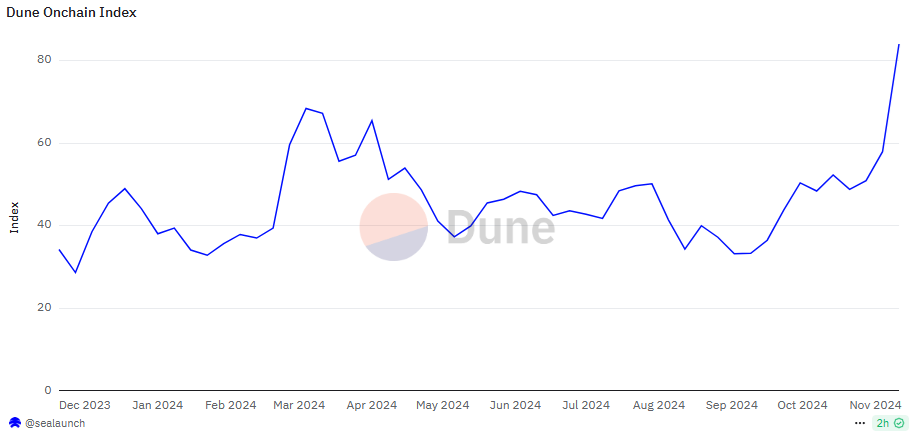

The Dune index, tracking on-chain activity and user profiles, points to a new all-time high of crypto adoption. The activity hinges on top chains, including Bitcoin ($BTC), and points to both wallet growth and token turnover.

The Dune index points to an all-time high crypto adoption, after a constant growth trend since September. The index expanded from a local low of 33 points to 84 points, coinciding with the all-time high of Bitcoin ($BTC) above $99,600. On-chain data of crypto adoption surpassed the market peak in March, and reflected the most successful weeks of the bull market in the last quarter. The index points to the most valuable networks and the most common uses for crypto.

The total Dune index hinges on chains that achieve an optimal mix of fees, transfer volumes in dollar terms, and the number of on-chain transactions. The normalized index shows which chains have livelier economic activity. The index weighs the value and fees more than raw transactions, as some chains have low-quality volumes. As a result, Dune filters out some of the chains which report high traffic, but without sufficient app activity or value transfers.

In Q4, the leading chains driving adoption were Solana, Bitcoin, and Ethereum. TRON was in fourth place, though with a differently focused ecosystem. The index fluctuates for each chain, depending on current conditions. Some of the former leaders lost their footprint in the index, with outflows from Arbitrum, Avalanche, and Base.

Solana becomes the biggest net gainer based on its Dune index

The Dune index also measures the success of specific chains. Solana had the biggest index change, underscoring its rise as the go-to chain for the biggest inflow of new users. On a weekly basis, Solana also had net gains in adoption, while most other top L2 and other networks saw their usage index slide. Solana also achieved 3,442% growth of its on-chain fees due to demand for fast DEX swaps.

Base had the second-highest yearly growth, but stalled in the short term. One of the reasons for the lower adoption is the observation that L2 chains did not really tap the meme token trend. Technically, almost all L2 chains were capable of carrying meme tokens. Base was especially equipped, even holding an on-chain summer to drive meme tokens for fun. In the short term, Gnosis had the strongest month-on-month growth, due to the inflow of interest into prediction markets.

While Solana had significant on-chain activity and fees, Bitcoin and TRON were leaders in terms of the share of net transfers. In the case of $BTC, transfers are larger and more valuable. TRON has a different user profile and is getting a boost from USDT transactions. Both chains achieved much higher dollar amount transfers, while Solana and Base carried multiple low-value transactions.

Solana is yet to outperform Ethereum in absolute terms of value locked, market capitalization, or available liquidity. However, the chain showed the necessary conditions for much wider adoption and consolidated liquidity. In comparison, the Ethereum ecosystem had a wider distribution of apps and versions, leading to user confusion and fragmented markets.

Ethereum still carries the bulk of value transfers

L2 chains have increased their adoption, but not as much as expected. In the Ethereum ecosystem, the main chain still carries more than 66% of economic activity. The rest is split between the top L2, with negligible contributions from niche chains.

The Dune index remains strong for Arbitrum, Base, Optimins, Celo, and Mantle, with no significant adoption from the likes of Zora, ZKEVM, or ZKSync. Those chains continued to decline after the initial hype around the airdrop periods.

The Ethereum ecosystem peaked in March 2024, at the time the L2 narrative was more widely hyped. Despite growth in the past month, the Ethereum ecosystem is yet to recover its all-time high. The Dune index is the highest for Ethereum, with much lower values for its entire L2 ecosystem. Ethereum’s index also had the strongest growth, while other chains did not accelerate their adoption. Despite the on-chain index, $ETH prices failed to break out of their usual range. $ETH traded around $3,300, continuing to mark new all-time lows against $BTC.

From Zero to Web3 Pro: Your 90-Day Career Launch Plan

cryptopolitan.com

cryptopolitan.com