Bitcoin (BTC) has been falling at an accelerated rate since June 7, creating seven bearish daily candlesticks in the process.

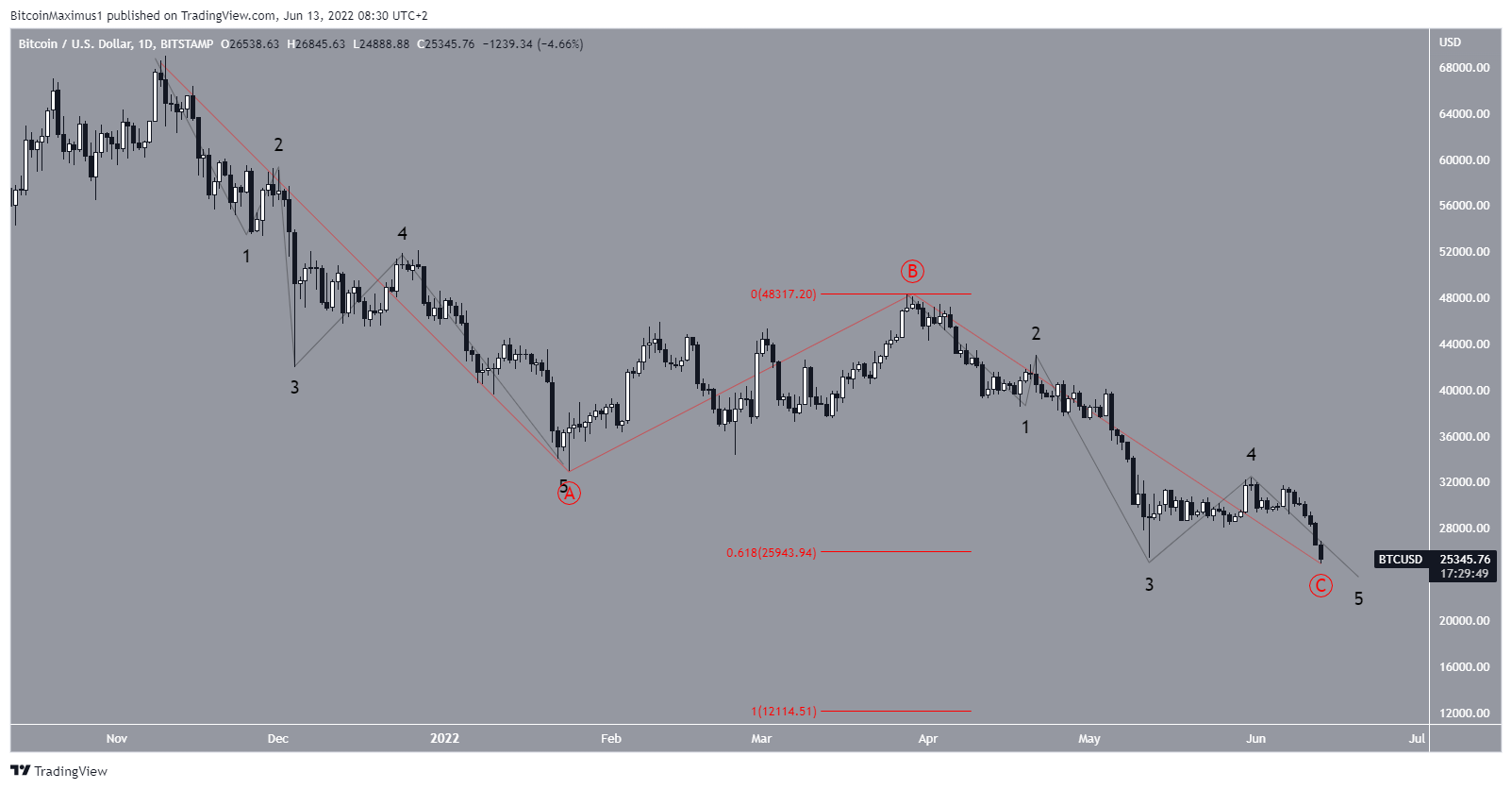

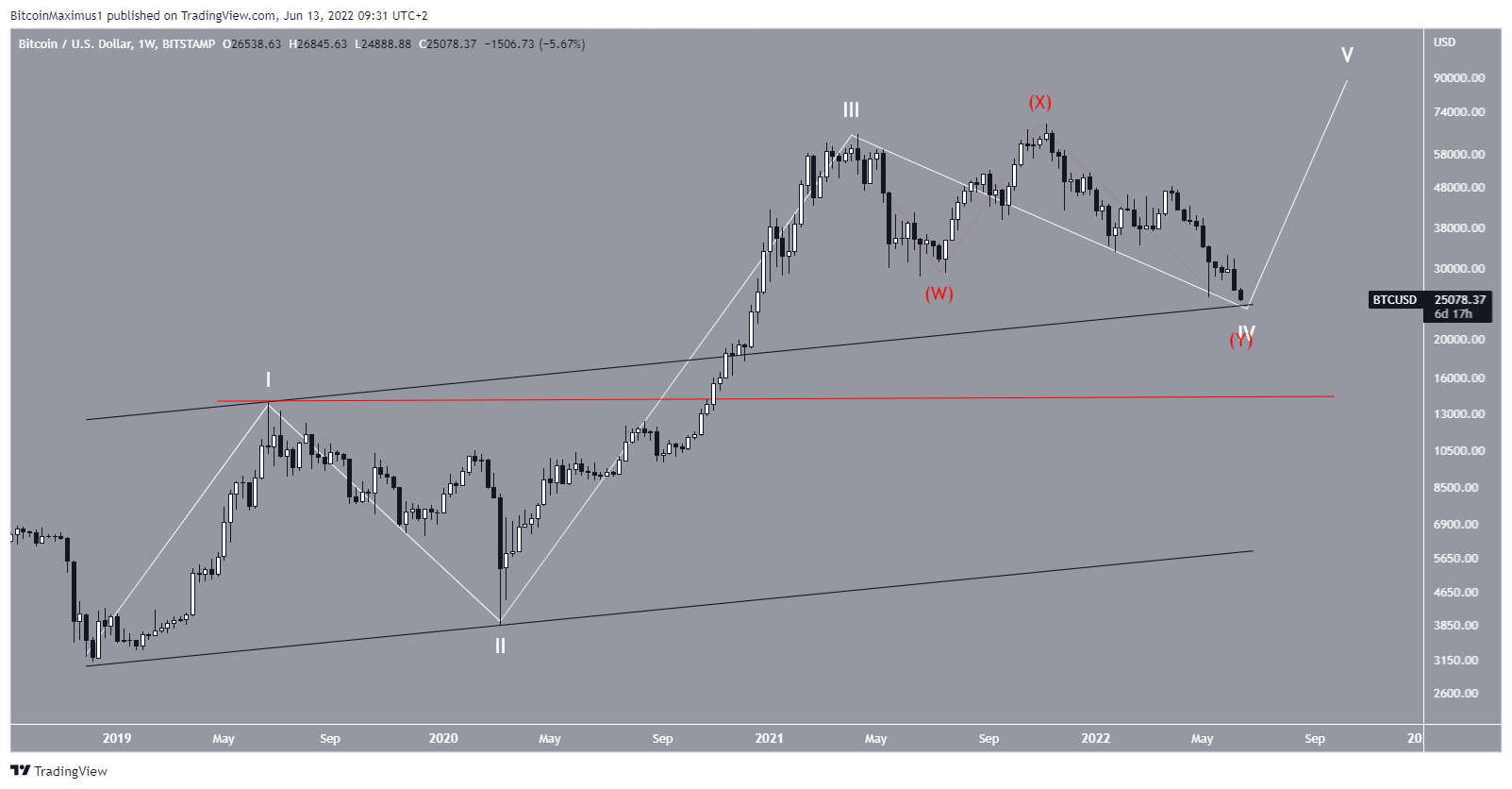

BTC has been falling since reaching an all-time high price of $68,995 last Nov. In May, it broke down from a long-term ascending parallel channel, confirming that the trend is bearish.

Initially, the price bounced at the 0.618 Fib retracement support level, but was rejected by the $30,000 horizontal area (red icon), validating it as resistance.

If the downward movement continues, the next support area is at $22,000. This is the 0.382 Fib retracement level when using a logarithmic Fib tool and the resistance line of a previous ascending parallel channel (red circle).

As a result of these confluences, it is likely to provide support.

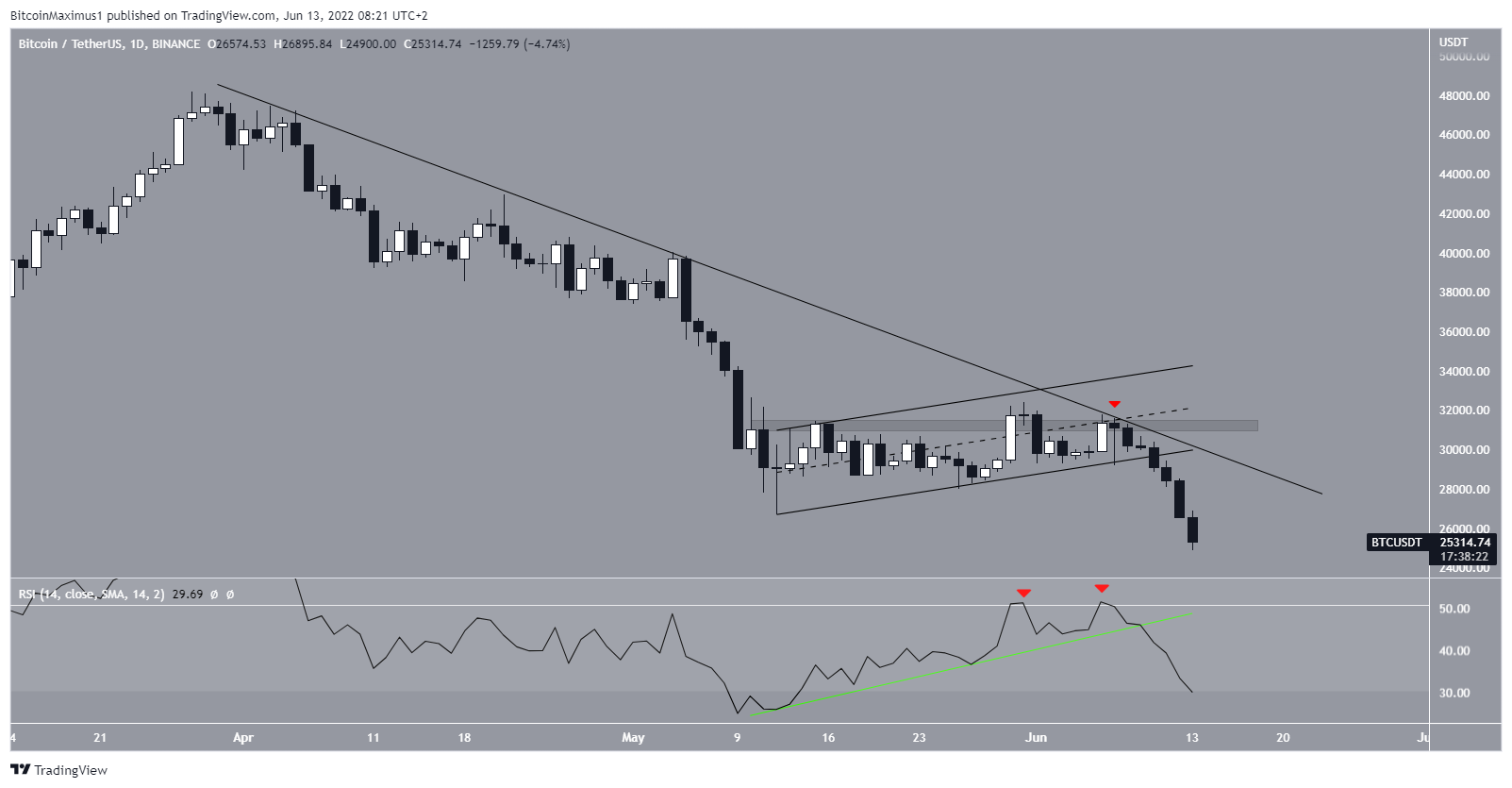

Short-term breakdown

The daily chart shows that BTC had been increasing inside an ascending parallel channel since May 12. While trading in it, it proceeded to reach a high of $31,589 on June 7.

Once there, it was rejected by a confluence of resistance levels, more specifically the $31,500 horizontal area, the middle of the aforementioned channel and a descending resistance line in place since April.

Additionally, the daily RSI had been generating bullish divergence (green line) since the May 12 low. The channel breakdown coincided with a break of this trendline, another sign that the trend is bearish.

BTC wave count analysis

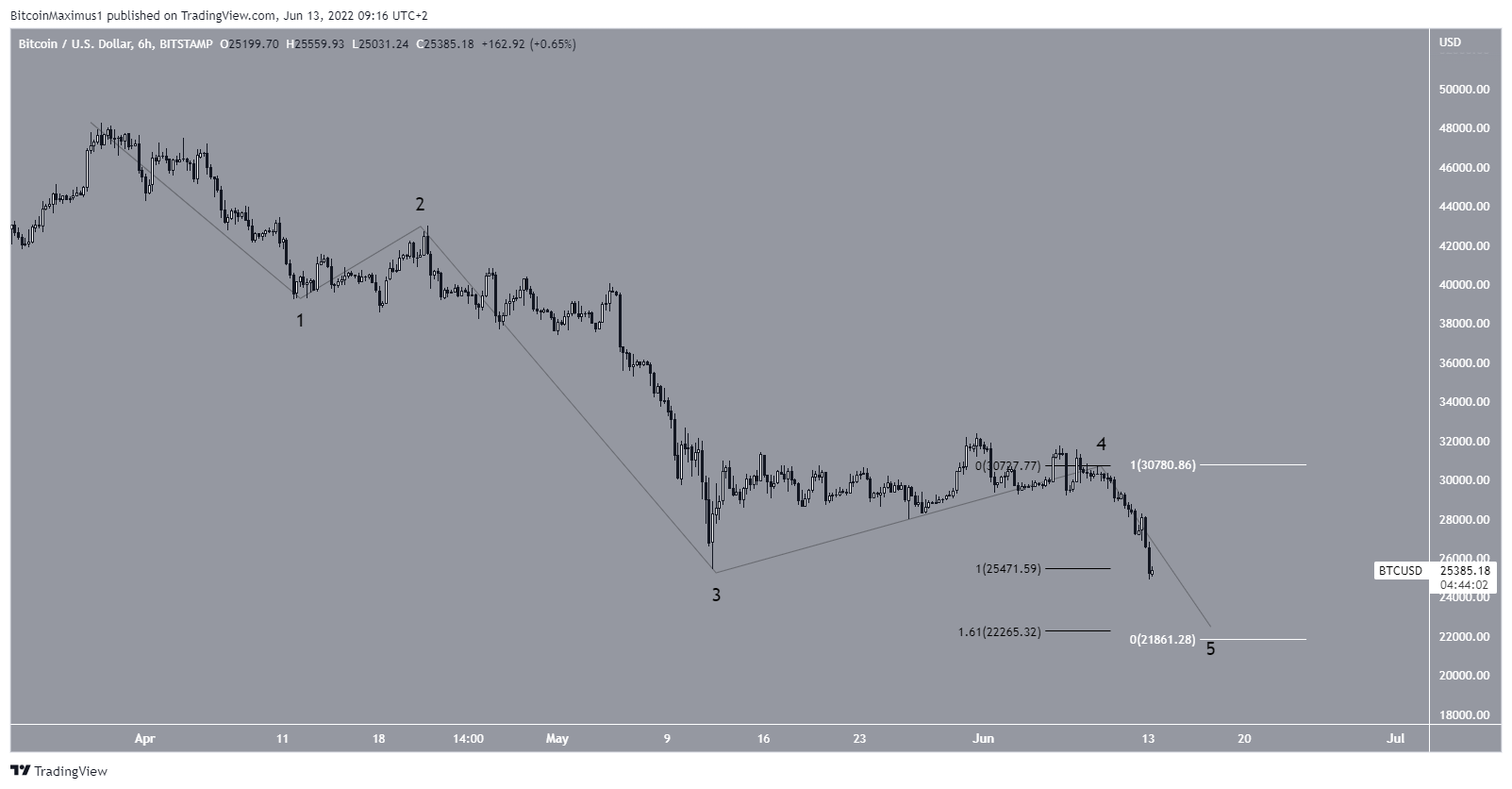

The wave count suggests that BTC is in the C wave of an A-B-C corrective structure (red). The sub-wave count is given in black, suggesting that the price is in the fifth and final sub-wave.

The short-term count provides a target close to $22,000, found by using the length of sub-wave one (white) and an external retracement on sub-wave four (black). This is also in alignment with the readings from the weekly time frame.

As for the long-term count, it is likely that the price is nearing the bottom of wave four (white) of a long-term upward movement that began in Dec 2018.

So, after the current decrease is complete, another movement towards a new all-time high could still occur.

A decrease below the wave one high (red line) at $13,880 would invalidate this potential wave count.

For Be[in]Crypto’s previous bitcoin (BTC) analysis, click here

beincrypto.com

beincrypto.com