Investment giant Fidelity, through its digital assets subsidiary, has announced plans to offer institutional users access to Ethereum (ETH) transactions.

The firm noted that the decision to allow access to Ethereum comes after the successful Merge upgrade, and customers will be able to buy, sell and transfer the asset from October 28, Fidelity said in an email to investors as shared by crypto proponent Bruce Fenton on October 19.

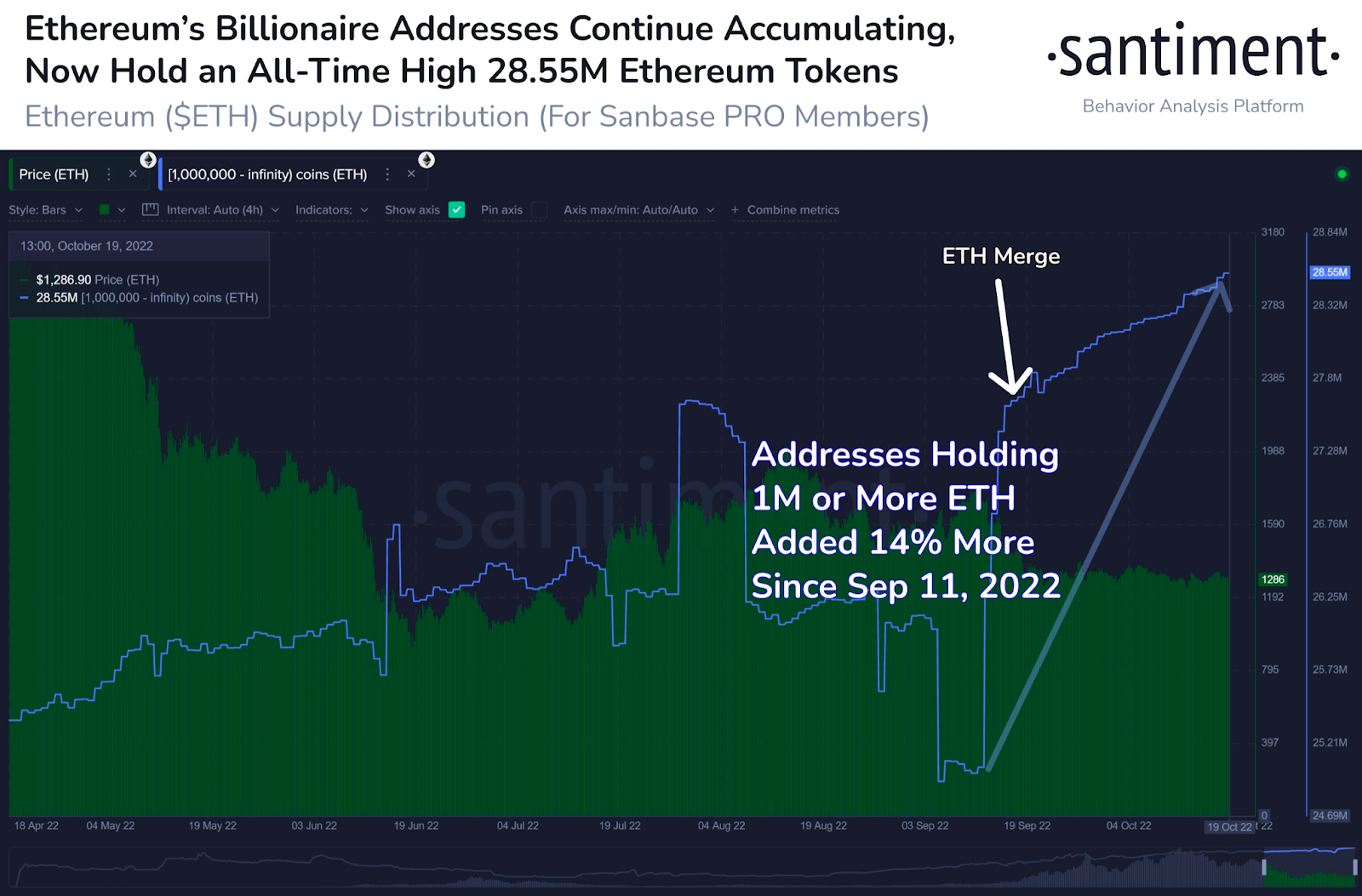

“With the Ethereum Merge completed, many investors are looking at Ethereum through a new lens,” read part of the email.

Overall, Ethereum has largely traded around the $1,200 and $1,300 level after being weighed down by the general market correction. Interestingly, Ethereum is exhibiting a bearish momentum in contrast to other top assets.

According to a Finbold report on October 20, Bitcoin, Cardano (ADA), XRP, and Binance COIN (BNB) have recorded a bullish sentiment, hinting at a possible breakout in Q4. However, Ethereum remains slightly bearish.

Fidelity’s venture into crypto space

The incorporation of Ethereum comes after Fidelity recently revealed it intends to launch a new Ethereum Index Fund after making the necessary filings with the Securities and Exchange Commission (SEC).

Notably, Fidelity Digital Assets, which focuses exclusively on digital assets, has recently made inroads into offering more crypto-related services. For instance, it emerged that Fidelity was exploring the option of launching Bitcoin (BTC) trading capabilities for retail customers.

Finally, it is worth pointing out that as per Finbold’s report, Fidelity Digital Assets, Charles Schwab (NYSE: SCHW), and Citadel Securities announced a plan to launch a crypto trading platform.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com