Online searches questioning Bitcoin survival have climbed to their highest level in years, highlighting deepening anxiety across the crypto market.

According to Google Trends data, global interest in the phrase “Bitcoin going to zero” peaked at 100 in February 2026. The surge comes as Bitcoin trades roughly 50% below its record high, amid broader economic and geopolitical uncertainty.

Key Points

- Google searches for ‘Bitcoin going to zero’ reached a peak of 100 in February 2026, the highest in over 3.5 years.

- The Crypto Fear & Greed Index currently stands at 11, reflecting extreme market caution.

- Bitcoin currently trades roughly 50% below its all-time high of $126,080 reached on October 6, 2025.

Search Data Signals Growing Fear

The latest spike marks the strongest search interest in more than 3.5 years. Specifically, the previous peak occurred in June 2022, when the score reached 72 during a major market downturn.

At the time, Bitcoin fell 37.29% in a single month, sliding from $32,000 to $19,942. This pattern underscores how retail sentiment often reacts sharply to volatility, with panic-driven searches rising as prices decline.

Analysts frequently track Google search trends as a real-time indicator of public sentiment. Typically, search activity accelerates during major rallies or sharp sell-offs. In this case, the surge reflects mounting concern rather than renewed optimism.

Market anxiety has intensified since Bitcoin reached its all-time high of $126,080 on October 6, 2025. Since then, the asset has declined 47%, weakening overall market confidence and fueling renewed debate about its near-term outlook.

Sentiment Index Reflects Extreme Caution

The shift in investor mood is also evident in traditional crypto sentiment indicators. For instance, the Crypto Fear & Greed Index, which measures market emotion on a scale from 0 to 100, currently stands at 11. Earlier this month, on February 6, 2026, the index dropped to a record low of 5.

Such low levels typically signal widespread caution among investors. Historically, extreme fear has often been viewed as a potential buying opportunity. However, that assumption is now being questioned.

Nic Puckrin, co-founder of Coin Bureau, recently challenged the conventional strategy in a post on X. He argued that buying Bitcoin during extreme fear does not always produce strong short-term gains.

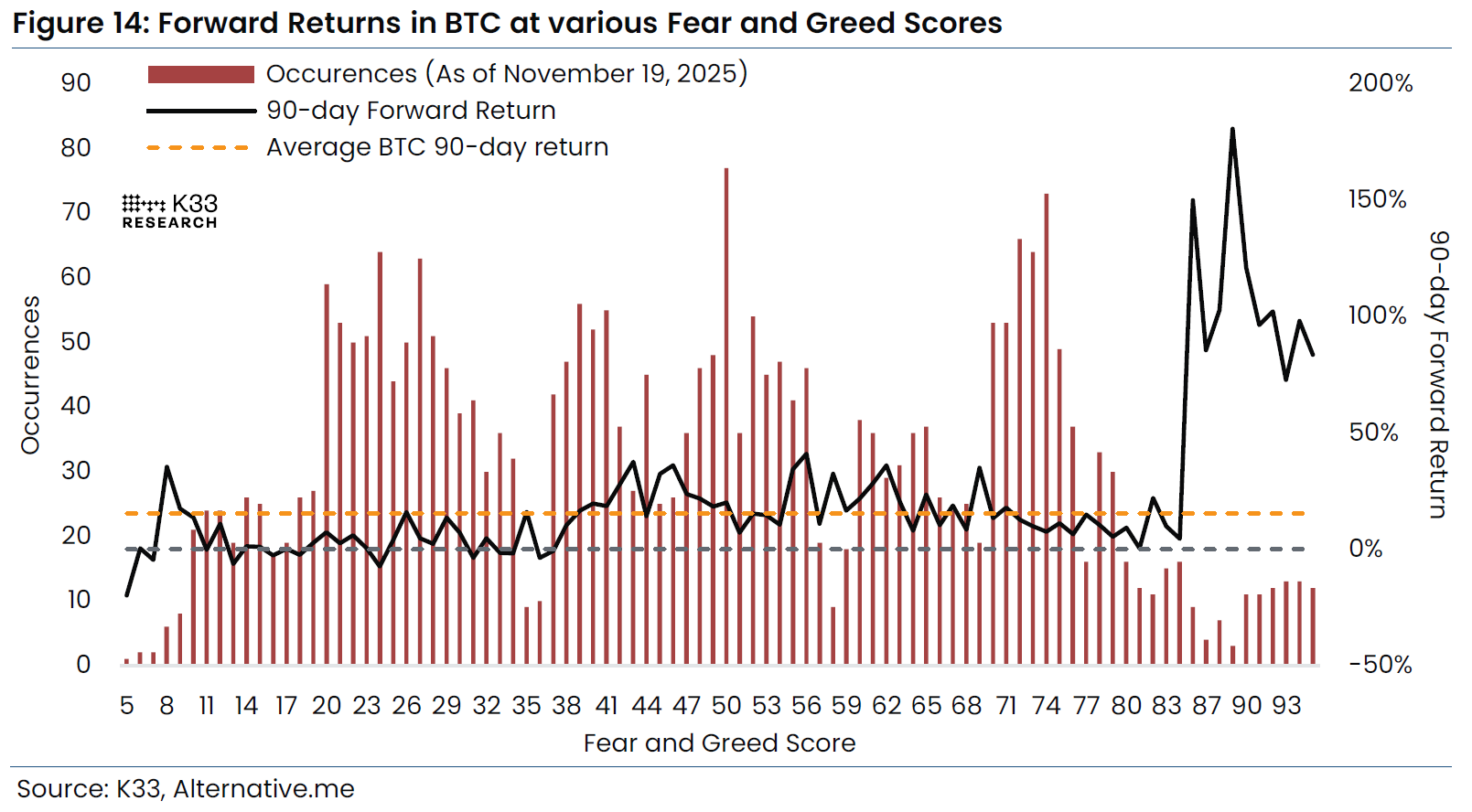

Based on his analysis, when the index falls below 25, the average 90-day forward return has been just 2.4%. By comparison, purchases made during “Extreme Greed” periods have historically generated average 90-day returns of up to 95%. He described the index as a backward-looking momentum indicator rather than a reliable forecasting tool.

Debate Over Time Horizon

Puckrin’s findings quickly sparked debate. Meanwhile, critics questioned whether a 90-day window captures the full picture.

One market observer responded that Bitcoin’s longer-term performance tells a different story. Over 12 months following extreme fear readings, the cryptocurrency has historically delivered average gains exceeding 300%.

Supporters of this view contend that the Fear & Greed Index is more useful for accumulation strategies than short-term trading. They argue that investors should not expect immediate gains when buying during periods of peak pessimism.

The debate reflects a broader divide between short-term traders and long-term investors. For now, however, rising panic-driven searches and continued price weakness suggest that caution remains the dominant sentiment across the market.

thecryptobasic.com

thecryptobasic.com