A recent Bank of America study shows that Ethereum usage could drop if they cannot increase throughput. Ethereum remains a dominant blockchain, offering an operating system ecosystem to over 200 Decentralized Finance (DeFi) projects. But a March 21, 2023 report says that they may soon lose the race if they do not solve underlying problems.

The Bank of America Report on Ethereum

In their report, the bank suspects Ethereum adoption might suffer if the blockchain does not increase its throughput. This problem can force dAPP developers to shift to other blockchains to build their projects. Exciting projects greatly fuel adoption, and a lack of them has adverse effects.

Alkesh Shah and Andrew Moss, analysts of the report, say that Ethereum’s feasibility largely depends on the blockchain’s ability to implement a sharding architecture. This keeps it on the laid-out roadmap and expands its throughput capacity.

Ethereum and its Underlying Problem

The Bank of America, in their report, refers to Ethereum’s smart-contract-enabled platform. They provided a first-mover advantage to the blockchain, inviting developers to the platform to create projects. As a result, the number of dApps and users grew significantly.

This early success is often considered as a “double-edged sword” for Ethereum, as increased transactions caused network congestion and a rise in transaction fees. While other blockchain competitors have taken advantage of this flaw, and are called Ethereum killers.

Top Projects Currently on Ethereum

Ethereum is home to thousands of blockchain projects, all of which work on decentralized apps (dApps). All these applications build on the Ethereum blockchain and service a variety of fields ranging from financials, trading, gaming, NFTs and numerous other services. The major projects working on it are, OpenSea, UniSwap, Chainlink, StrongBlock, Tether, 1Inch V4, Ethichub, Zeroex, Otherdeed, etc.

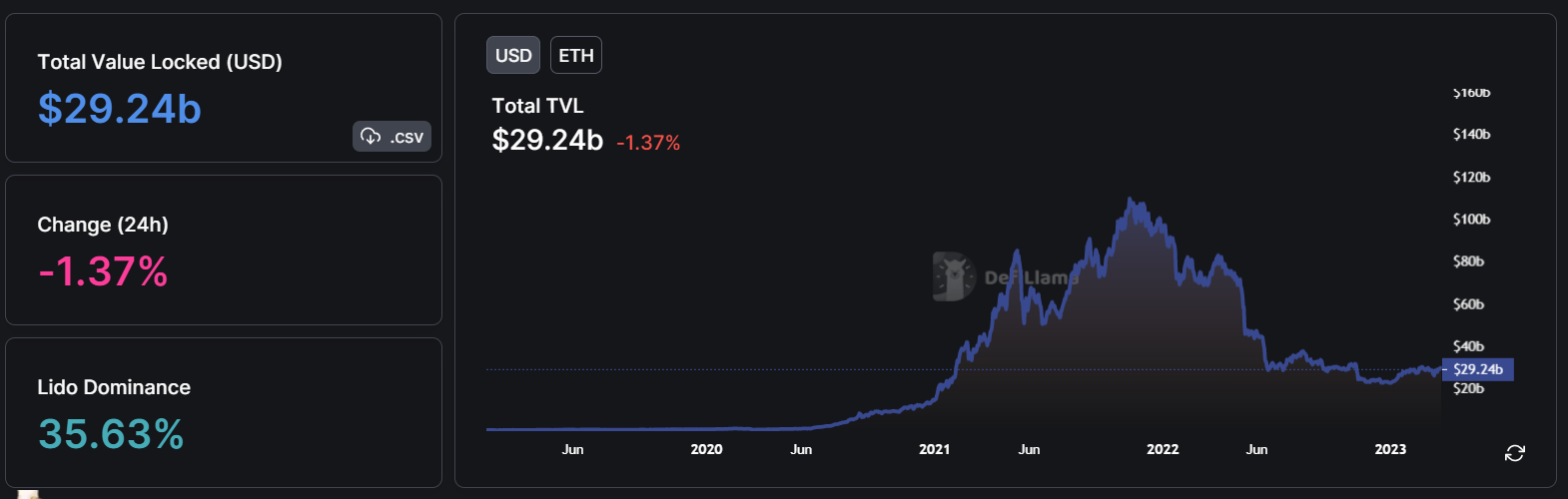

When writing, the current Total Value Locked (TVL) at Ethereum was $29.24 billion, dropping 1.37% in the last 24 hours.

The Ethereum Killers

Blockchains which are directly competing with Ethereum and can dethrone the blockchain, are called Ethereum killers. Concerning the Bank of America report, these are the options developers might switch to if they do not address the throughput. Major Ethereum killers are Solana, Cardano, Polkadot and Avalanche.

Launched in 2020, Solana is a layer-1 blockchain that garnered the attention of both retail and institutional investors. It uses a unique Proof-of-Honesty (PoH) consensus algorithm. Allowing Solana to create unique timestamps for verifying transactions at very high speeds.

Major projects on Solana are Raydium, Mercurial Finance, Orce, Star Atlas, STEPN, Coin 98, Audius, Civic, Ren, etc.

Ethereum co-founder Charles Hoskinson created Cardano (ADA) in 2017. Cardabi was built with a slow and steady approach. Everything in Cardano gets through multiple checkpoints, thus, ensuring credibility. Their token – ADA – ranks among the top 10 cryptos by market cap and is available on several exchanges.

Major projects working on the Cardao blockchain are MinSwap (MIN), SundaeSwap (Sundae), MELD (MELD), Cornucopias (COPI), Empowa (EMP), Djed (DJED), Revuto (REVU), etc.

Polkadot (DOT) was also created by a former Ethereum developer, Dr. Gavin Wood in 2017, and it went live in 2020. Its network employs a complex architecture involving a main Relay Chain and various other Parachains used to create dApp projects. The blockchain also has an auction system to decide which project can put their dApps on Parachains.

Major projects currently running on the Polkadot blockchain are; Moonbeam (GLMR), Acala (ACA), Parallel Finance (Para), Astar (ASTR), Efinity (EFI), Clover Finance (CLV), Composable Finance (LAYR), etc.

thecoinrepublic.com

thecoinrepublic.com