- Chainlink and DTCC have launched a pilot program tagging along other 10 financial institutions bringing fund data on-chain using Chainlink’s Cross-Chain Interoperability Protocol (CCIP).

- The pilot program is poised to unlock a new era of efficiency, security, and innovation in the financial sector.

The financial sector is at the apex of a transformative shift with the groundbreaking launch of the pilot program. Chainlink, a decentralized blockchain oracle network has joined forces with Depository Trust & Clearing Corporation (DTCC), the world’s largest post-trade settlement organization to bring fund data onto blockchains.

Notably, this collaboration has brought about ten more financial institutions highlighting the growing interest in traditional finance (TradFi). This pilot program enhances operational efficiency and data security.

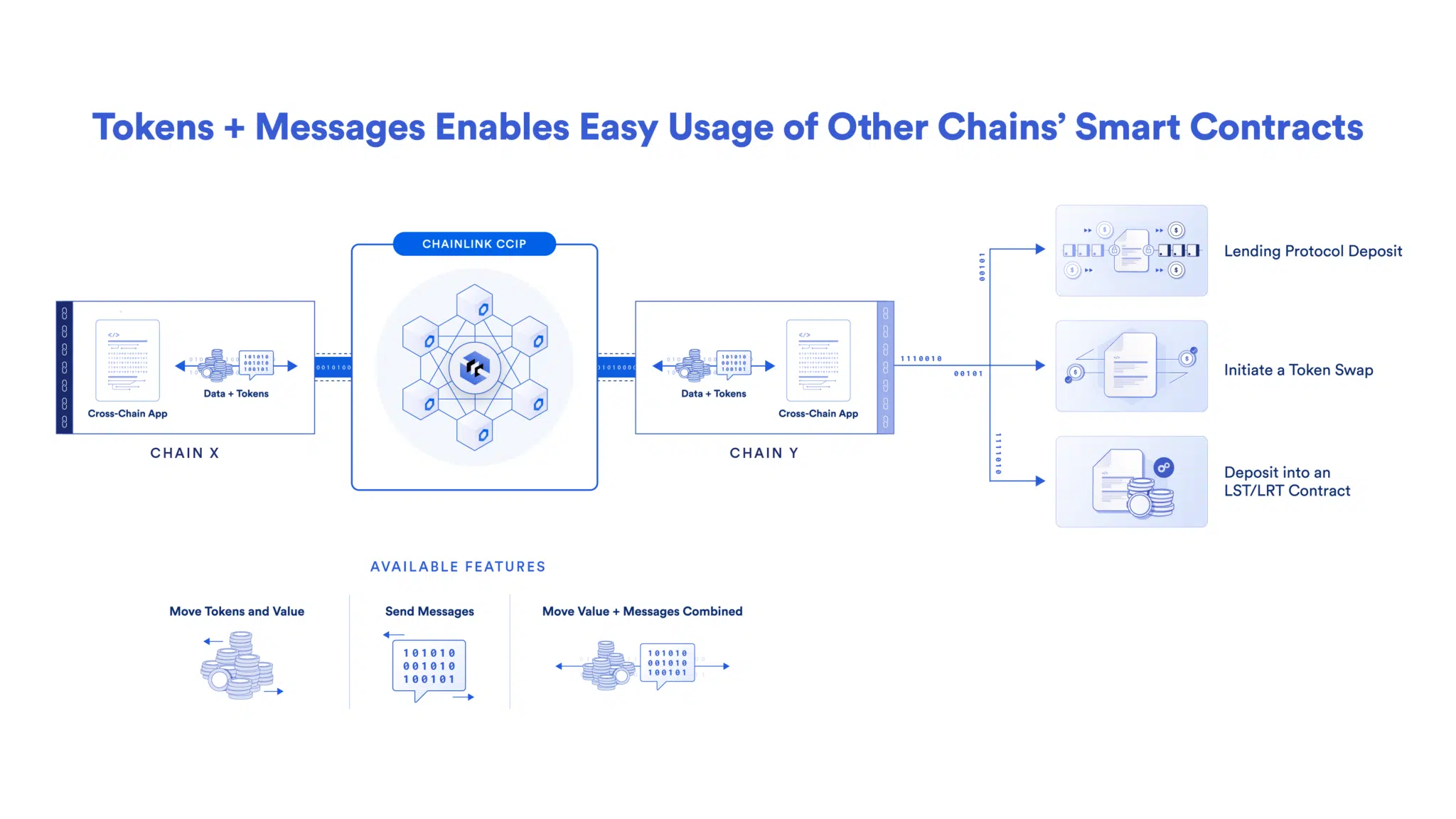

The pilot program utilizes Chainlink’s Cross-Chain Interoperability Protocol (CCIP), -which is a complex messaging protocol designed to revolutionize cross-chain communication. Chainlink’s sophisticated protocol, unlike traditional protocols, CCIP facilitates the transfer of not just tokens (value) but also messages (data) or both, all within a single transaction. Nigel Dobson, the Banking Services Lead at ANZ stated:

This is the pinnacle of our achievement so far… The value and the message moving together is revolutionary,

This innovative aspect enables smart contracts to swiftly execute complex cross-chain operations. It simply allows the transfer of value alongside a set of instructions on how to utilize that value upon reaching its destination chain. This ingenious capability of sharing value adjoining a set of instructions marks a pivotal moment for both DeFi (decentralized finance) and TradFi.

Interestingly, Chianlink’s CCIP enables the creation of cross-chain decentralized applications (dApps). This creative ability does away with manual intervention bringing in a new ray of a more automated and efficient financial ecosystem. The CCiP sees to it that a smart contract automatically transfers tokens across different blockchains and deposits them into the lending market offering the highest yield.

Focusing on the other side, TradiFi also gets to enjoy a slice of the pie. One notable use case is cross-chain delivery-versus-payment (DvP) transactions. This allows institutions holding stablecoins on a private blockchain to purchase tokenized assets on a different blockchain without direct integration beneficially cutting down on overhead costs and security risks.

Chainlink’s CCIP support for arbitrary messaging empowers developers to encode and transfer any type of data across blockchain networks. This opens doors for the creation of smart contracts capable of executing complex, multi-step tasks across various chains. As a result, blockchain applications gain greater flexibility and functionality. Additionally, CCIP prioritizes security. Its token transfer mechanism utilizes rigorously audited token pool contracts, ensuring not only reliable transactions but also the highest security standards.

As financial institutions continue to dig deep into the blockchain landscape, the need for robust compatibility becomes fundamental. CCIP emerges as a frontrunner, offering a secure and seamless movement of tokens and data across blockchains. This collaboration could see Chainlink’s price which at the time of writing is hovering around$14.29 experiencing significant gains.

Additionally, by bringing fund data on-chain, this pilot program is poised to unlock a new era of efficiency, security, and innovation in the financial sector.