The latest Ethereum fork date has been confirmed for April 12th, 2023. Called the Shanghai upgrade it is first major Ethereum upgrade since the Merge in September 2022.

The Ethereum foundation stated that the Merge was ‘the most significant upgrade in the history of Ethereum.’ The Merge witnessed the joining together or ‘merging’ of the execution layer with a consensus layer called the Beacon chain that had been running separately until then. The Beacon chain uses a Proof-of-Stake (PoS) consensus model that replaced the Proof-of-Work (PoW) model that the mainnet previously used.

What Is The Shanghai Upgrade?

The ETH Shanghai upgrade via Ethereum Improvement Proposal-4895 enables the withdrawal of staking rewards that were earned by participating in Ethereum Proof-of-Stake Consensus. Users will also be able to exit staking entirely and unlock their full validator balance. The Shanghai upgrade is affecting execution clients and this ETH fork is occurring in parallel with consensus client upgrade Capella.

Together, these updates are commonly referred to as "Shapella". Versions of the Upgrades on the Sepolia and Georli testnets are now complete and the functionality of ETH staking withdrawal has been clearly defined. The mainnet upgrade is now ready and is ETH fork date is set for April 12th.

Shapella is the first simultaneous upgrade of Ethereum’s executions and consensus layers.

How Does ETH staking work?

Post-Merge Ethereum operates as a single blockchain with two layers. The execution layer is where Ethereum transactions are processed and then broadcast to the rest of the network and the consensus layer manages transaction settlement and finality via the proof-of-stake consensus model.

Ethereum staking refers to participation in Ethereum's transaction validation. Users lock-in, or ‘stake’ their ETH tokens on the blockchain in order to earn transaction validation opportunities that secure the network in exchange for rewards.

The key outcome of Shapella will be to allow the ETH validators who manage proof-of-stake consensus to shift their balances, currently locked on the consensus layer, to an execution layer address. This is simply an address that any everyday user of the Ethereum network is familiar with. This means validators will finally be able to unstake their ETH and staking rewards.

Perhaps the most significant impact of the Shanghai upgrade will be that it will the first time in recent history when the entire ETH staking community will be able to change how, who, and where they stake their Ethereum.

Ethereum functions as a decentralized network of validators who collectively secure and push forward the blockchain. Ethereum underpins a broader social community and stakers can use their stake to essentially vote on what network consensus will look like. If more stakers prefer assigning their stakes to a large institutional custodian then Ethereum will be less democratic than a consensus with a majority of independent stakers.

Staking on Ethereum can occur in many ways including —

* Solo staking and running independently

* Using a non-custodial staking service like Consensys Staking

* Using a liquid staking service like LIDO

So far, because ETH staking withdrawals have not been available, Ethereum holders have been constrained in how they stake and signal their values. The Capella upgrade will offer an opportunity for stakers to vote with their stake. This may mean withdrawing their previously locked stakes and liquidating or shifting their stake to a staking method that more aligns with their values.

New Features —

* Capella delivers the ability to update the withdrawal credentials of an Ethereum validator from the older 0x00-type (derived from a BLS key), to the newer 0x01-type (derived from an Ethereum address).

* It will allow for partial withdrawals, or the periodic and automatic “skimming” of earned, consensus layer rewards from an active validator’s balance (that has more than 32 ETH).

* It will enable full withdrawals, or the reclaiming of an “exited” validator’s entire balance.

Ethereum Upgrade - What Do The Charts Say?

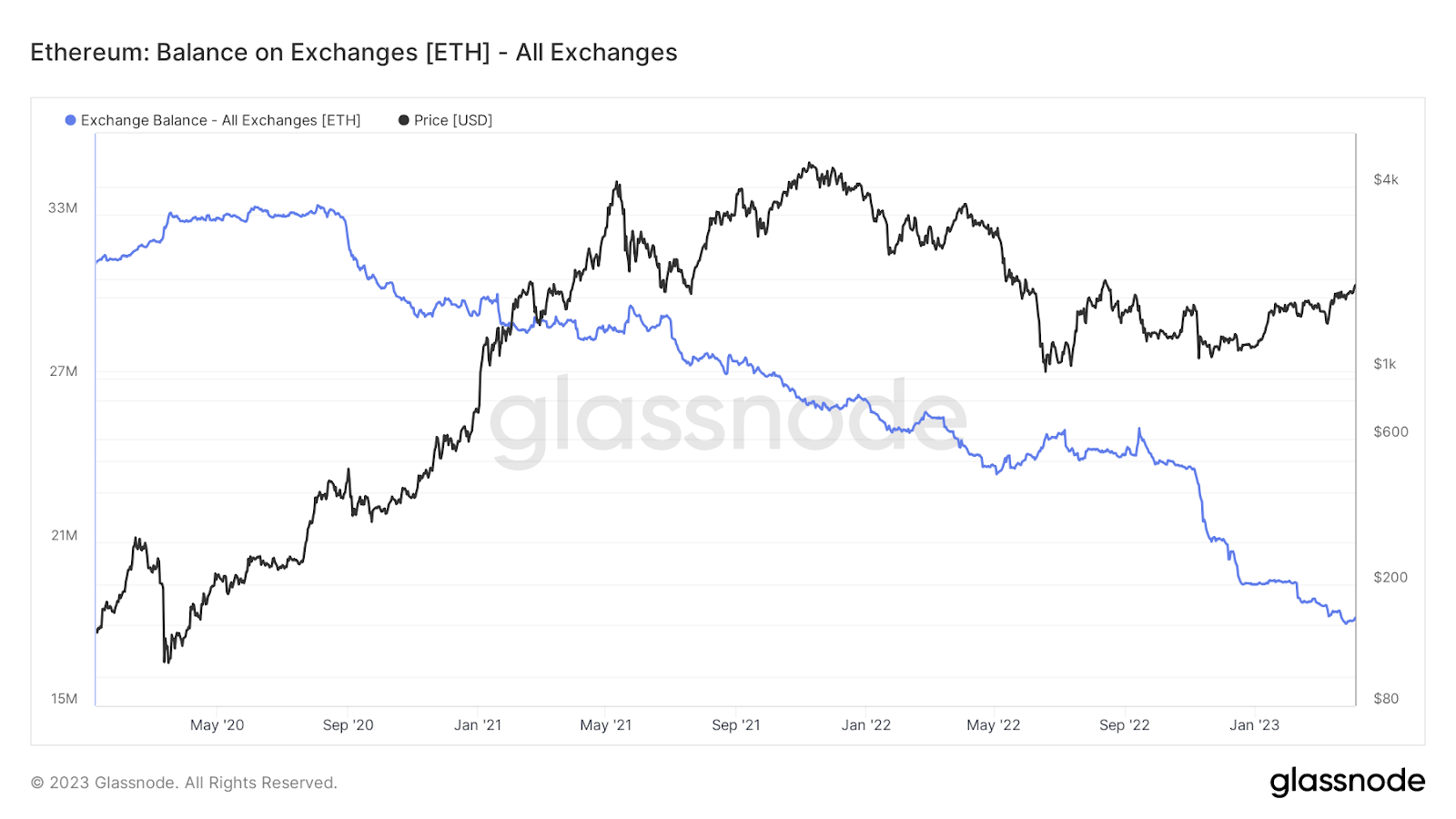

As the chart above shows, there has been a significant drop in the amount of Ethereum on centralized exchanges since May 2020. In general, a lower amount of a digital asset on an exchange, compared to those held in self-custody, is a bullish signal. More Ether on exchanges means a higher likelihood of incoming selling pressure. This suggests that the selling pressure emerging from Shanghai staking unlocks may be less intense.

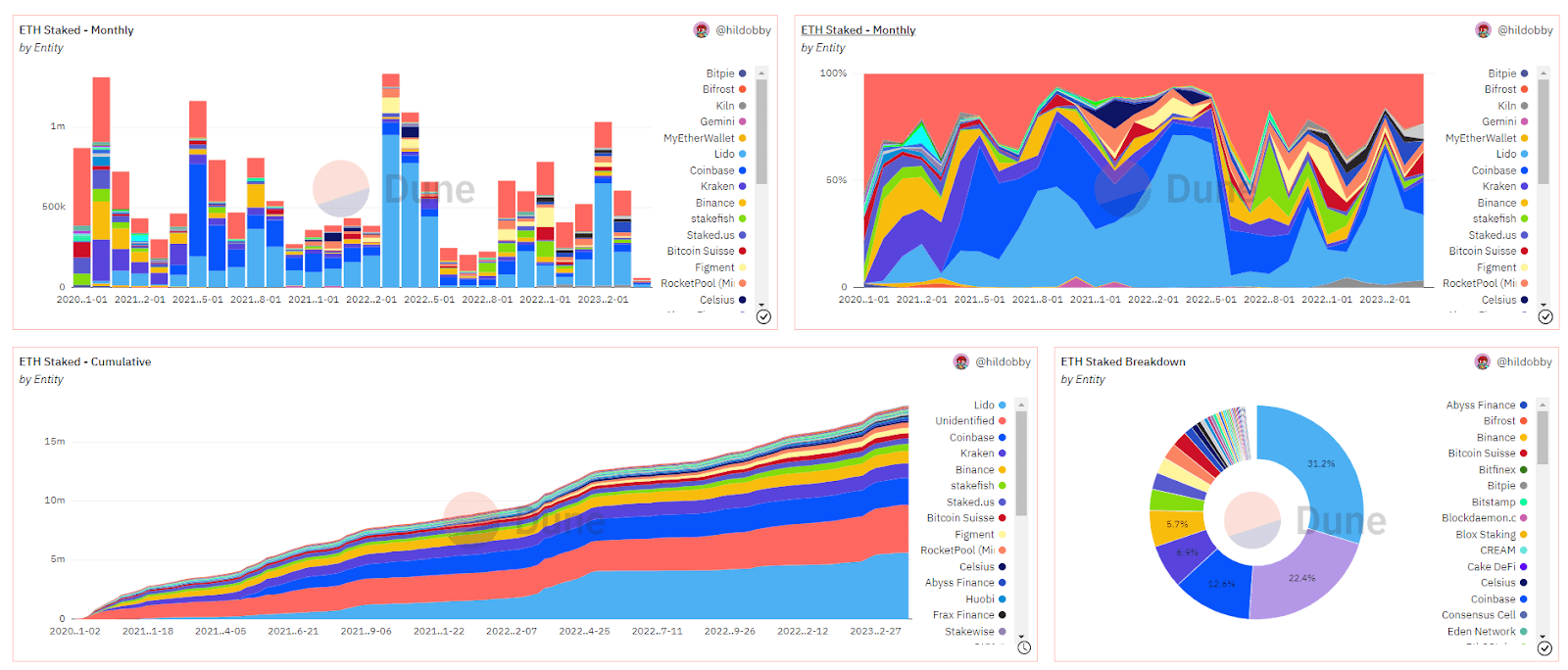

Liquid staking protocol Lido dominates the ETH staking ecosystem. Liquid staking is popular because it addresses the main drawback of staking—long lock-ups. When users deposit their ETH for staking through a liquid staking protocol, they receive back a tokenized version of the asset they deposit 1:1, with Lido ETH staking this asset is called stETH.

Over time, if the user chooses to continue staking, the stETH position will continue to get larger but the user can withdraw and sell their stETH at any time without having to wait for a cool down or unlock period as a validator would.

31.2% of all Ethereum staked is currently staked using Lido, 22.4% is staked unidentified (individual), 12.6% is staked with Coinbase, 6.8% is staked with Kraken and 5.7% is staked with Binance.

In a comment sent to Brave New Coin Ilya Volkov, CEO and co-founder of YouHodler, a Swiss-based international fintech platform providing a variety of Web3 crypto and fiat services, offered insights into why the market share of centralized exchanges offering staking services has slid. “Centralized exchanges are no longer able to offer staking services in the U.S. So, ETH will be withdrawn from these exchanges and staked elsewhere (e.g decentralized staking services). At the moment, the SEC cannot prevent users from staking ETH tokens via an individual node or via decentralized staking services.” Volkov says.

With Shapella, the number of node operators and types of validators can be accommodated by Lido. Following Shapella, Lido is set to introduce a staking router and a modular infrastructure. This will mean staking deposits will be spread to a much more diverse set of validators and Lido will have more diversity and security in how it manages user’s stakes.

Following Shapella, users of Lido will be able to withdraw ETH 1-for-1 directly from Lido. More information on the changes Lido will make to its protocol Shapella can be found here.

The Ethereum Price Leading Into Shanghai Fork

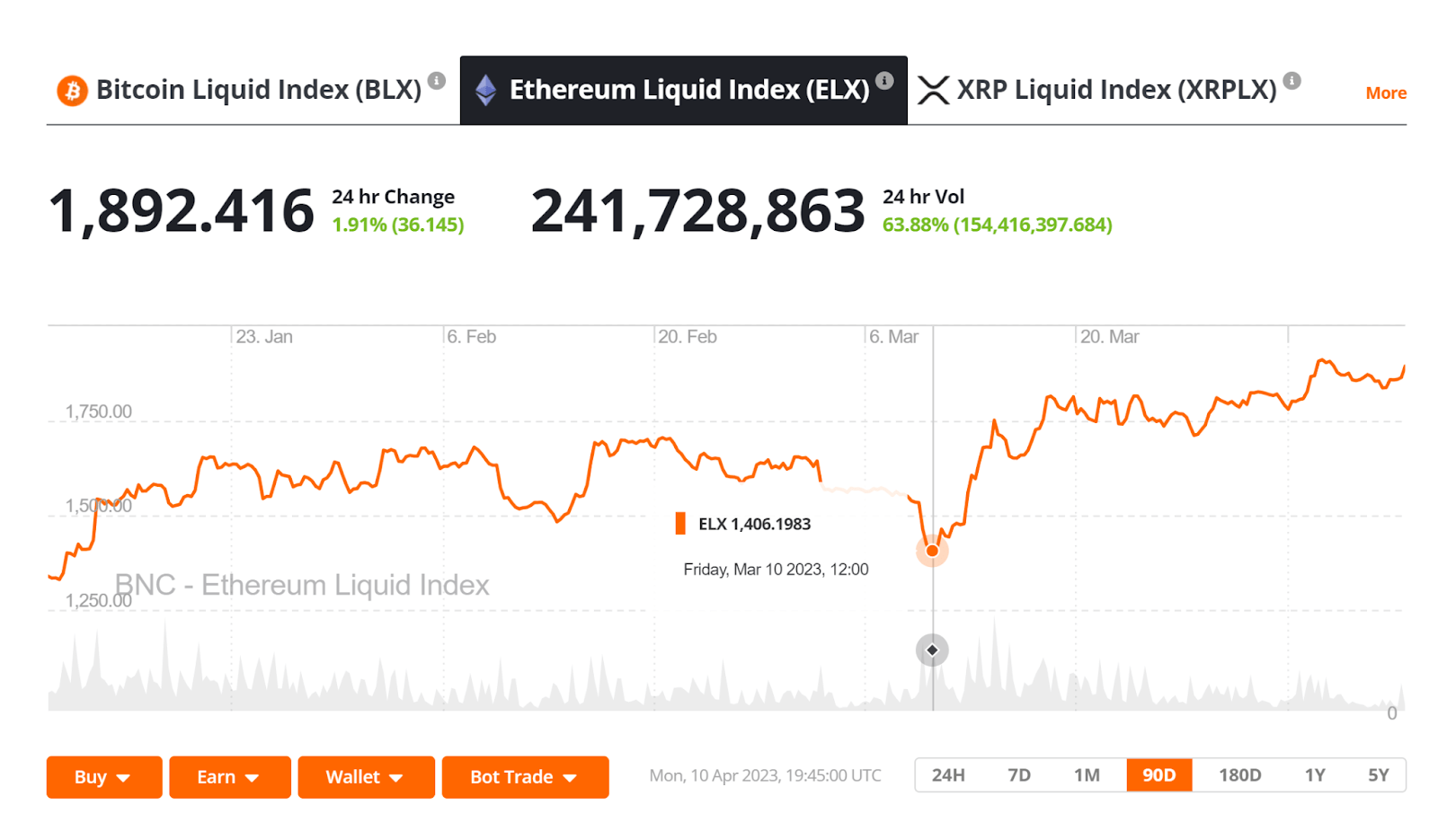

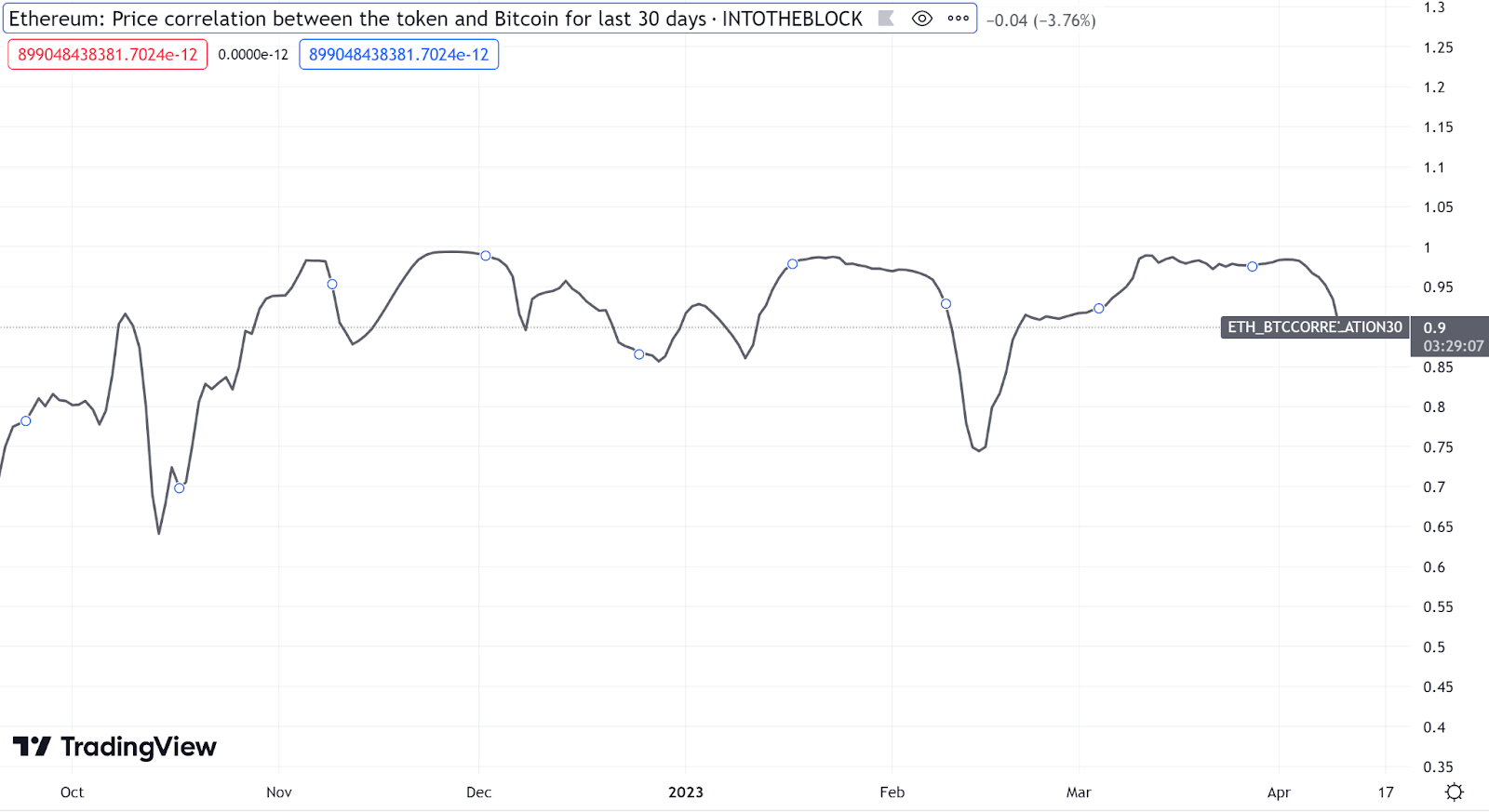

In the lead-up to the Shanghai upgrade, the price of Ethereum has soared. The asset is up ~28.9% in the last 30 days. The strong performance may not be driven purely by the excitement around the Shanghai hard fork, though, given the strong performance of other large-cap digital assets. In fact, Ethereum is actually lagging as in the last 30 days the Bitcoin price (BTC) is up ~42.8% and the XRP price is up ~39.8%.

The correlation between ETH and BTC is also high and has been historically high. This suggests that either the same factors drive the price of both assets or one asset leads the other. BTC’s excellent momentum in the last month has been driven by its position as the ‘highest beta monetary irresponsibility hedge.’ Bitcoin has enjoyed excellent momentum as traditional financial markets have stuttered in recent months.

Years of excessive money printing and low-interest rates that are now being reversed are creating chaos throughout global credit markets. Additionally, the government backstopping of a number of American banks and notable Swiss bank Credit Suisse has created concerns about the stability of global financial markets.

Gold has soared and continues to establish new all-time highs. Safe havens like the US dollar and Treasury bills have been affected by the chaotic interest rates - increasing the appeal of assets like BTC, gold, and silver.

The price of ETH and other digital assets maybe be benefiting from their close macro connection to BTC. They don’t have the same ‘flight to quality’ digital gold narrative that Bitcoin has - but are rising because of osmosis.

The Ethereum Price After The Shanghai Upgrade

There are some concerns that the large unlock of staked Ether will lead to a wave of selling pressure as stakers can finally regain liquidity, but some observers say the unlocked ETH liquidity will be swept up by new demand to stake. There is also a view that ETH staking will increase post-Shanghai, given the new flexibility offered to stakers.

At YouHodler, Volkov tells Brave New Coin that he expects volatility around the time of the Shanghai fork because of factors like the potential failure of the upgrade to implement on time.

He also points to a futures market where there has not been a significant increase in the number of short orders for ETH placed. This suggests that this market is unclear on whether Shapella will be a bullish or bearish event. Check here for more on what futures data tells us about where the smart money sees price going.

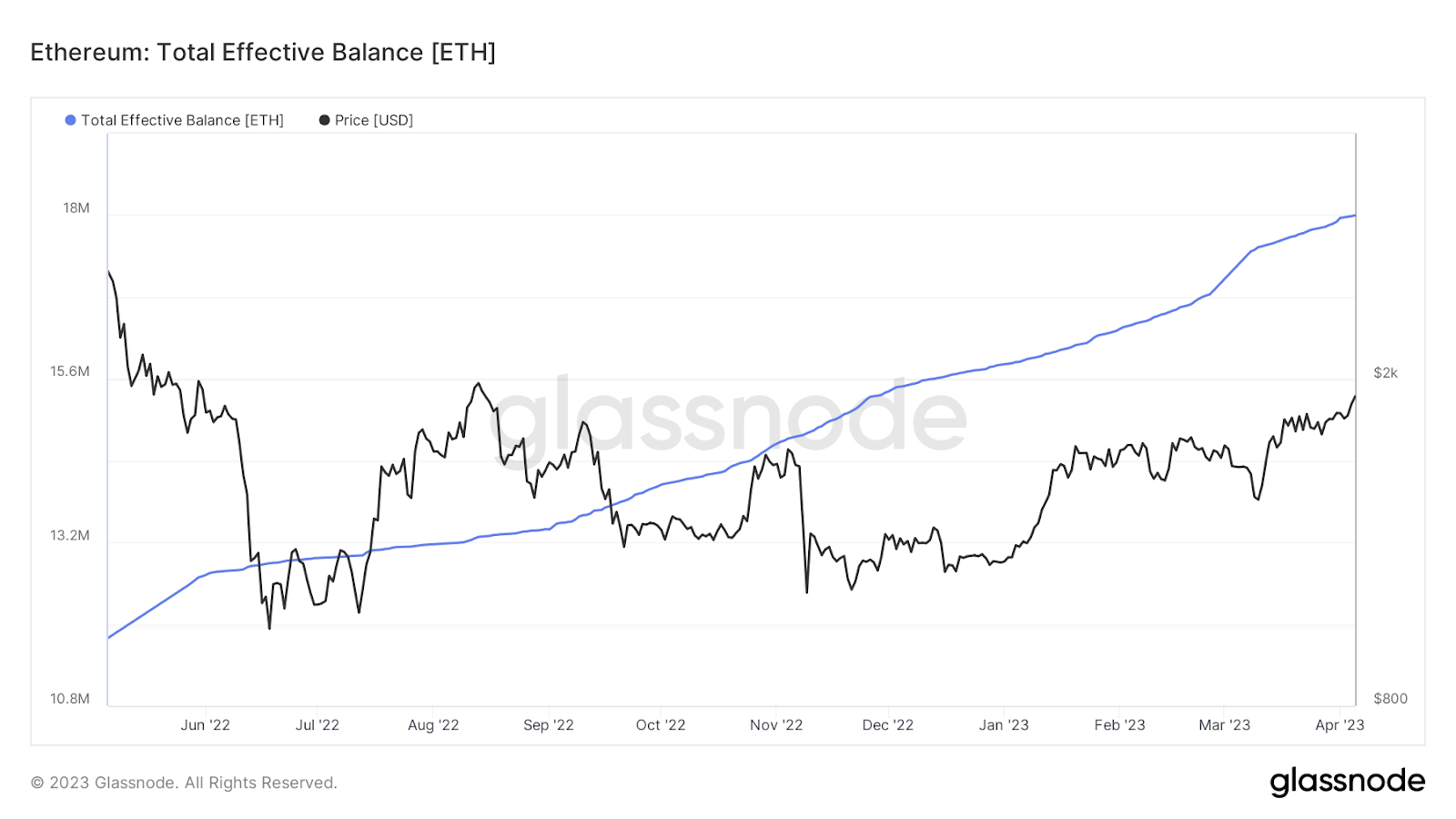

Despite being the most staked asset in crypto, the ratio of staked ETH is just 15.64% of the total ETH supply according to stakingrewards.com. This compares poorly to the ratio of staked assets on other major proof-of-stake chains like BNB-chain, Cardano, and Solana, all of which have ratios of staked assets sitting above 70%.

This suggests that the adoption of Ethereum staking has been slow and that so far at least, the inability of validators to unstake has held up the adoption of Ethereum staking.

Conclusion

The upcoming Shanghai upgrade represents a significant milestone in the development of Ethereum consensus and the broader cryptocurrency market. With the ability for ETH validators to finally unstake their tokens and withdraw their rewards, there is likely to be a significant shift in how staking functions on Ethereum. Ethereum validators will finally be able to vote with their stake and will be able to shift to their preferred type of consensus participation.

While there are concerns about potential selling pressure following the unlock, the strong performance of ETH and other digital assets leading up to the upgrade suggests that a bullish wider crypto market may outstrip any increased selling pressure.

The impact of the Shanghai upgrade on the cryptocurrency market remains to be seen, but it is clear that Ethereum continues to play a significant role in the development of Web 3.0 and the future of decentralized finance.

bravenewcoin.com

bravenewcoin.com