It’s been months now that Grayscale Bitcoin Trust has been trading at a steep discount.

GBTC is not the only one as the discount on ETCG actually went as low as 54.9% and is currently at just under 40%. While ETHE is trading at a discount at 4.52%, LTCN is at a premium of a whopping 1,168% and BCHG at almost 182%, as per Bybt.

But, of course, GBTC is the most important one.

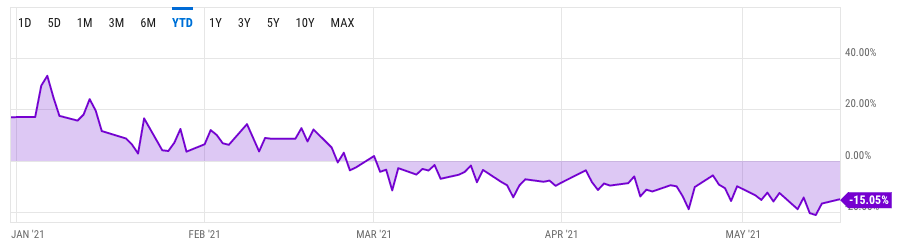

Late in February 2021 was the first time when it briefly went negative, but the next drop below zero on March 2nd was the last time it saw positive numbers. Since then, it has continuously been declining, hitting a fresh low of 21.23% on May 13.

As of writing, the GBTC is trading at a discount of 15.05% to NAV.

The time between when the discount on GBTC shares went record low this year and recovered some this week, the price of Bitcoin crashed almost 20%.

“GBTC prem is diverging from BTC price action recently,” noted Avi Sanyal, Head of Trading at BlockTower.

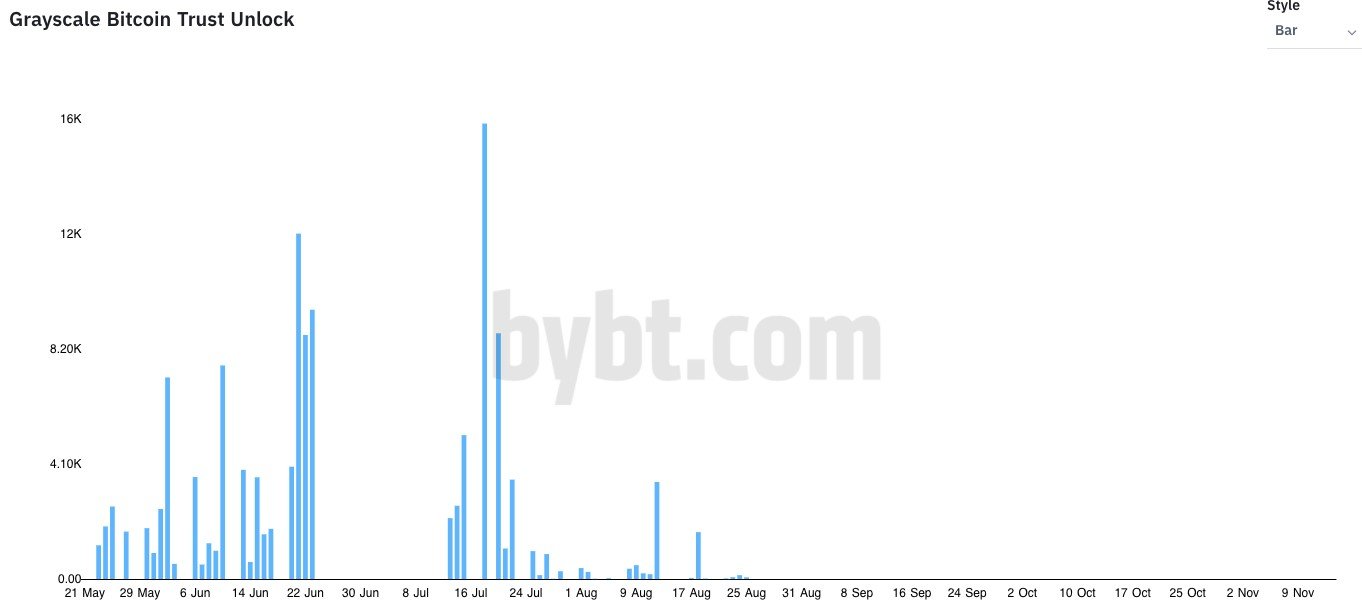

While this discount may make GBTC look attractive on paper, James Seyffart, a Bloomberg ETF analyst, noted that GBTC is trading at a discount because of the shares coming into the market in recent months, and soon, in June and July, there will be a flood of them.

“Currently around 530 million shares that could be eligible for trading and rising to 692 million at the end of August,” he stated.

As we reported, Grayscale has been trying to limit the discount by announcing the buyback program, which was recently increased to $750 million; the discount has yet to take a good hit. While GBTC’s conversion into an ETF would eliminate any discount and premium, it is anyone's guess when that would happen.

[caption align="alignnone"]

While this discount may make GBTC look attractive on paper, James Seyffart, a Bloomberg ETF analyst, noted that GBTC is trading at a discount because of the shares coming into the market in recent months, and soon, in June and July, there will be a flood of them.

“Currently around 530 million shares that could be eligible for trading and rising to 692 million at the end of August,” he stated.

As we reported, Grayscale has been trying to limit the discount by announcing the buyback program, which was recently increased to $750 million; the discount has yet to take a good hit. While GBTC’s conversion into an ETF would eliminate any discount and premium, it is anyone's guess when that would happen.

[caption align="alignnone"] Source: Bybt[/caption]

While there are no new creations ever since Grayscale halted them at the end of February, the 6-month lockup on the shares already created is ending, increasing the supply by 31% over the next ~3.5 months, he stated.

As Scopus Asset Management disclosed in its SEC filing, it almost doubled its Bitcoin exposure through GBTC since Dec. 31st from 173k GBTC to 321k GBTC shares.

“I'm convinced a factor here is the money that was pouring into these Grayscale trusts. It was a lot of institutions piling in to take advantage of the massive premiums. Some didn't care about crypto, and the ones that did are probably buying it directly now,” Seyffart said.

Trader Loomdart, an advisor to the firm eGirl Crypto, is of a similar opinion. He noted last month that these funds that aped into GBTC just 5-6 months ago without having “any real crypto love” are probably going to market sell their GBTC shares when they unlock, which will start happening next week and accelerate from there.

https://twitter.com/loomdart/status/1393477984556879873

This is the very reason Loomdart sees “longing GBTC at like 30% discount and smashing long on BTC” as the next big trade.

“With GBTC starts changing drastically, big sign the big guys are starting to arb GBTC because it's profitable enough to do so,” he added.

On Monday, Vailshire Partners, a smaller hedge fund that manages under $30 million in AUM, shared on Twitter that they took advantage of the discount by purchasing “an additional 6,753 shares of GBTC today.”

However, it is yet to be seen if the GBTC is done trading at a discount or another drop is to come before it starts to recover completely.

[deco-beg-single-coin-widget coin="BTC"]

Source: Bybt[/caption]

While there are no new creations ever since Grayscale halted them at the end of February, the 6-month lockup on the shares already created is ending, increasing the supply by 31% over the next ~3.5 months, he stated.

As Scopus Asset Management disclosed in its SEC filing, it almost doubled its Bitcoin exposure through GBTC since Dec. 31st from 173k GBTC to 321k GBTC shares.

“I'm convinced a factor here is the money that was pouring into these Grayscale trusts. It was a lot of institutions piling in to take advantage of the massive premiums. Some didn't care about crypto, and the ones that did are probably buying it directly now,” Seyffart said.

Trader Loomdart, an advisor to the firm eGirl Crypto, is of a similar opinion. He noted last month that these funds that aped into GBTC just 5-6 months ago without having “any real crypto love” are probably going to market sell their GBTC shares when they unlock, which will start happening next week and accelerate from there.

https://twitter.com/loomdart/status/1393477984556879873

This is the very reason Loomdart sees “longing GBTC at like 30% discount and smashing long on BTC” as the next big trade.

“With GBTC starts changing drastically, big sign the big guys are starting to arb GBTC because it's profitable enough to do so,” he added.

On Monday, Vailshire Partners, a smaller hedge fund that manages under $30 million in AUM, shared on Twitter that they took advantage of the discount by purchasing “an additional 6,753 shares of GBTC today.”

However, it is yet to be seen if the GBTC is done trading at a discount or another drop is to come before it starts to recover completely.

[deco-beg-single-coin-widget coin="BTC"]

Grayscale Bitcoin Trust (GBTC) Shares to Flood the Market Over the Next Couple of Months

bitcoinexchangeguide.com

18 May 2021 11:46, UTC

bitcoinexchangeguide.com

18 May 2021 11:46, UTC