Surprisingly, the newly introduced Ethereum (ETH) token standard, ERC-404, made an impressive debut in the crypto market, outperforming many other digital assets.

However, as Bitcoin ($BTC), the dominant cryptocurrency, began to rally, investors swiftly shifted their focus to the king of crypto. Consequently, this shift led to notable price drops and market capitalization declines across the ERC-404 ecosystem and its associated tokens.

From Skyrocketing Surges To Sharp Corrections

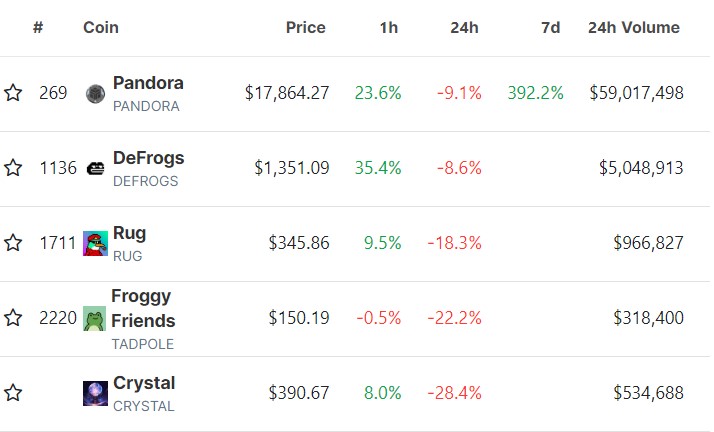

According to data from CoinGecko, the ERC-404 sector has experienced a significant decline, with an overall market capitalization drop of 29% in the past 24 hours.

Key tokens within this sector, including PANDORA, DeFrogs, RUG, Froggy Friends, and Crystal, have all witnessed substantial price decreases. PANDORA, which had garnered attention and speculation, surged by a staggering 12,000% within a week.

Opening at $250 on February 3, 2024, its value skyrocketed to over $34,000 per token by February 9, 2024. However, it dropped by 38% from its all-time high ($ATH) in just 24 hours.

On the other hand, Crystal suffered the most significant losses, with its price plummeting by 28.4% and trading volume declining by over 35%. These figures indicate a stark decline in market activity for the token. Currently, Crystal is down more than 51% from its $ATH of $792.74, exemplifying the inherent volatility of the ERC-404 sector.

Following closely behind, Froggy Friends experienced a 16% drop in trading volume and an 81% decrease in price from its peak of $823. CoinGecko data reveals that Froggy Friends currently trades at $150 per token.

But what are the ERC-404 token standards? And what is causing the price and market capitalization to drop?

Navigating The ERC-404 Ecosystem

Ethereum, known for its smart contract platform, has been a breeding ground for various token standards. While ERC-20 and ERC-721 gained widespread adoption for fungible and non-fungible tokens (NFTs), a new contender emerged: ERC-404.

Named after the popular website error code “404,” ERC-404 introduces the concept of “semi-fungibility” to Ethereum. It combines the divisibility of ERC-20 tokens with the uniqueness of ERC-721 tokens, bridging the gap between these two types.

ERC-404 tokens are associated with specific NFTs, allowing fractional transfers of linked NFTs. Full ownership results in minting the linked $NFT to the holder’s wallet, while fractional transfers trigger the burning of the associated $NFT. New NFTs are automatically minted when sufficient fractions are accumulated to form a complete token.

DN-404 Prepares To Challenge ERC-404’s Dominance?

According to a recent report by The Block, transaction fees increased as ERC-404 tokens gained traction, prompting developers to work on an alternative implementation called Divisible $NFT (DN-404).

This new standard aims to optimize code and reduce transaction fees, addressing the rising costs associated with ERC-404 tokens. The DN-404 implementation is set to be released soon, potentially alleviating network congestion caused by the influx of ERC-404 tokens.

While there were initial discussions between the Pandora team, the creators of ERC-404, and the developers working on DN-404, the two groups did not reach an agreement and are not collaborating, according to the report.

This introduces uncertainty for traders and investors who navigate between supporting the original ERC-404 or the upcoming DN-404 implementation.

Overall, the introduction of ERC-404 brought excitement and volatility to the crypto market. While semi-fungibility and fractional transfers of linked NFTs hold promise, challenges such as rising transaction fees and the emergence of DN-404 have impacted the ERC-404 ecosystem.

Traders and investors now face the dilemma of choosing between the original implementation and the upcoming alternative. As the market evolves, it will be interesting to see how the ERC-404 sector adapts and whether it can regain stability and investor confidence.

Featured image frm Shutterstock, chart from TradingView.com

newsbtc.com

newsbtc.com