What Are Daily Active Users?

DAU is a metric that reflects the number of unique public addresses transacting on a blockchain each day. This gauge can tell a lot about the health of a blockchain ecosystem.

As an analogy, think of a social media application like Facebook, which also has Daily Active Users. Billions of people own Facebook accounts, but many of them are unused. To measure the health of Facebook, we can look at their Daily Active Users, tracking it over time.

Like social media networks, blockchains have network effects: the more people that use them, the more useful they become. When we see that a blockchain has many DAUs, it is a strong signal that it might be a good investment – especially if the DAUs grow over time.

Additionally, a large user base means genuine decentralization for any blockchain, which is important for the network’s security.

Top Blockchains Ranked by Daily Active Users

Here are the blockchains with the largest DAU numbers:

Tron

Daily Active Users (Sept. 2023): 1,637,200

Tron is a public blockchain created in 2017 by Justin Sun, who envisioned an Ethereum alternative for the Asian market. His vision has proven successful, as it’s the 10th largest chain today, with a market cap of over $7.5 billion.

Since its inception, Tron made sure to be compatible with Ethereum. Its native cryptocurrency, TRX, was an ERC-20 token until moving on its proprietary chain in 2018.

Tron uses the Delegated Proof of Stake (DPoS) consensus algorithm, like EOS, and hosts thousands of dapps. Thanks to its support for dapps, Tron has become one of the largest ecosystems in decentralized finance (DeFi), with its dapps accounting for over 15% of the total value locked (TVL) in DeFi.

With over 1.7 million DAUs, Tron has the largest daily active user base. While the DAU metric doesn’t directly influence Tron’s trading volume and revenue, it contributes to the ecosystem's health.

$BNB Chain

Daily Active Users (Sept. 2023): 1,095,483

$BNB Chain ($BNB), created by the global cryptocurrency exchange Binanace and previously known as $BNB Smart Chain (BSC), is another fast-growing blockchain ecosystem in DeFi. $BNB is the fourth-largest cryptocurrency, with a market cap of over $32 billion. This huge market cap is largely due to the token being used on Binance for perks and fee discounts.

Binance Chain launched in 2020, hosting the native token $BNB. Eventually, BSC came up in 2021 to tap into the fast-growing DeFi sector. BSC has been appreciated for its intuitive design, compatibility with Ethereum Virtual Machine (EVM), and low fees.

Eventually, BSC merged with Binance Chain, forming today’s $BNB Chain. It hosts about 5,000 dapps while having the governance token on the same chain. The ecosystem accounts for almost 8% of TVL in DeFi, with PancakeSwap being the most popular dapp.

$BNB Chain has over 935,000 DAUs, down 20% compared to the previous month. In October 2022, it hit over 2.1 million in DAUs. However, excluding that short-term spike, the DAU figure has been unchanged year-on-year.

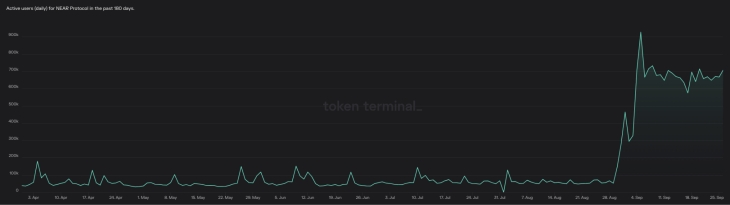

$NEAR Protocol

Daily Active Users (Sept. 2023): 706,407

$NEAR Protocol is a Proof of Stake (PoS) blockchain launched in 2017. $NEAR focuses very much on scalability, offering fast speed at meager prices.

This unmatched scalability is achieved thanks to an exceptional architecture known as “sharding,” a system in which the network’s infrastructure is split into multiple parts so that participating nodes can handle only a fraction of the network’s transactions.

Interestingly, $NEAR hosts only a handful of dapps – about 200 – but its DAU metric suddenly surged at the end of August to propel it among the most used networks. Interestingly, there is no known reason for this large and sudden uptick in users. Some have speculated that it is due to the number of deals and partnerships that $NEAR has been quietly inking, but there’s no concrete proof. $NEAR’s DAU figure hovers near 700,000, seven times higher than a year ago. With a market cap of $1 billion, $NEAR is the 40th largest cryptocurrency.

Another interesting observation is that $NEAR’s DAU figure doesn’t correlate with the market cap, in other words, we haven’t seen price increasing at the same time as the DAU metric has grown. However, it has driven fees and revenue on $NEAR, which could lead to a coming increase in price.. This is because $NEAR is smaller compared to Tron and $BNB Chain.

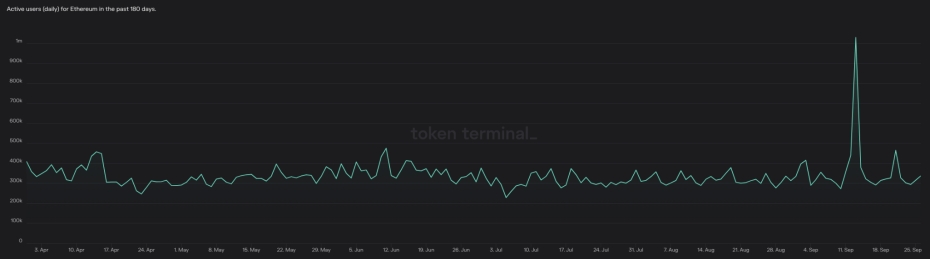

Ethereum

Daily Active Users (Sept. 2023): 336,186

Ethereum is the largest blockchain network using smart contracts. It was launched in 2014 to improve bitcoin’s scalability and bring more functionality by hosting dapps. Today, ETH’s $191 billion market cap is second only to bitcoin.

Ethereum has been dominant in the DeFi space and accounts for more than half of the total TVL in DeFi. However, cracks may be showing as its level of dominance in terms of users is as low as it has ever been, with Tron, $BNB, and other chains gaining traction.

Since Ethereum is a well-established network that has dominated the blockchain space for years, its DAU figure isn’t changing much, remaining in the range of 300 - 400,000 over the past year. The DAU can sometimes break above 1 million – it happened twice during the last 12 months, but the spikes are rare.

Since Ethereum is a large and liquid ecosystem, its DAU figure no longer correlates with other metrics.

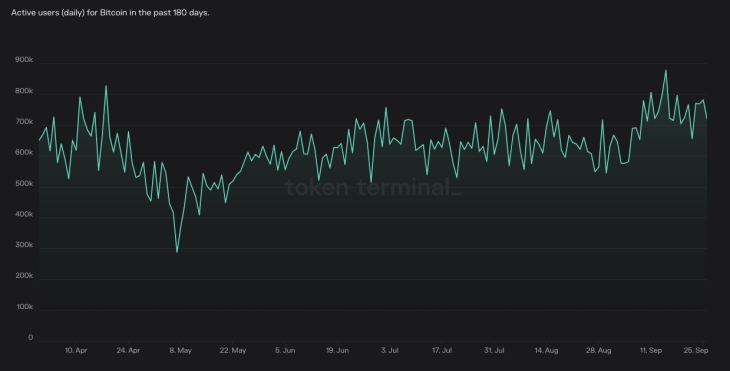

Bitcoin

Daily Active Users (Sept. 2023): 720,355

Bitcoin is the largest and oldest cryptocurrency. It was launched at the end of 2009 and represents the first use case of blockchain technology.

The decentralized network has a rigid architecture that doesn’t support smart contracts and the development of dapps.

The bitcoin blockchain has been built exclusively for the native cryptocurrency, $BTC, which was meant to be a decentralized peer-to-peer (P2P) money system, although it acts as a store of value (SOV) today.

Even though bitcoin doesn’t support dapps, $BTC alone is quite active, driving the entire crypto market. The number of DAUs is over 750,000 today, up over 100,000 year-on-year, as per TokenTerminal. Other sources, such as BitInfoCharts, show that $BTC’s active addresses exceed 950,000 today.

Today, bitcoin’s DAU figure doesn’t show a correlation with anything. In fact, during the last three years, the DAU performance has been a horizontal channel, although $BTC’s price and trading volume have fluctuated a lot.

Special Mention: Starknet

Daily Active Users (Sept. 2023): 162,103

Starknet deserves a special mention since its DAU figure surged over 30,000% during the last 12 months.

Starknet is a Layer-2 scaling solution for Ethereum. Its main goal is to take some burden off Ethereum to make transactions more efficient and cheaper.

Like other Layer-2 chains, such as Polygon, it operates as a Zero-Knowledge Rollup (ZK-Rollup), bundling Ethereum transactions in batches and settling them off-chain.

Starknet’s DAU has surged during the last year amid increasing demand for Ethereum scaling solutions. Its DAU figure is almost 170,000, up from about 600 in September 2022.

Like in the case of $NEAR, Starknet’s sudden increase in DAU has directly impacted fees and revenue.

How to Grow Daily Active Users

A rapid increase in DAUs demonstrates that a blockchain is creating more value to attract more users. This may occur because of various factors:

- The network has launched recently and addresses some important issues;

- The network has been upgraded, and added unique features that attract users;

- The network hosts a dapp that has surged in popularity and brings more activity.

Also, it’s interesting to observe the correlation between DAUs and market cap, revenue, and transaction volume. Generally, there are three scenarios:

- Large chains like bitcoin and Ethereum have DAU figures that move horizontally for years and don’t show any correlation.

- Mid-cap chains, such as Tron or $BNB Chain, show a correlation between DAU and market cap.

- Fast-growing chains with lower market cap, such as $NEAR or Starknet, show a correlation between their DAU figure and fees and revenue.

The Benefits of DAUs for Crypto Projects

A high DAU figure should be the goal of any blockchain network: it means more users driving the ecosystem, with more growth and wealth generation potential. Generally, more users also means a network with many nodes, meaning it’s more secure and decentralized.

A larger user base can directly impact the ecosystem's health, as it encourages more developers to build great dapps, which eventually attracts even more users, creating a virtuous circle.

Eventually, blockchains with larger user bases gain more reputation, trust, and recognition among industry stakeholders.

Challenges and Considerations

A large user base benefits any blockchain, but growth brings growing pains. As a rule, more activity requires more scalability, so blockchain developers should focus on transaction speed and lower fees. More often, scalability may be achieved at the expense of less decentralization, which is another drawback. Generally, blockchains try to find the perfect balance between decentralization, scalability, and security – the so-called blockchain trilemma.

Layer 2 solutions, such as Starknet, Polygon, Arbitrum, and Optimism, have been developed to bring scalability and cheaper transactions to Ethereum, which often struggles with network congestion due to high demand (too many DAUs).

Another challenge is that DAUs is not an entirely accurate metric since each user can have multiple wallet addresses, which leaves the door to manipulation of this gauge, especially in the case of smaller networks. (But in the case of larger tokens, it’s good enough for us.)

Investor Takeaway

DAUs play a crucial role in evaluating the health and growth of blockchain investments. This metric reflects the lifeblood of any blockchain project, demonstrating popularity and resilience–both leading to innovation and growth. Their numbers often reflect the growth trajectory and possible mass adoption of a blockchain ecosystem.

While they aren’t the only important metric for assessing DeFi projects, investors should measure DAUs carefully, as they can signal great crypto investments – and warn us away from crypto projects that are all hype, with no users.

bitcoinmarketjournal.com

bitcoinmarketjournal.com