Ethereum whales are showing signs of panic following the sale of substantial holdings by both Vitalik Buterin and the Ethereum Foundation. Recently, two significant Ethereum whales dumped a combined total of 19,090 ETH, valued at approximately $35.7 million, on Uniswap after the Ethereum Foundation offloaded 15,000 ETH ($29.7 million) to Kraken. These considerable sales have sent shockwaves throughout the Ethereum community and are causing concern among investors.

The panic set in when the first whale, identified as 0x6071, exchanged 9,950 ETH for 18.63 million DAI at a rate of $1,873 per ETH. Shortly after, another whale, 0x7641, followed suit and exchanged 9,140 ETH for 17.07 million DAI at a rate of $1,867 per ETH. These massive sales have ignited concerns among Ethereum holders and prompted a surge in selling activity beyond the whale group.

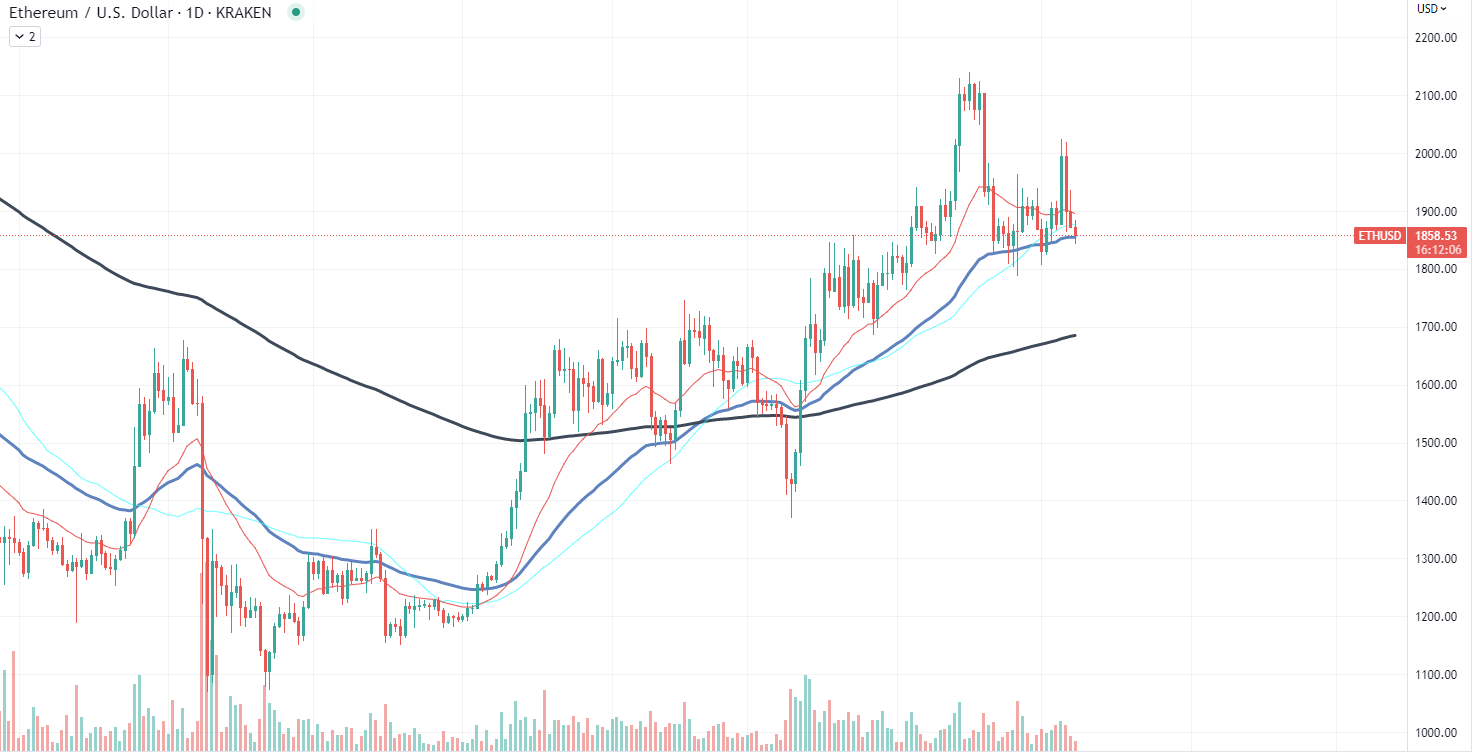

The increased selling pressure has had a significant impact on Ethereum's price, which plummeted from $1,900 to $1,850 within hours following a surge in selling activity. As a result, Ether is now consolidating around the 50-day moving average, causing uncertainty and speculation among investors.

The recent actions of Vitalik Buterin and the Ethereum Foundation have raised questions about the future of the cryptocurrency and the implications of such large-scale selling on the market. Some analysts argue that the sales might be a response to the recent rally of meme assets on the cryptocurrency market.

In any case, panic among Ethereum whales has highlighted the vulnerability of the market to the actions of influential individuals and organizations. The foundation's actions are not causing fluctuations on the market for the first time. The last time the foundation sold its holdings, the industry entered a prolonged bear market that it has not exited to this day.

u.today

u.today