The total number of transactions conducted on the Solana ($SOL) network is nearing the 100 million mark, at a time in which institutional investors keep betting on products offering them exposure to the cryptocurrency, despite the ongoing bear market.

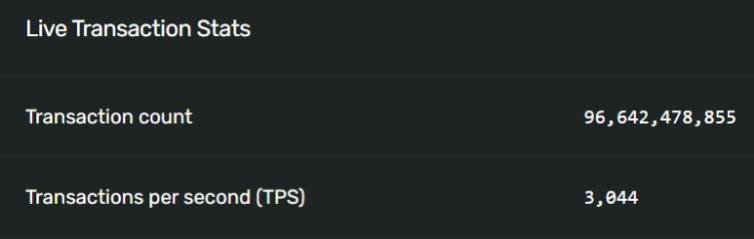

According to data from Solana’s blockchain explorer, the network has now processed a total of 96.62 million transactions and is currently processing an average of 3,044 transactions per second, well below the network’s touted capacity of up to 50,000.

Solana has notably been on a significant downtrend so far this year, as Finbold reported, as has the entire cryptocurrency market and other risk assets. Market data shows that while the flagship cryptocurrency Bitcoin lost around 60% of its value so far this year, Solana lost around 79% of its value.

Total value locked on Solana’s decentralized finance (DeFi) space has also been dropping, presumably because the network has suffered a number of outages so far this year that affected users’ confidence in it. Solana’s co-founder, Anatoly Yakovenko, has said in an interview that outages are the network’s “biggest challenge.”

Nevertheless, as CryptoGlobe reported, institutional investors have over the past week largely reduced their bets on both Bitcoin and Ethereum-based investment products, while increasing their exposure to several altcoins, including Solana.

Products offering exposure to Solana saw $500,000 in inflows, while products offering exposure to XRP saw $200,000 in inflows. Cardano-based investment products saw $100,000 in inflows, while multi-asset products saw $3.3 million in inflows.

Solana is a high-performance blockchain founded by former Qualcomm, Intel, and Dropbox engineers that uses a delegated Proof-of-Stake (dPoS) consensus algorithm. The network uses a unique method of ordering transactions to significantly improve its speed and throughput.

Using what’s known as Proof-of-History (PoH), the Solana blockchain is able to handle thousands of transactions per second. PoH uses Verifiable Delay Functions to hash incoming events and transactions to allow nodes to locally generate timestamps of SHA256 computations, eliminating the need for timestamps to be broadcasted across the network.

Image Credit

Featured Image via Unsplash

cryptoglobe.com

cryptoglobe.com