PricewaterhouseCoopers (PwC) have outlined the need for blockchain technology to combat the ongoing financial inclusion issue, which is only set to get bigger as time goes on.

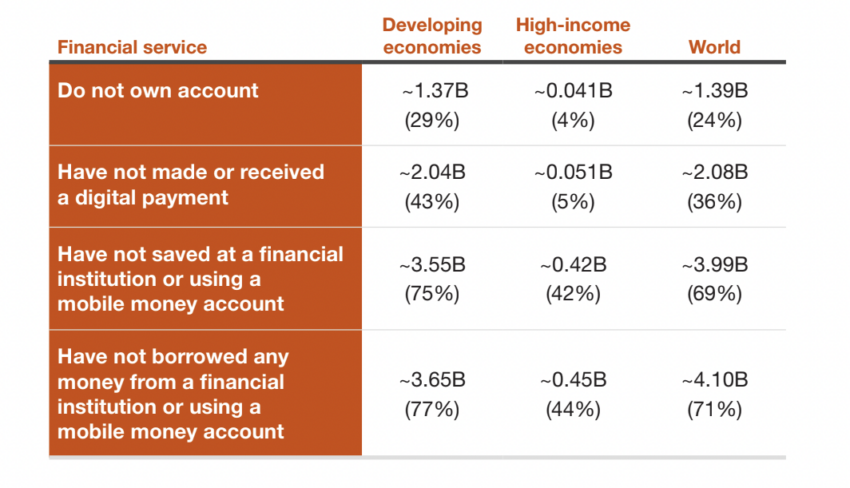

“Financial inclusion remains a significant global challenge, with over 1.4 billion people lacking access to an account or essential financial services,” the report noted.

PwC Champions Blockchain for Wider Financial Access

A recent report from PwC highlights substantial growth in innovative services within blockchain networks. PwC noted this has played a pivotal role in fostering financial inclusion.

One it noted in particular, is the surge in stablecoins:

“Nearly 200 different stablecoins are available today, offering users the stability of a variety of traditional fiat currencies while maintaining the benefits of digital assets The largest stablecoins are pegged to the U.S. dollar.”

It emphasizes the significance of offering alternatives since numerous individuals in developing nations face limited access to conventional financial institutions.

Moreover, PwC asserts that around 3.55 billion people in emerging economies have never participated in saving money.

CBDC’s Preferred In Developing Countries

Furthermore, 43% of individuals in developing countries have never conducted online payments.

Meanwhile, a recent CFA Institute survey reveals that central bank digital currencies (CBDCs) are gaining more traction in developing countries.

In developed nations, only 37% of respondents showed a preference for CBDCs, while in emerging markets, the figure rose to 61%.

Following the successful enrollment of thousands of customers and merchants in the CBDC pilot in India, the e-rupee initiative is actively exploring the feasibility of a digital cash alternative.

beincrypto.com

beincrypto.com