Financial technology company Digital Asset will start a privacy-enabled interoperable blockchain network designed to provide a decentralized infrastructure for institutional clients, the firm announced on Tuesday.

Participants of the network, which is called the Canton Network, include BNP Paribas (BNP), Deloitte, Cboe Global Markets (CBOE), Goldman Sachs (GS), Broadridge (BR), S&P Global, and Microsoft (MSFT), among many others.

“The Canton Network is a powerful answer to industry calls for a solution that harnesses the potential of blockchain while preserving fundamental privacy requirements for institutional finance,” Chris Zuehlke, partner at DRW and global head of Cumberland, another participant, said. “This unique approach, coupled with the ability to execute an atomic transaction across multiple smart contracts, is the building block needed to bring these workflows on chain.”

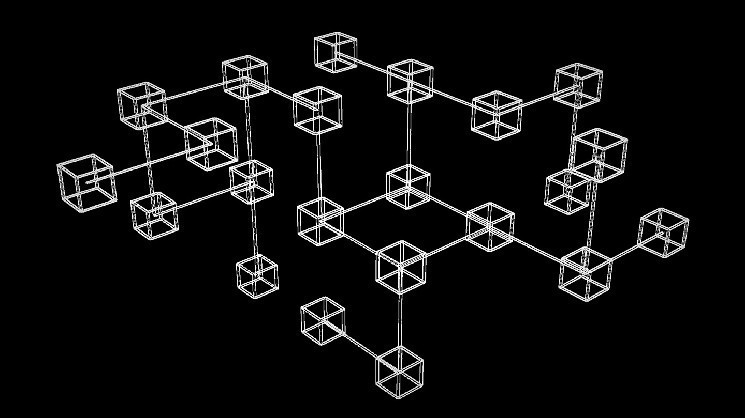

The network connects applications built with Daml, Digital Asset’s smart-contract language, allowing various systems in financial markets to interoperate and synchronize.

“Such solutions are a key building block for future digital and distributed financial market infrastructures,” Jens Hachmeister, head of Issuer services and new digital markets at Deutsche Börse Group said.

While Digital Asset provides and owns the technology behind the infrastructure, the Daml smart contracts and the Canton protocol which enables the applications, it does not own the network itself as it is owned by its participants, which include Digital Asset.

coindesk.com

coindesk.com