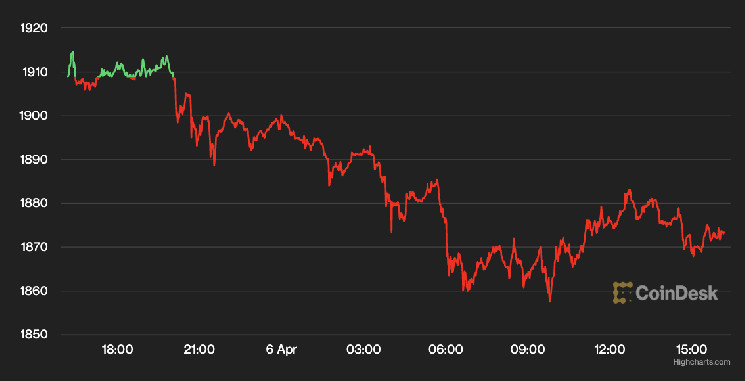

Ether (ETH) retreated below $1,900 on Thursday a day after surpassing this threshold and reaching its highest level since last August.

The second-largest cryptocurrency by market capitalization was recently trading at $1,876, off 1.5% over the past 24 hours. Still, ETH has gained over 4% for the past seven days as market participants eye Ethereum’s April 12 Shanghai hard fork, which aims to address staked ETH withdrawals.

After rising the day before, liquid staking tokens flattened on Thursday. LDO, the governance token of the decentralized autonomous organization behind Lido, dropped by 3% for the day to hover around $2.50 on Thursday. The price drop came after a Lido protocol developer said in a Twitter Space Thursday that Lido stakers can expect their ETH withdrawals “no sooner than early May.” Rocket Poll’s RPL token was down 2.9% to trade near $46, according to CoinGecko data.

How the Shanghai fork affects ether’s price remains uncertain with some observers expecting selling pressure but others expecting a surge amid fresh interest in the Ethereum platform. Gökçe Guven, the co-founder and CEO of Kalder, said the ability to freely stake and un-stake will “add a tremendous amount of utility” and in turn likely attract growing institutional interest.

“Larger institutional players often base whether or not they choose to get exposure to a certain asset class on whether there is the option to get yield,” Guven told CoinDesk in an email, adding: “Staking – but also, now, the ability to un-stake – provides that option now.”

And crypto research firm Delphi Digital's research analysts said in a note Thursday that Shanghai has created a timeline for stakers to withdraw their locked-up ETH holdings, and that more investors will “prefer to stake ETH rather than keeping their assets idle.”

“Liquid staking protocols, including Lido, are in the best position to capture these flows,” the analysts added.

Elsewhere in markets

Bitcoin (BTC), the largest cryptocurrency by market value, was changing hands at around $28,100, down 0.1% from Wednesday, same time. BTC has been range-bound between $27,200 and $28,200 for much of the past three weeks.

The CoinDesk Market Index, which measures overall crypto market performance, was recently off 1% from a day ago.

Brendon Sedo, a contributor to layer 1 blockchain Core DAO, highlighted in an email to CoinDesk that with the demands for bitcoin rising, miners increase profitability, leading to “growing competition” among them “to secure the Bitcoin network.”

“It’s a positive reinforcement loop that we’re witnessing in real-time,” he added.

Major stock indexes turned green as investors awaited Friday’s U.S. Labor Department’s nonfarm payrolls (NFP) job report for March. The S&P 500 closed up 0.3% while the tech-heavy Nasdaq rose 0.7%. The Dow Jones Industrial Average (DJIA) was flat.

The 2-year and 10-year treasury rates were flat on Thursday, recently sitting at 3.82% and 3.29%.

Equity markets will be closed Friday in celebration of Good Friday.

“When a plethora of markets will be closed, we will see if traders will look to take advantage of the one market that trades 365 days a year,” Edward Moya, senior market analyst at foreign exchange market maker Oanda, wrote in an email Thursday. “Bitcoin remains near the upper boundaries of its trading range and could see a good chance to breach the $30,000 level over the weekend when some of its derivatives are not actively trading.”

Moya added: “If the NFP report misses massively and supports the idea that the economy is in worse shape, we could see that provide a major boost for crypto.”

coindesk.com

coindesk.com