Bitcoin (BTC) is halfway to its next halving, and analysts are again coming out with their predictions for how the price will respond this time around. But market reactions to Bitcoin halvings in the past have been difficult to predict, and their results usually take time to materialize.

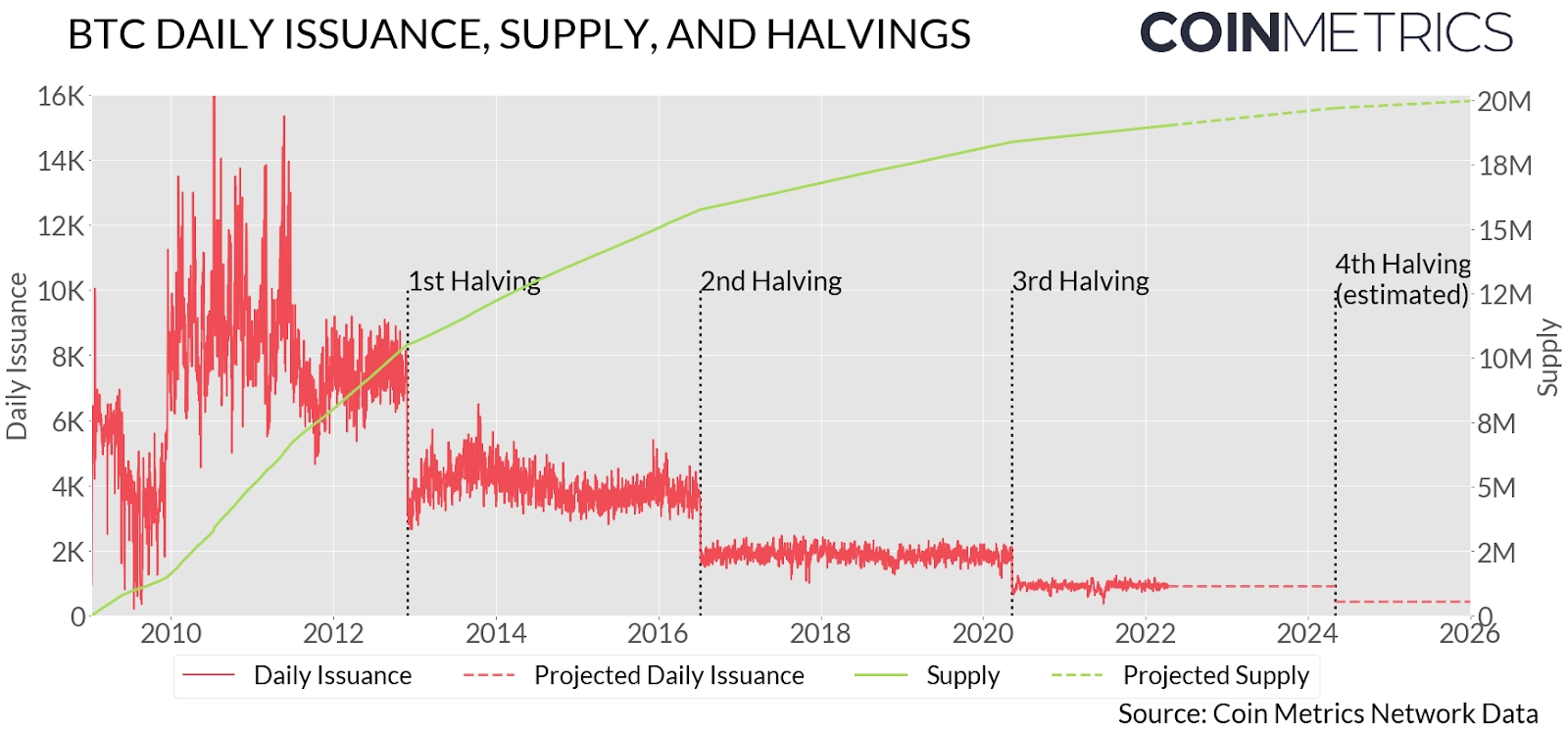

The next Bitcoin halving – the 50% reduction in block rewards paid to miners on the network that occurs about every four years – is expected to happen around March 30, 2024. At that time, the reward will be cut in half, from currently BTC 6.25 to BTC 3.125 per block mined.

Approximately BTC 900 (USD 27m) is currently being generated per day. Following the next halving, that number will fall to BTC 450.

At the previous Bitcoin halving, which took place on May 11 of 2020, Bitcoin’s block reward went from BTC 12.5 to BTC 6.25. As far as the price goes, however, the immediate reaction to the event was perhaps less significant than some had expected (and probably hoped for). BTC ended the day itself slightly lower, but according to some observers, the halving was among the triggers for a major bull run that started just over two months later.

The run, which lasted until April the following year, took BTC to highs of more than USD 60,000. At that point, a major correction halved BTCs price over a period of about 100 days, setting the stage for the second leg of the bull market which took BTC to its all-time high of around USD 69,000 in November 2021.

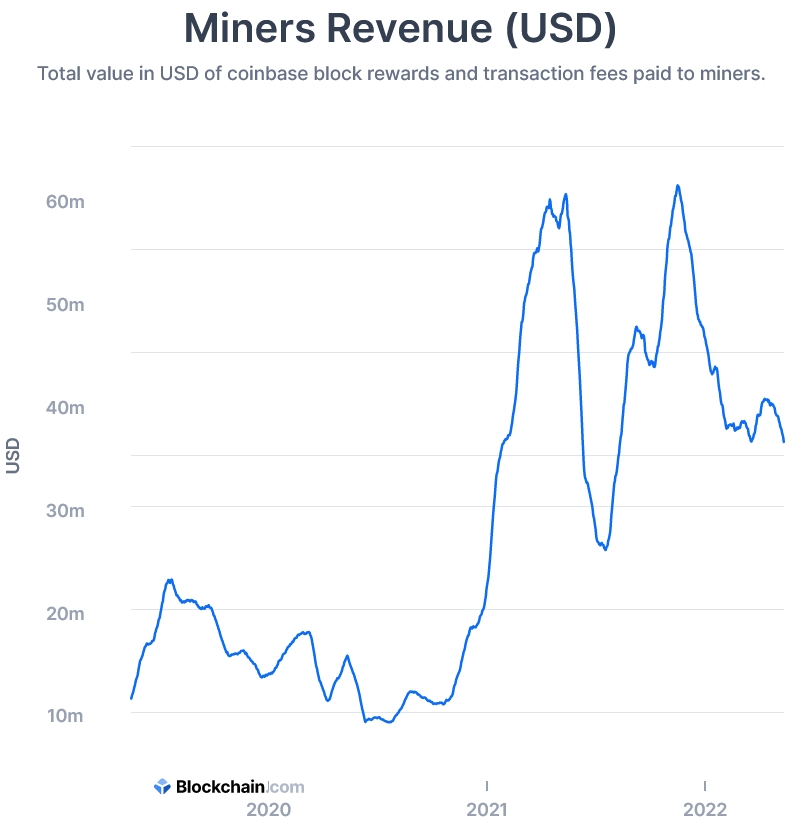

Nonetheless, we still don’t know how the market will react to the next halving. What we do know, however, is that the rewards to miners will be halved and that the price will therefore have to rise for mining to remain profitable.

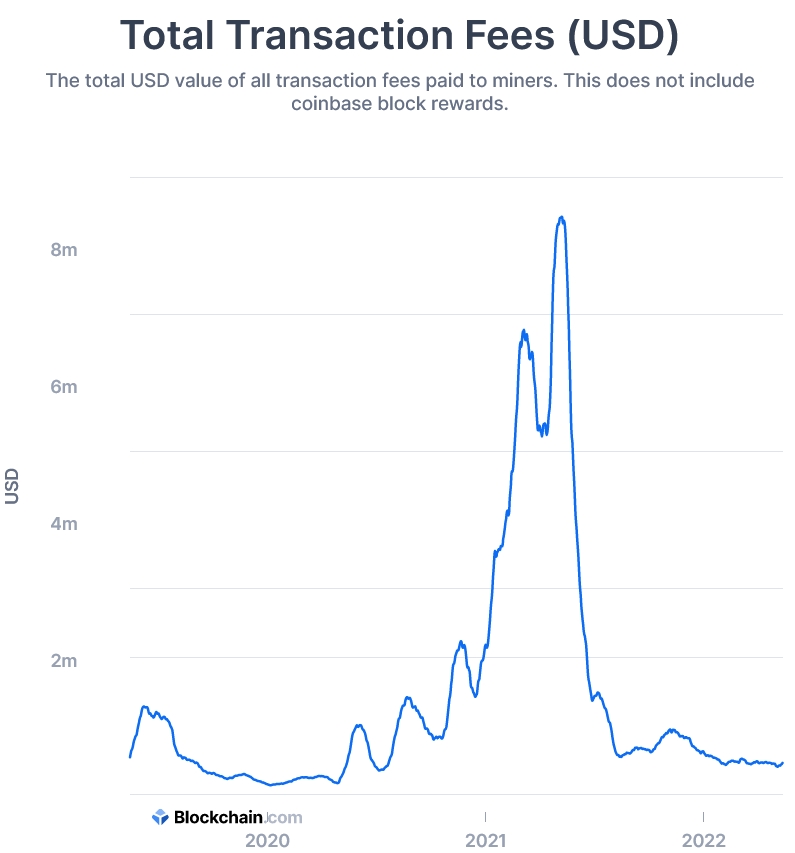

And given the widely held notion that the cost of production of new bitcoin roughly acts as a floor for the price – a theory that even Bitcoin creator Satoshi Nakamoto himself has written about – it would make sense for prices to rise. Also, the question of whether Bitcoin usage will increase enough and transaction fees will surpass block rewards - is still open.

Immediate price reactions are rarely seen

Looking back at the previous halvings, it is clear that there has rarely been an immediate price reaction to the halving event itself. And given that this is a known event that should be priced in by the market, this is not surprising.

What can be seen, however, is that prices on all three past occasions have risen significantly sometime after the halving took place.

3rd halving

Ahead of the previous halving, predictions ranged from the halving having no price impact at all, to a sell-off caused by miners offloading coins and traders following the ‘buy the rumor, sell the news’ strategy, as well as seeing upward price pressure as fewer new coins enter circulation.

Once the event had taken place, however, the reality turned out to be closest to the first prediction, with almost no impact on the price initially.

2nd halving

Going back to the second Bitcoin halving in 2016, the price in fact fell initially, to the surprise of many holders who had expected a price boost from the event. Like during the latest halving, however, an uptrend in the bitcoin price later resumed, sending BTC into a massive bull market that lasted until the end of 2017.

Among those who predicted a price rise, independent cryptography consultant Richelle Ross wrote in December of 2015 – when BTC was worth around USD 400 – that she believed BTC would hit USD 650 after the halving the following year.

The prediction turned out to be correct, albeit somewhat on the conservative side, with BTC reaching close to the USD 1,000 level before the year ended.

1st halving

The first Bitcoin halving happened in 2012. As explained in an article by Ethereum (ETH) founder Vitalik Buterin, who was then a writer for Bitcoin Magazine, the community was roughly split into two camps at the time. In the first camp were those who argued that the halving would cause a “supply shock” that would push the price up by as much as 2x, and in the second were those who viewed the halving as a “known event” for the market that would not impact the price at all.

Looking back at this today, we can conclude that what really happened was largely a combination of the views held by both camps – and this appears to have been the case for both halvings since.

Yes, the halving is – and has always been – a known event, and the immediate price impact has therefore been insignificant. However, the lower supply of new coins coming to the market, combined with the fact that miners, all else equal, will need a higher price to make a profit, has on all three occasions in the past led to higher prices in the medium to longer term.

So, while we don’t know what will happen after the next halving sometime in the first half of 2024, it is probably reasonable to expect more of the same – and that the event might trigger another bitcoin market cycle.

cryptonews.com

cryptonews.com