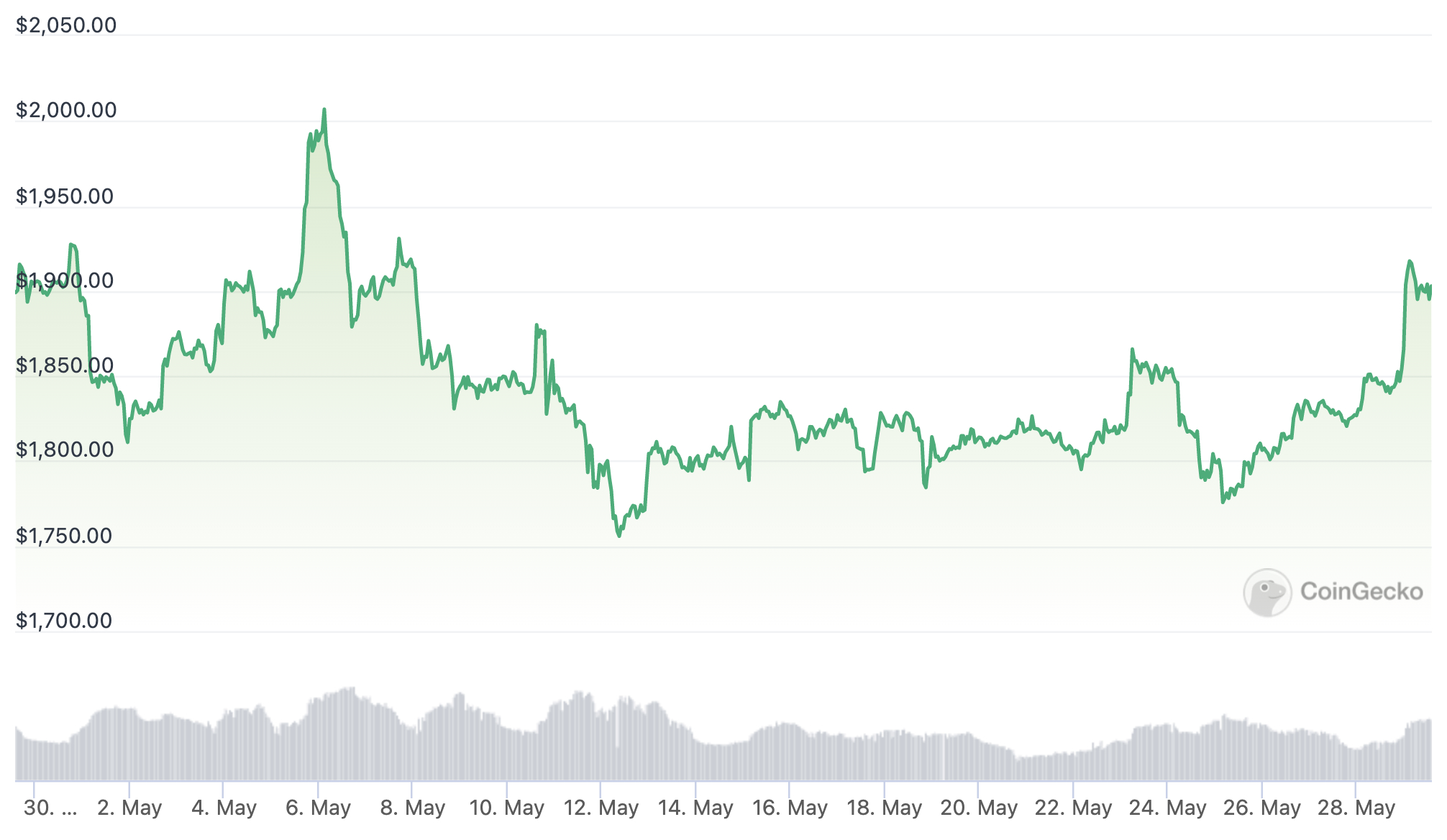

As of press time on Monday, ETH was up close to 3.2% for the past 24 hours, trading right around the $1,900 level.

The price is up 5% in the past week, but remains almost unchanged on a 30-day basis, data from CoinGecko shows.

cryptonews.com

cryptonews.com