Crypto whales have been accumulating Lido LDO tokens over the past week. The moves come in the lead-up to the release of staked Ethereum from the platform.

On May 16, the on-chain analytics feed ‘Lookonchain’ identified three whale accounts that have been accumulating LDO.

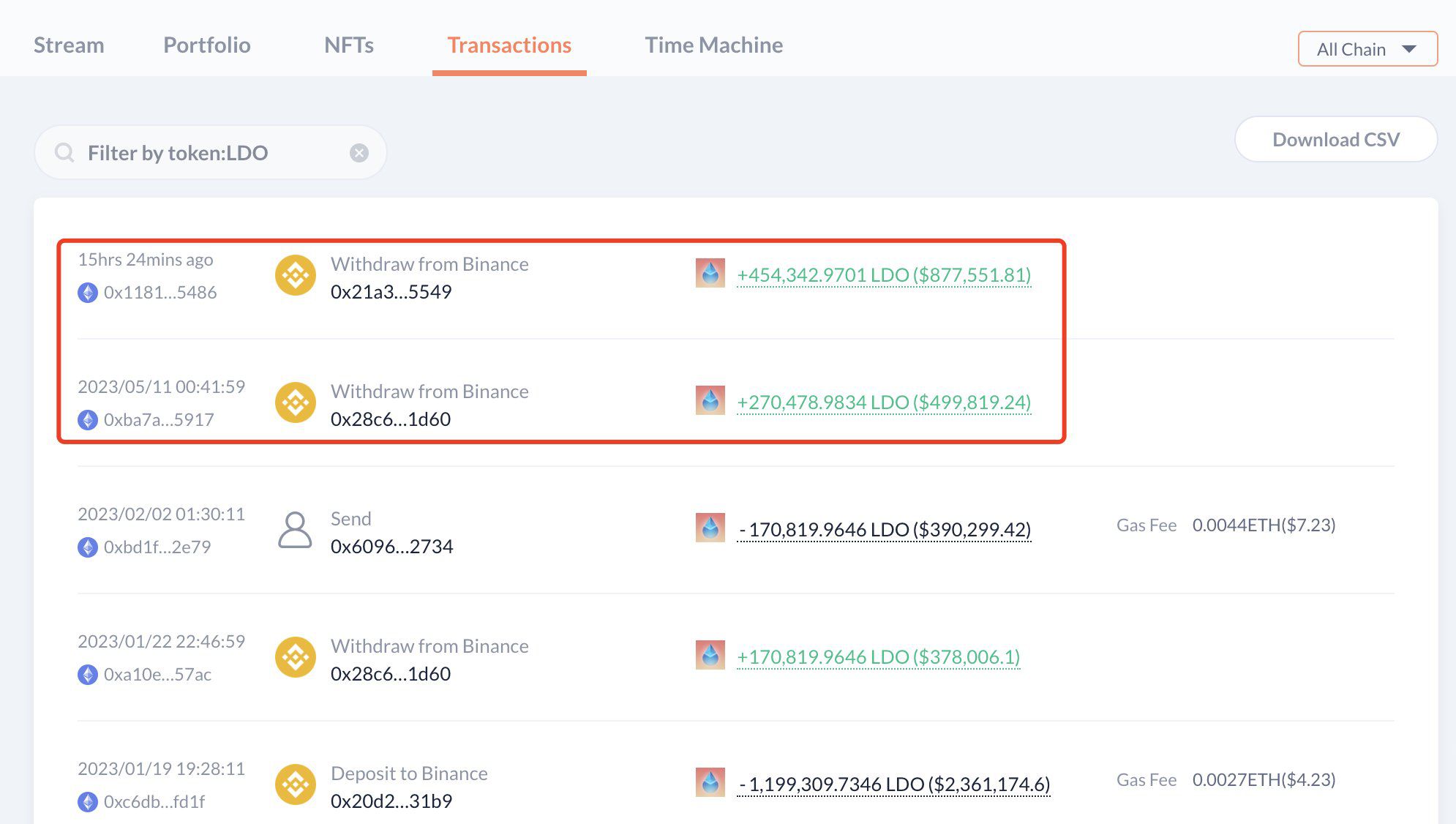

“Due to the launch of Lido V2, we noticed 3 whales accumulating LDO in the past week,” it reported.

Lido Whales Load Up

One address withdrew 724,822 LDO worth around $1.52 million from Binance at a price of $2.01. Another whale withdrew 655,641 LDO worth $1.38 million from Binance at $1.83. The third whale bought 570,883 LDO with 974,000 USDC at $1.71 on May 12.

Moreover, LDO prices have bucked the market trend with big moves over the past few days.

Staked ETH Withdrawals Enabled

On May 15, the liquid staking platform enabled staked ETH withdrawals as part of its V2 upgrade.

Lido announced that V2 introduces two major components, “with the most user-facing aspect being Ethereum withdrawals.”

A new withdrawals page enables users to deposit their staked Ethereum (stETH or wstETH) tokens to get ETH in return. Lido noted that the withdrawal period can be anything from one to five days.

Additionally, the V2 upgrade also includes a modular staking router. This promotes staking diversity by various cohorts, such as solo stakers, DAOs, and Distributed Validator Technology (DVT) clusters.

Nansen’s Shapella dashboard is still reporting that there are more ETH deposits than withdrawals. However, it has yet to include those from Lido, which has 29% of the staked total.

Deposits have been outpacing withdrawals so far, and the total amount locked in is around 18.3 million ETH. This represents 15.2% of the entire supply and is valued at around $33 billion.

LDO Price Pumps

The Lido DAO token surged 8% on the day to reach $2.11 at the time of writing. LDO has gained 15% over the past week in the run-up to the V2 launch.

LDO has been one of the better-performing crypto assets so far this year, having gained 122% since Jan. 1.

Ethereum prices, on the other hand, have been a bit sluggish recently. As a result, ETH has dipped by 1% on the day to trade at $1,811 at the time of writing. Crypto markets have been down-trending for the past month and will likely continue in the near term.

beincrypto.com

beincrypto.com