The PWN DAO Foundation, linked to the peer-to-peer lending protocol PWN, has released a comprehensive report analyzing user-incurred onchain fees within major blockchain networks and decentralized applications (dapps) for the past year. The 2023 analysis examines Ethereum, BNB Chain, Bitcoin, and layer two (L2) solutions, along with widely-used dapps such as Aave and Uniswap. The report sheds light on the primary trends in fee generation and discusses the changing patterns of blockchain utilization and revenue.

2023’s L1 and L2 Fee Generation Stats Revealed

The report published by PWN, illustrates a diverse landscape of onchain fee generation, underscoring a 33% overall reduction in fees across the selected projects compared to the previous year. This trend was particularly pronounced in non-fungible token (NFT) marketplaces, which experienced an 87% drop in fee generation. In contrast, L2 solutions exhibited significant growth of around 411%, indicating a shift in user preferences and platform utilization.

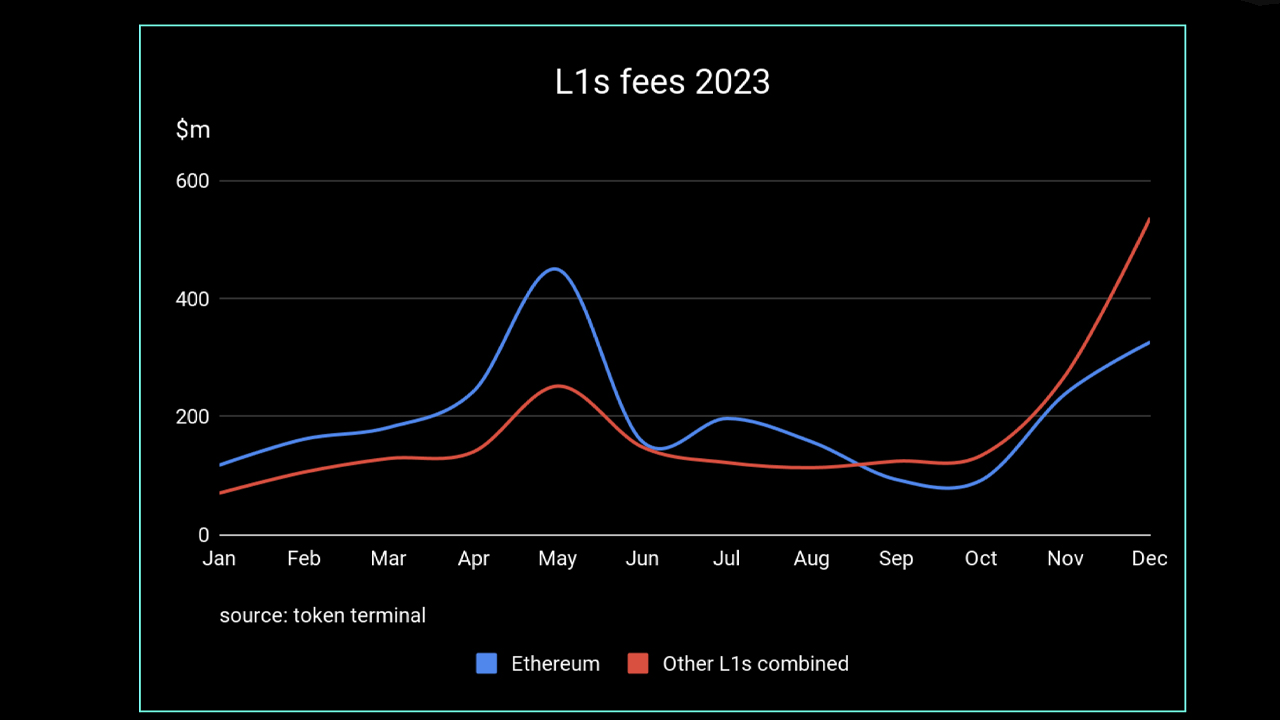

The study shows layer one (L1) blockchains, despite a slight decrease, continued to dominate the fee market, accounting for 59% of all fees, up from 48% in 2022. Ethereum, maintaining its position as a market leader, showed a notable 44% decline in fees, partly due to the migration of activities to L2 networks.

“The rising fees generated by [L2s] signal widespread adoption and a significant impact on user experience,” the study’s researchers detail.

The report also highlights significant changes in individual blockchain platforms. Bitcoin, Tron, and Polkadot saw the most substantial growth in fee generation, with Bitcoin’s fees surging by 461%. The increase in Bitcoin network fees was attributed to the popularity of Ordinal inscriptions, a novel embedding application within the Bitcoin network, marking a notable shift in its usage dynamics. As of Jan. 29, 2024, the count of Ordinal inscriptions on the Bitcoin blockchain has impressively surpassed the 58 million mark.

Decentralized exchanges (dexs) witnessed a 51% decrease in fee generation, with Uniswap emerging as a dominant player, securing 64% of dex-generated fees. The report suggests that despite the decline in fees, the trading volume on dex platforms remained relatively stable, pointing to an evolving relationship between trading activity and fee structures in the decentralized finance (defi) sector.

The report concludes by discussing liquid staking derivatives (LSDs) which showed a significant 93% increase in fee generation, highlighting the growing interest in staking solutions within the crypto-native economy. The report notes that Lido Finance, the LSD leader, collected a significant portion of these fees, reflecting the platform’s strong position in the market.

As the landscape evolves, with user preferences gravitating towards more efficient and innovative platforms, it’s clear that the blockchain ecosystem is continuously undergoing a transformative phase. This evolution paves the way for emerging technologies and strategies, potentially redefining the future of blockchain utility and economic models in the crypto space.

What do you think about PWN’s report surrounding L1s and L2s, dapps and fee generation? Let us know what you think about this subject in the comments section below.

news.bitcoin.com

news.bitcoin.com