Ethereum was officially launched on July 30, 2015, with the release of its first live mainnet, Frontier. Since then, it has grown to become one of the largest and most widely used blockchain platforms, with a global network of users and developers. Ethereum allows developers to build and deploy a wide range of applications on its platform using a programming language called Solidity.

ETH now holds a market capitalization of $161,483,079,935 but has failed to make a substantial uptrend. Even with a 165% jump in the volumetric transaction over the last 24 hours, ETH has failed to make any progressive impact on the price action. Read how Ethereum will perform in the coming years by clicking here!

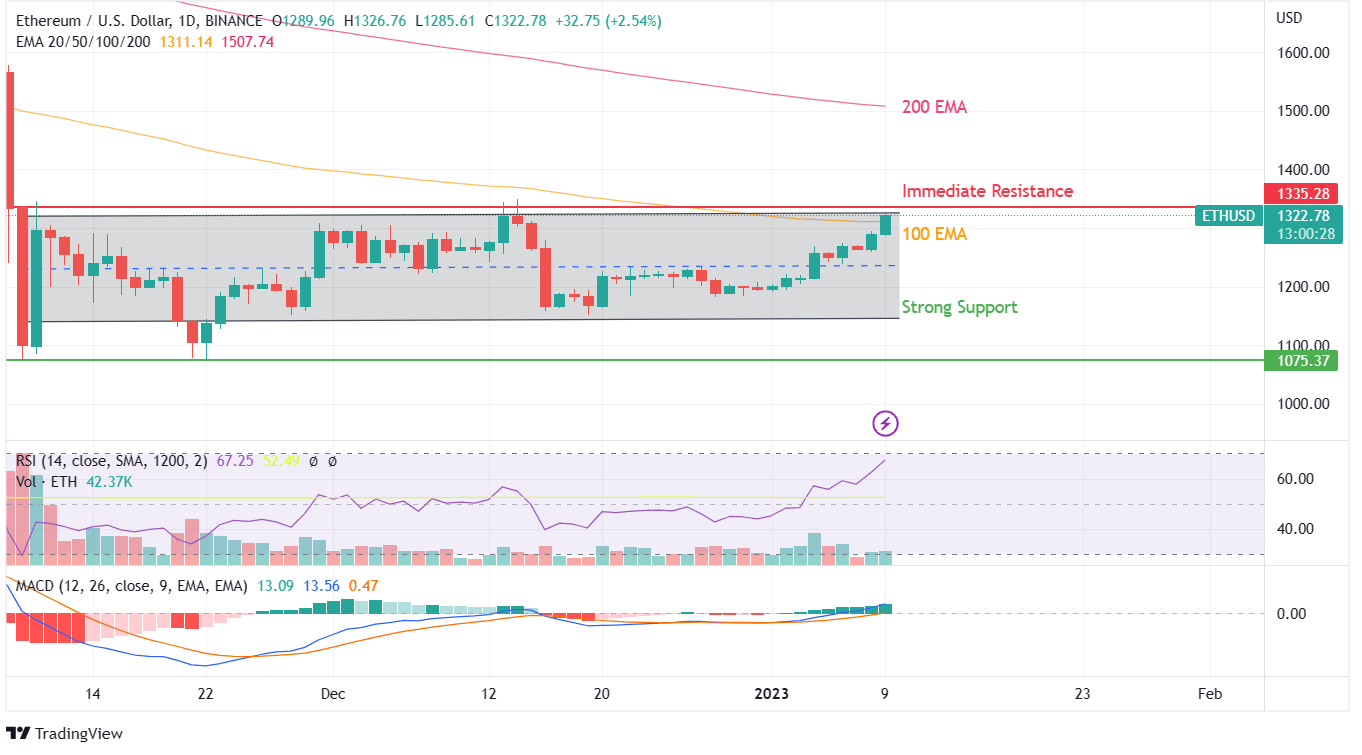

At a single glance, ETH seems to be trapped in a consolidation zone since its decline in November 2022 without any positive outlook. With prices having tumbled from the current values a month ago, the hope of a positive breakout is not justified. The only difference this time is the trading value of ETH being above the 100 EMA curve, while the 200 EMA curve is trading near the $1500 value.

In case buyers do not hoard towards Ethereum in the coming days as a result of it breaching the 100 EMA, one might have to wait till the 200 EMA curve for a turnaround in buyers’ sentiment. Retailers have faced tremendous bearish trends in the last year, and despite having overcome the challenges of a merger, ETH has failed to garner the attention expected for this feat.

Since all previous price rejection of ETH has happened as the token moved towards the 200 EMA curve, buyers might be worried about its trend reversal before it managed to trade above $1500. A massive jump in token demand could lead it to surpass even $2000 if the order of events maintains lower volatility and positive news comes from the government actions of crypto adoption.

cryptonewsz.com

cryptonewsz.com