LSD tokens are heading higher.

Lido Finance (LDO) and Rocket Pool (RPL) led weekly market gains with 22.9% and 12.8% price surges, respectively, even amid a widely bearish move from the broader crypto market.

Ethereum's price lost 1.% in the last seven days, according to CoinGecko data.

Liquid staking refers to the process of depositing ETH into a protocol that then deposits those assets to the Ethereum mainnet.

Unlike depositing directly to mainnet, which requires a minimum deposit of 32 ETH, services like Lido Finance allow anyone to stake any amount.

In exchange for staking, users receive a staked version of ETH; Lido’s derivative token is called stETH, for example.

Ethereum staking post-Shapella

These days, such projects have taken center stage following the successful Shapella upgrade last month.

A merge of two key upgrades, Shanghai and Capella, Shapella let stakers finally withdraw their Ethereum from the mainnet. Many users had begun staking back in 2020 when the network began its transition to a proof-of-stake consensus algorithm.

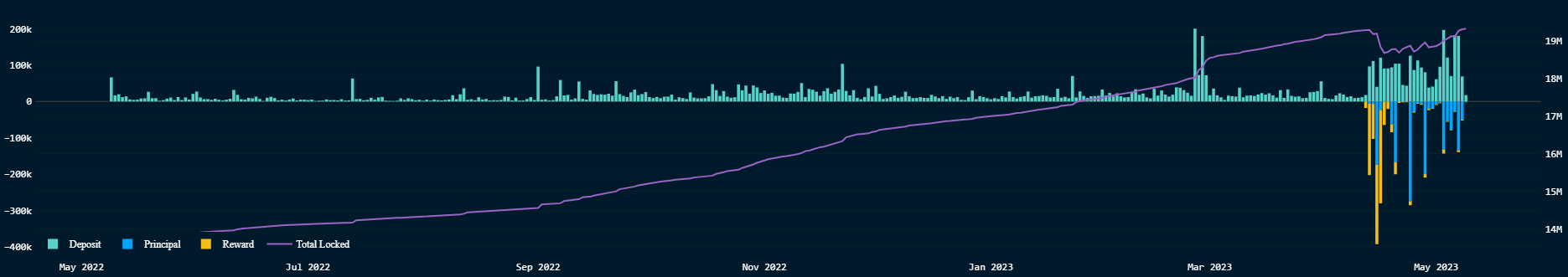

The staking contract had 19.27 million ETH locked in a day before Shapella went live on April 12, per Nasnen’s Ethereum staking dashboard.

A month after the Shapella upgrade, the staking contract has reclaimed pre-Shapella levels with around 19.3 million ETH staked.

The first week after the upgrade saw a 3.1% decline in staked ETH to a low of 18.67 million on April 17. Deposits picked up after that, however, and decentralized LSD platforms have been one of the biggest beneficiaries.

These platforms are gradually building a moat in this sector, with a dominant 36% market share compared to other staking methods like direct staking or via centralized exchanges like Coinbase.

For instance, the share of Coinbase’s staked ETH derivative, cbETH, has shrunk from 16.4% to 14.5% since the Shapella upgrade. In fact, it has declined since the start of the year.

A Dune dashboard by data analyst owen05 shows that Lido Finance has maintained its lead, with the amount of staked ETH increasing by 9.87% in the last 30 days.

Stakewise and Frax Finance have also fared well, with 38.73% and 3.71% increases in the last 30 days.

In the last 24 hours, tokens backing other staking projects like Frax Finance (FXS), StakeWise (SWISE), and ANKR, all rose between 3% and 6%.

decrypt.co

decrypt.co