After reaching a high of $2030 on August 14, Ethereum’s price began a corrective wave, forming a descending channel – as shown in blue on the following chart.

The bottom of this channel, combined with the 200-week moving average line (in yellow), acted as support and prevented the price from dropping further. This resulted in the development of a local low at $1,220.

A bullish wave towards the channel’s top will only occur if buyers can reclaim $1,420 (in red). In this case, the short-term target would be $1,550. On the other hand, if ETH breaks below the 200-week MA line, we can expect further decline towards the $1K zone.

The bottom of the channel currently lies at around $1,170. This, together with $1,220, combines the first significant support range.

Key Support Levels: $1280 / $1,220 & $1170

Key Resistance Levels: $1420 & $1550

Daily Moving Averages:

MA20: $1391

MA50: $1554

MA100: $1487

MA200: $1960

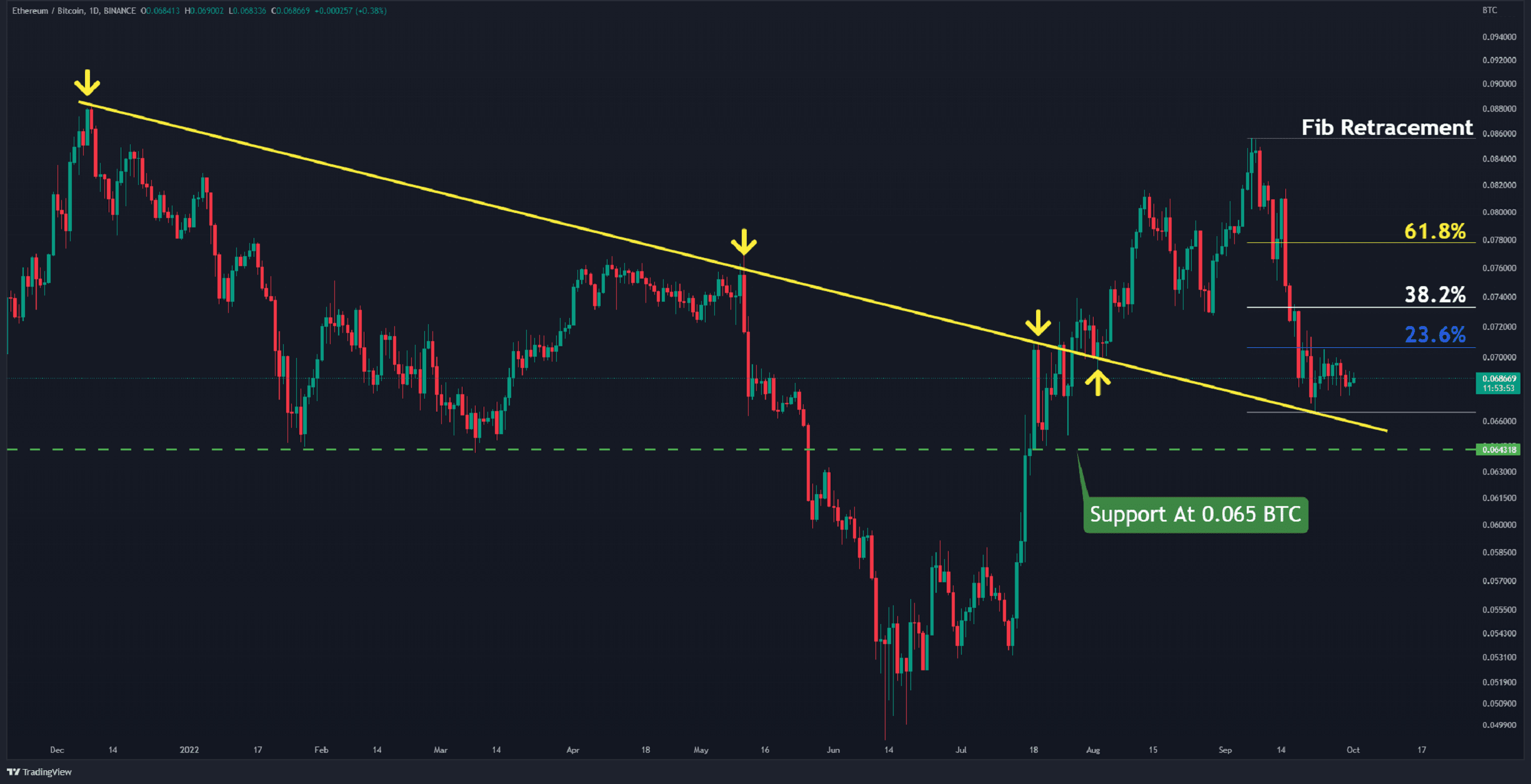

The ETH/BTC Chart

Against Bitcoin, the descending line (in yellow) acted as support following the major drop after The Merge event.

The initial attempt to breach above the 23.6% Fib level resistance at 0.07 BTC (in blue) has failed. As the 38.2%, Fib level overlaps with the resistance at 0.073 BTC (in white), a break and close above it may indicate a trend reversal. On the other hand, the first major support lies around 0.065 BTC (in green).

It’s worth mentioning that several times so far in 2022, this level has effectively supported the price.

Key Support Levels: 0.065 & 0.06 BTC

Key Resistance Levels: 0.073 & 0.08 BTC

Technical Analysis By Grizzly

On-chain Analysis

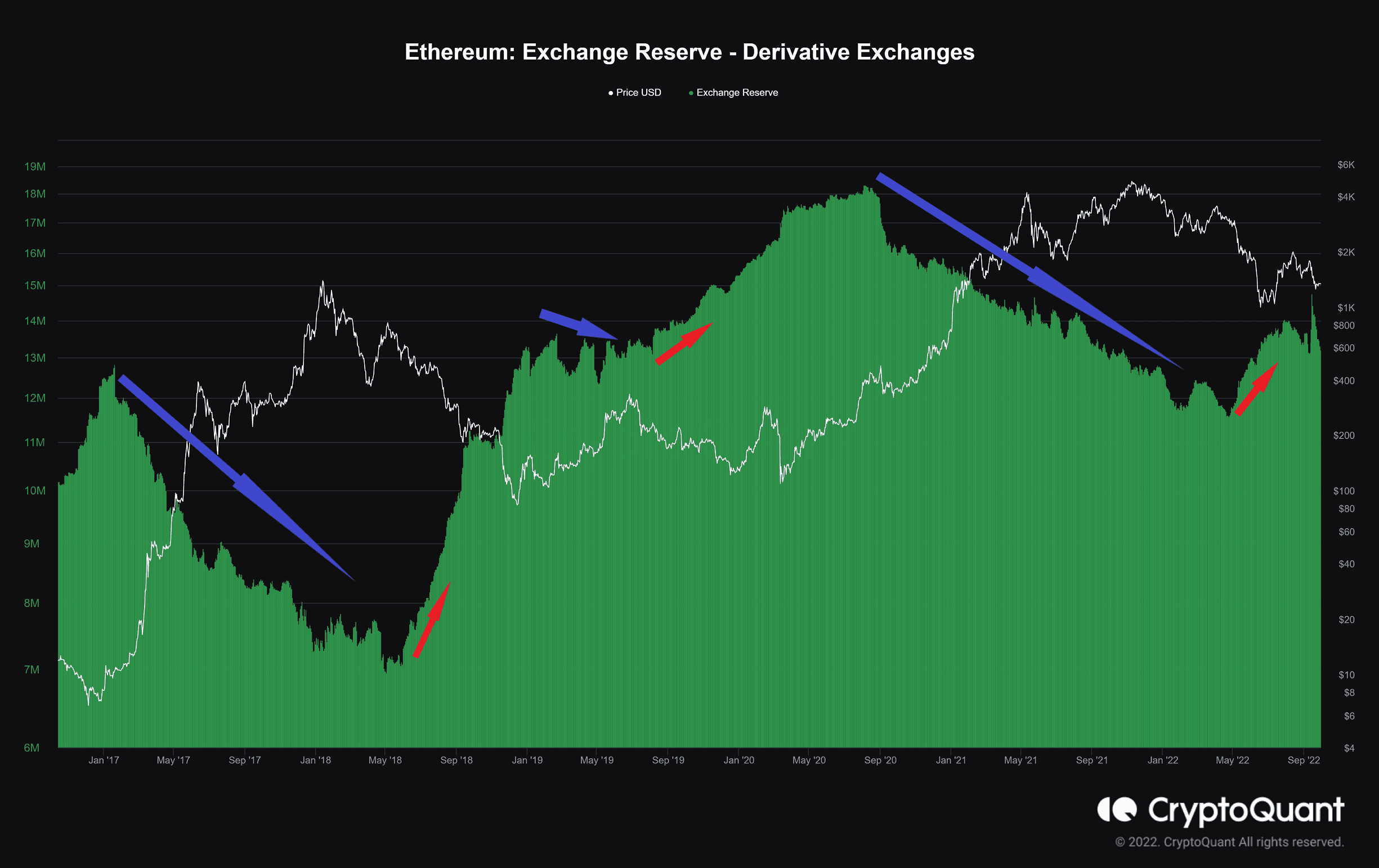

Exchange Reserve – Derivative Exchanges

Definition: The total number of coins held on exchanges.

An intriguing pattern may be found in the supply held in derivative markets since 2017. Bullish rallies that have resulted in all-time highs have been followed by a dramatic decrease in supply on derivative markets. This was probably due to the dominance of the spot market, as investors have eased selling pressure by withdrawing their coins.

On the other hand, bear markets corresponded with coins being sent into derivatives exchanges. This metric is now increasing in value, and historical data suggests that no substantial price change is expected.

cryptopotato.com

cryptopotato.com