On Tuesday, Digital Asset unveiled a major project to reshape the digital assets landscape. Having harnessed blockchain technology to reshape FinTech, the company announced the launch of the Canton Network.

Aimed at institutional players, the privacy-enabled network is the first interoperable blockchain to link financial markets frictionlessly. Canton is a “network of networks” with decentralized applications to serve financial institutions for asset tokenization, governance, payments, clearing, settlement, custody, and asset life cycle management.

Canton’s list of network participants is who’s who in finance and tech, encompassing the industry’s leading companies: Goldman Sachs, Moody’s, S&P Global, Deloitte, BNP Paribas, Cboe Global Markets, Paxos, and Microsoft, to name a few.

How Will the Canton Network Work?

While many crypto investors take it for granted that blockchains must be decentralized, public, and transparent, Digital Asset sees these features as flaws. At least, when it comes to the targeted clientele, transparency needs to be closely managed.

For this reason, Canton Network is all about scaling, data control, and privacy. This way, the blockchain trilemma is resolved by focusing less on decentralization and more on security and scalability.

Case in point, the more nodes the network has, transactions have to pass through a greater number of obstacles, resulting in greater costs. While this increases decentralization and security, it decreases performance. All Canton Network participants will be approved and compliant with strict security and regulatory requirements to counterbalance that.

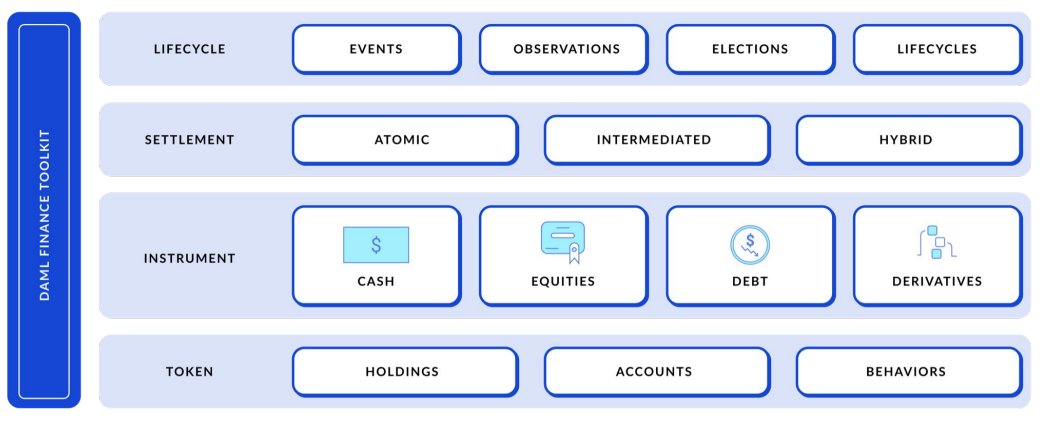

For this purpose, the Digital Asset team developed Canton’s smart contract programming language, Daml. Thanks to the Daml finance toolkit, institutions have ready-to-go tools for the full-spectrum management of digital assets.

In this light, Canton Network is poised to render legacy settlement systems obsolete, as their inefficiency was demonstrated during the GameStop short squeeze. If the Canton list of participants expands, institutions will have real-time information on asset flows, removing trading latencies and expediting transactions.

Despite being a private blockchain, regulators could still access all transactions across the blockchain’s immutable ledger.

Likewise, businesses can use Canton to automate payments thanks to smart contracts, reducing errors and payment failures. Combined with encroaching AI systems, it is not difficult to see that many HR and accounting departments could be made obsolete.

What Does it Mean for Crypto Space?

As the saying goes, the tide lifts all boats. Given the caliber of Canton Network participants, financial tokenization is a certainty. In a spillover effect, Canton’s blockchain interoperability will accelerate the deployment and trading of digital assets.

In particular, tokenized real-world assets (RWA), as Cboe Executive Vice President Cathy Clay hinted.

“At Cboe, we believe the tokenization of real world assets may offer an unprecedented opportunity to create new market infrastructure and drive efficiency in the trading of products across the globe.”

However, it bears noticing that already highly regulated financial institutions will have a leg up over various crypto companies and DeFi protocols. This extra layer of legitimacy will likely spur greater participation of the public. In turn, digital assets elsewhere will also benefit, with one blockchain network leading to another.

Who is Behind Canton?

Headquartered in New York in 2014, Digital Asset was founded by Don Wilson, Eric Saraniecki, Shaul Kfir, Sunil Hirani, and Yuval Rooz. Since its founding, Digital Asset received $307.2 million to build distributed ledger technology (DLT) infrastructure and enterprise tools.

The latest funding round, in May 2022, was led by Japan-based SBI Group, a financial services company in banking, securities, and asset management. Previous leads were no less impressive, including JP Morgan, IBM, Goldman Sachs, Eldridge, Salesforce, and Samsung.

Do you think Canton Network will endanger more enterprise-oriented crypto retail/VC networks? Let us know in the comments below.

tokenist.com

tokenist.com