Another wave of selling hit the bitcoin ($BTC) market and sent its price to lows last seen in December 2021. Many now wonder, does on-chain data suggest that it is the perfect time to buy the dip?

On June 13, the crypto prices dropped significantly deeper into the bear market territory after Bitcoin sliced through its current trading range and momentarily touched the $22,600 level, a low not seen since December 2021.

Based on the bitcoin historic data, the market has now reached some valuation metrics that show the price is now severely oversold and maybe near the bottom. Bitcoin has now dropped below its realized price, which represents the average price for every coin that is in supply according to the time that it was last spent on-chain.

While the massive pain that this most recent capitulation has brought in across the entire ecosystem cannot be understated, the one glimmer of hope that it provides the weary crypto traders is that the worst of the drop could have already happened. The coming days will confirm the theory and proof would be institutions and retail traders coming in to buy the dip in large numbers.

“Shrimps And Whales” Accumulate

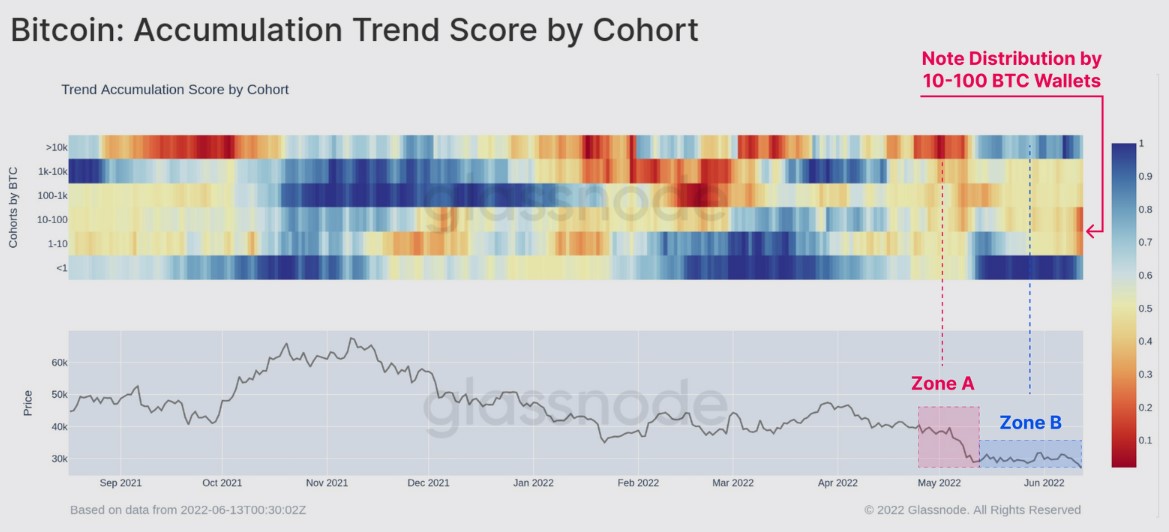

Most of the on-chain data suggest that not all the traders feel devastated about bitcoin at the yearly lows. Shrimp wallets, which hold less than 1 $BTC, and whale wallets, those that hold over 10,000 $BTC have been accumulating since Terra collapsed sometime in early May 2022.

Based on data from acquired blockchain intelligence provider Glassnode, shrimp wallets have recorded a net balance growth of +20,863 since the May 9th Luna crash and the cumulative increase of 96,300 $BTC since November’s all-time highs.

Whale wallets, on the other hand, have also been busy during this period as “this cohort has a monthly position change peak of ~140k $BTC/month” and has added a cumulative +306,358 $BTC since its all-time high in November 2021.

Support Limited In The Mid-$20,000 Zone

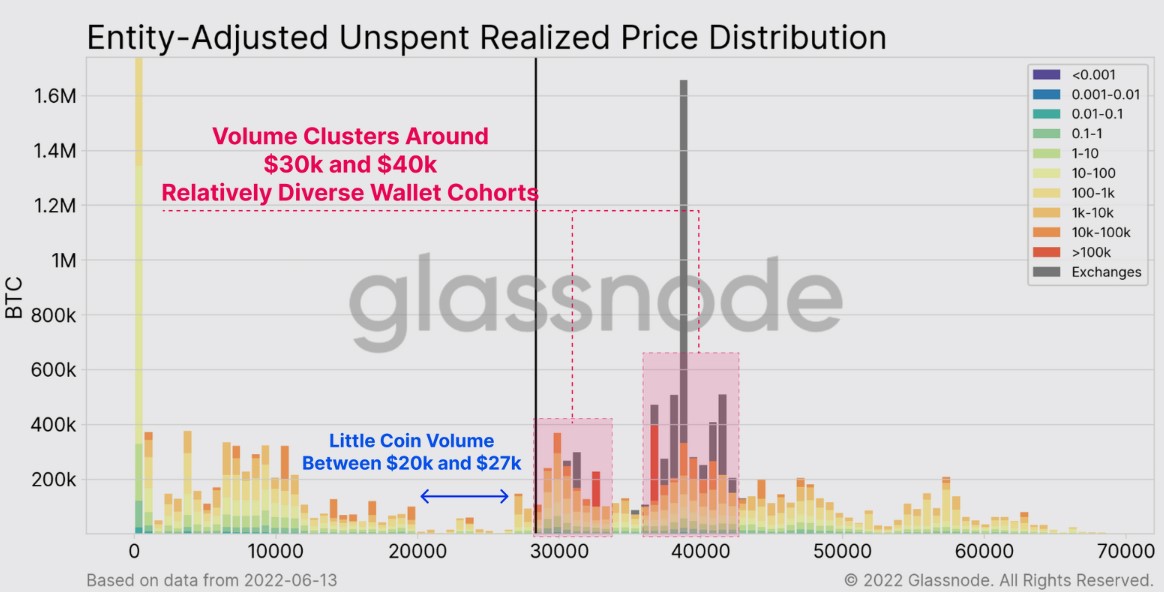

Part of the reason for the recorded rapid sell-off on June 13 was the lack of any formidable demand in the $20,000 to $27,000 range as seen in the following entity-adjusted unspent realized price distribution chart.

While there is a huge amount of demand that had formed near the $30,000 and $40,000 price ranges, some of the lowest volumes recorded were seen between $20,000 and $27,000. That phenomenon left little support as the price of bitcoin crashed violently in the early hours of trading on June 13.

Nonetheless, relief might be in sight as the saying goes, “it’s always darkest before the dawn” and this might apply to the current state of the cryptocurrency market based on multiple metrics.

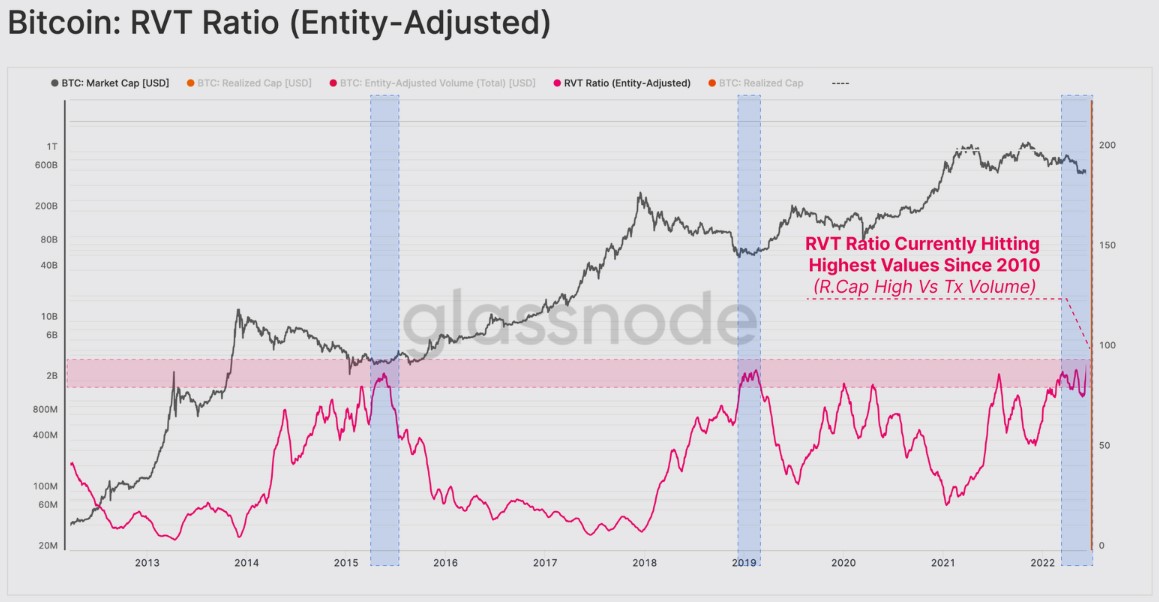

Based on the RVT Ratio that compares the realized capitalization against the daily volume settled on-chain, “the network valuation is now 80 times larger than the daily value settled” which suggests a low amount of on-chain activity.

Glassnode stated:

“In past bear cycles, an underutilized network has provided confluence with bear market bottoms.”

The RVT ratio is now at its highest level since 2010, which may indicate that the market has now reached the point of maximum pain and might soon see some improvements. Nevertheless, the possibility of more weakness cannot be ruled out at this point.

The general crypto market cap now stands at $980 billion and Bitcoin’s dominance rate is 46.3%.

cryptovibes.com

cryptovibes.com