I love Bitcoin. It holds down a position in my portfolio, and I don’t intend to sell it anytime soon. I may or may not even dabble with the odd laser eyes profile picture on my Twitter account. Nonetheless, I like analysing bear arguments for it and some definitely have merit. If you can’t beat down a counter-argument against an asset you hold with a well-structured response, then perhaps you need to re-evaluate that position.

Your mom, obviously

— Do Kwon 🌕 (@stablekwon) January 28, 2022

Bear Case

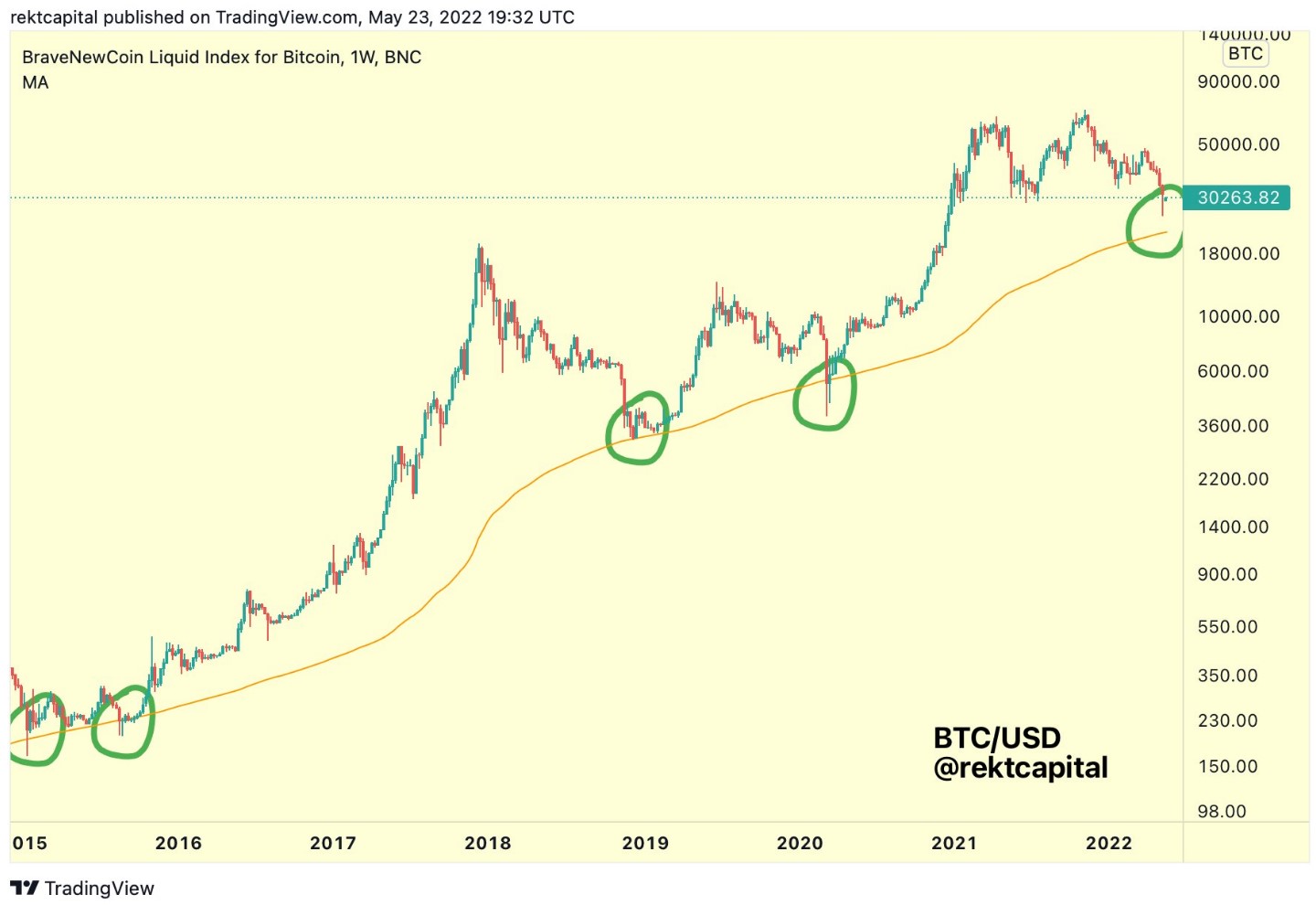

I came across an interesting bear case on Bitcoin this week. Rekt Capital (a good follow on Twitter if anyone wants objective analysis on magic Internet money, @rektcapital) released a thread on the 200-week moving average (200-MA).

As the below chart shows, this 200-MA has historically acted as stout support, but only after a violent, but brief, wick below.

| Date | Wick Below 200-MA |

| Early 2015 | -14% |

| Late 2015 | -14% |

| March 2020 | -28% |

Hmmm. So, we are looking at wicks between 14% and 28% below the 200-MA. With the 200-MA currently sitting at $22,000, it is unfortunately not outside the realm of possibility that Bitcoin now hit this mark. Should it meet it, a downside wick of -14% would be $19,000, whereas a -28% wick would equate to $15,500. Scary stuff, huh?

My Thoughts

I like mixing in a bit of technicals to use in conjunction with my wider analysis, but we need to be careful here in the context of Bitcoin.

Two of the three instances above came in 2015, when Bitcoin was only a baby, with a market cap south of $7 billion. I’m not sure we can draw any solid conclusions from charts that far back, given the journey since. Back then, it was still a niche asset largely operating within the nerdy corners of the Internet, not the macro juggernaut that currently sits on Tesla’s balance sheet and generates headlines from CNBC and the FT on the regular.

As for the final scenario of March 2020, I’m hesitant to put too much weight on this either, given the black swan nature of the panic amid COVID’s arrival on the scene (note to self: using the phrase “black swan” far too much these days, which is a paradox, no?). I remember emptying my locker at work thinking I would be returning to the office three weeks later, but ended up spending two years in my bedroom like a convicted prisoner. Extrapolating price action from that Armageddon month hence feels a little spurious.

Finally, we actually bottomed right at the 200-MA, with no wick below it all, at the third green circle above in the chart above in late 2018. While this certainly strengthens the case for the 2000-MA acting as support, it does take the shine off any wick analysis, now that we have wicks of 0%, 14% and 28%.

However, the $22,000 mark, which is the current 200-MA, is definitely a benchmark I am keeping an eye on, as we continue to bleed towards it. While the wick analysis above is interesting, and certainly not meaningless, I think the $22,000 as support would represent a good opportunity to fill up some buy orders.

In reality, we are dependent here on the wider macro environment. Sure, that’s always the case, but it feels more significant now when fear is at an all-time high and the markets are swinging back and forth off the tentative geopolitical situation, nauseating inflation and a Federal Reserve that is as indecisive as me when faced with a seven-page menu in a Mexican restaurant (all the dishes look so good, but they’re all so similar – it gives me a terrible case of decision paralysis).

Conclusion

Am I saying the $22,000 mark is in play with anywhere near enough conviction to even contemplate selling my precious Bitcoin? No. As I said, charts are a nice addition to analysis, but never serve as the only input for me. I think that’s especially true with an asset offering as small a sample space as Bitcoin, and one that has changed so fundamentally in the last few years.

But it’s a scenario which could verifiably happen, especially in this volatile world with egomaniac heads of state invading fellow countries at will, a Federal Reserve that seemingly changes its mind daily, and a whole host of other variables that no one could possibly predict.

I hate to say it, but there could be more pain here. And hat tip to @RektCapital for the analysis – he’s one of the good guys.

invezz.com

invezz.com