Blockchains rely on consensus mechanisms to verify transactions, but why does it matter if a network is proof-of-work (PoW) or proof-of-stake (PoS)? In this guide, we’ll break down PoW vs. PoS in simple terms, explaining how each method secures the blockchain while addressing the pros and cons and features of each. Here’s what to know in 2024.

- What is proof-of-work (PoW)?

- What is proof-of-stake (PoS)?

- Proof-of-work vs. proof-of-stake: Comparison

- Challenges associated with PoW

- Challenges associated with PoS

- Which consensus is better: PoS or PoW?

- Frequently asked questions

What is proof-of-work (PoW)?

Proof-of-work (PoW) is a consensus mechanism where miners use computational power to solve complex mathematical puzzles and validate transactions on a blockchain. This process ensures the network is secure and decentralized through the competition of miners.

Key characteristics of PoW

- Mining-based validation: Miners compete to solve cryptographic puzzles, with the winner getting to validate a block and receive rewards.

- Energy-intensive: Just like a giant puzzle competition requires energy, PoW uses a lot of computational power, making it energy-intensive.

- Security through difficulty: The complexity of the puzzles makes it very difficult for anyone to tamper with the network. Any changes would require re-solving all previous puzzles, which is practically impossible.

How PoW ensures security and decentralization

PoW provides security by making it extremely costly to try to attack or manipulate the network. The resources needed to cheat are so high that it’s not worth the effort. At the same time, PoW allows anyone with the right hardware to participate in mining, ensuring no single entity controls the network.

Examples of blockchains using PoW

- Bitcoin: The first cryptocurrency to implement PoW, Bitcoin’s decentralized network relies on miners to secure the blockchain.

- Litecoin: A fork of Bitcoin, Litecoin uses PoW but offers faster transaction times, making it more suitable for smaller, everyday transactions.

What is proof-of-stake (PoS)?

Proof-of-stake (PoS) is a consensus mechanism where validators are chosen to create new blocks based on the amount of cryptocurrency they hold and are willing to “stake” as collateral. This method reduces the need for energy-intensive computations and increases network efficiency.

Key characteristics of PoS

- Staking replaces mining: Instead of miners, PoS uses validators who lock up (or stake) their coins for a chance to validate blocks.

- Energy efficiency: Since PoS doesn’t rely on heavy computation, it consumes significantly less energy than PoW.

- Validator selection based on stake: Validators are chosen based on how many coins they have staked, which incentivizes holding and securing the network.

Staking and validator selection process

In PoS, validators lock up a portion of their cryptocurrency as collateral. When selected, they validate new transactions and add them to the blockchain. If they act dishonestly, their staked coins can be slashed (lost), ensuring participants follow the rules. This system favors those who have a large stake but also allows smaller holders to participate.

Examples of blockchains using PoS

- Cardano: A leading PoS blockchain known for its research-driven approach, Cardano emphasizes security and sustainability through staking.

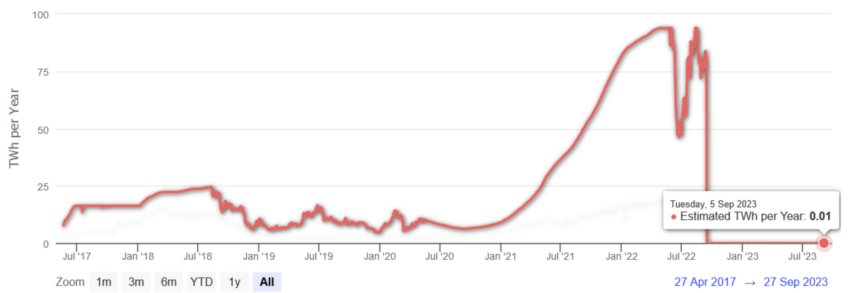

- Ethereum: After its transition from PoW in 2022, Ethereum now uses PoS, greatly increasing its energy efficiency and scalability.

Proof-of-work vs. proof-of-stake: Comparison

While the differences can always be detailed, here is a quick table for your reference, which might help you make better sense of how each works:

| Feature | Proof-of-work (PoW) | Proof-of-stake (PoS) |

| Energy consumption | High | Low |

| Transaction speed | Slower | Faster |

| Security | Highly secure, but risks centralization in mining pools | Secure, but risks centralization if wealth is concentrated. |

| Economic model | Mining-based rewards | Staking-based rewards |

Challenges associated with PoW

While proof-of-work (PoW) is widely recognized for its security and decentralization, it comes with significant challenges. Its energy consumption, centralization risks, and slow transaction speeds pose limitations for scalability.

High energy consumption

One of PoW’s most talked-about drawbacks is its environmental impact. The energy required to solve cryptographic puzzles is massive, leading to concerns about sustainability. This has prompted debates about greener alternatives in blockchain technology.

Bitcoin’s enormous transactional, trust, and security advantages are offset by the actively resource-intensive design of its transaction verification process, which now compromises our ability to survive in a climate-dependent world.

Truby, J. (2018). Decarbonizing Bitcoin: Science Direct

The chart below demonstrates the change in Ethereum’s energy consumption after moving from a PoW consensus mechanism to PoS.

Centralization risks due to mining pools

As mining becomes more competitive and hardware-intensive, smaller miners struggle to compete. This has led to the rise of mining pools — groups of miners who combine their resources to solve puzzles together. While this makes mining more efficient, it also risks centralizing power in the hands of a few large pools, which could undermine the decentralization principle of PoW.

Slower transaction times

PoW networks like Bitcoin process transactions at a slower pace compared to newer consensus mechanisms. As miners need time to solve each puzzle, block generation can take longer, causing delays in transaction validation, especially during periods of high network traffic.

Challenges associated with PoS

Proof-of-stake (PoS) is praised for being energy-efficient and scalable, but it faces its own set of challenges. These include:

- Risks of centralization

- Potential security vulnerabilities

- The complexity of staking

Risks of centralization due to wealth concentration

In PoS systems, validators with larger amounts of staked cryptocurrency have a higher chance of being selected to validate blocks. This can lead to a situation where a small group of wealthy participants controls a significant portion of the network, raising concerns about centralization.

Security concerns (long-range attacks, slashing risks)

While PoS is generally considered secure, it has its own vulnerabilities. One such risk is a long-range attack, where an attacker rewrites history from far back in the blockchain.

To mitigate this, PoS systems implement penalties (slashing) for validators who act dishonestly. However, there’s a risk that honest validators might be penalized by accident, leading to the potential loss of staked coins.

Complexity of the staking process

Staking can be a complicated process, especially for beginners. Validators need to understand how much to stake, manage the risks of slashing, and stay online to maintain their role in the network. This complexity may discourage smaller holders from participating, potentially leaving the system in the hands of more experienced or wealthier users.

As of 2024, several hybrid models are being explored, combining aspects of both PoW and PoS. For example, projects like Kadena use PoW for security and PoS for governance to strike a balance between security and energy efficiency.

Which consensus is better: PoS or PoW?

There isn’t a clear winner in this proof-of-work vs. proof-of-stake discussion; each has its strengths and weaknesses depending on the use case. However, as blockchain technology matures, PoS is gaining more attention for its energy efficiency, sustainability, and scalability, while PoW remains trusted for its high level of security.

While many new chains choose to embolden greener credentials with PoS, the status of the original and most popular blockchain, Bitcoin, as PoW ensures that the more energy-intensive consensus mechanism will remain relevant in the long term.

beincrypto.com

beincrypto.com