The Bitcoin “buy zone” meme just got real again, here’s what it means in the ETF era

A certain kind of Bitcoin post shows up right on schedule. It usually arrives right after price stops feeling fun.

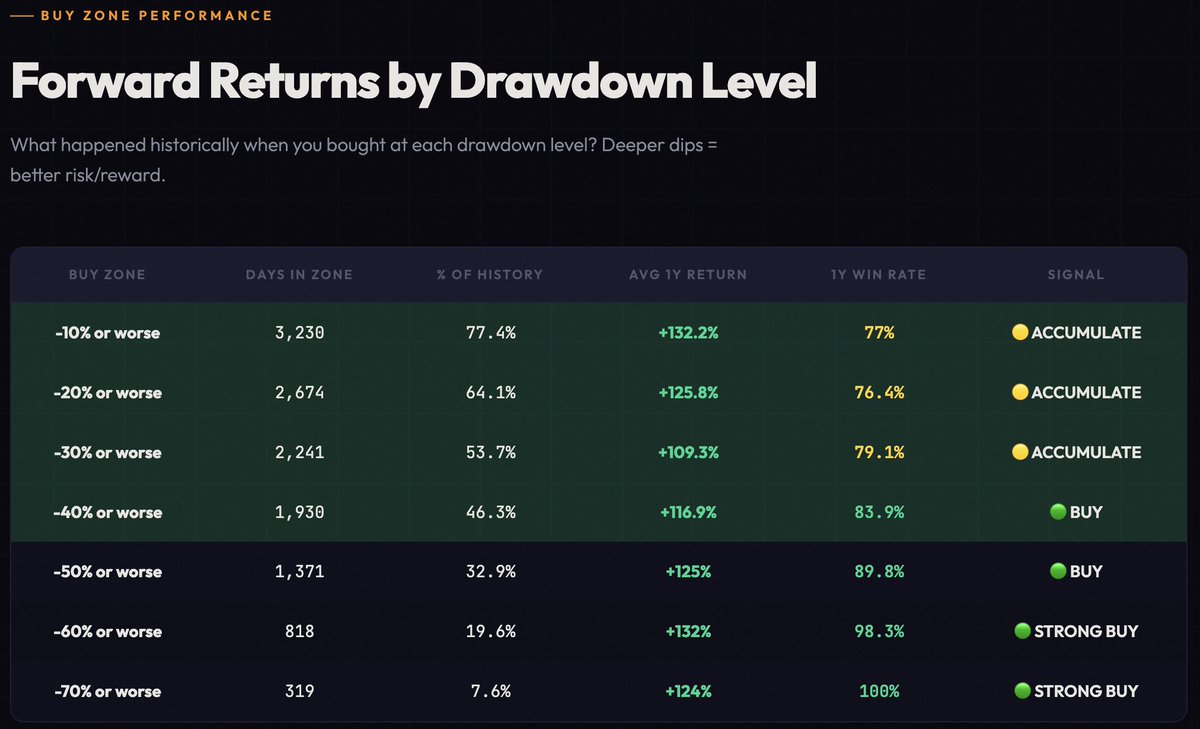

This week it came from PricedinBTC, dressed up as a neat table titled “Forward Returns by Drawdown Level.”

The headline numbers do the heavy lifting, buying at a 50% drawdown supposedly delivers around a 90% win rate over the next year, with average returns near 125%. The caption ends with “LOCK IN,” the kind of line that sounds like advice and reads like a challenge.

People share these charts for the same reason they bookmark workout plans. Drawdowns scramble the brain, even for holders who swear they feel nothing. A clean rule offers relief, a line in the sand, a way to act without re-living the whole debate every time the price ticks down.

This one is circulating at a moment when the math sits close to the meme. Bitcoin has been trading around the high $60,000s, and the last peak still hangs over the market. That puts the drawdown in the mid-40% range, close enough that sustained pressure can push it into the minus-50% bucket.

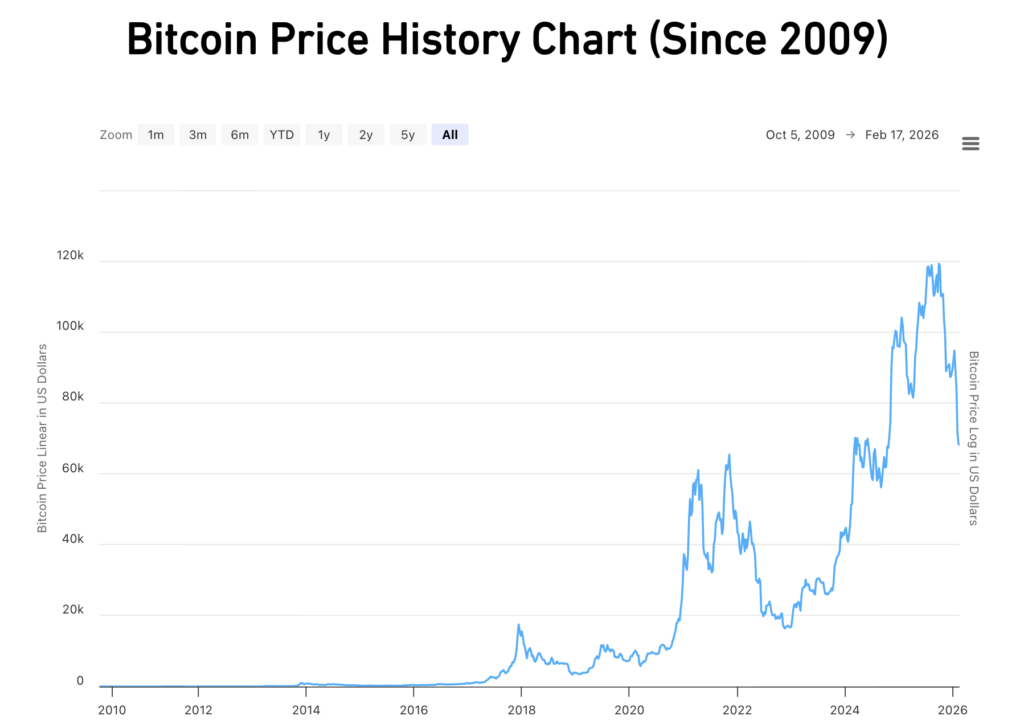

The chart makes the dip feel like a destination, and history offers comfort. The same history also carries a warning label. Research from iShares notes four drawdowns greater than 50% since 2014, the three largest averaged around an 80% decline, and recoveries took close to three years in three out of four cases.

That gap between “one year later” and “living through it” is where a lot of confidence gets tested. Today, that test runs through new plumbing, spot ETFs, rate expectations, the dollar, and options hedging, all visible in real time.

The minus 50% line feels like a promise, and it sits close

Using the last peak above $126,000 as the reference point, the levels land in familiar places. Minus 50% is around $63,000, minus 60% is around $50,000, and minus 70% is around $38,000. With bitcoin near $68,000, the first line sits within a few thousand dollars.

That proximity turns a number into a plan. Some people start stacking cash, waiting for the tag. Some buy early to avoid missing it. Some freeze when it finally arrives, because the move down feels louder than the chart looked on their screen.

The meme works as a psychological tool because it compresses chaos into a simple trigger.

The lived experience expands again the moment the trigger hits, and the drawdown keeps moving. The iShares drawdown history matters here, because it frames a deeper truth, many “winning” entries still came with a long stretch of doubt, and sometimes a much deeper slide, before the recovery showed up.

Winning with Bitcoin isn't quite as simple as buying Bitcoin early. Anyone who has been around for over a decade has at least one story about a time they sold too early. I certainly do. I have a 7-figure HDMI cable lying around somewhere that I bought using Dogecoin in 2014.

ETFs turned the dip into a daily receipt

Spot Bitcoin ETFs added a scoreboard that everyone can watch, every day. US spot bitcoin ETFs held roughly 1.265 million $BTC as of market close on Feb. 13, with AUM around $87 billion.

That scale changes how drawdowns travel through the market. A large wrapper can support price during calm periods, and it can also amplify selling pressure when flows turn negative, because the shift becomes visible, measurable, and easy to follow.

There's been roughly 55,665 $BTC in net outflows over the last 30 days, a multi-billion dollar swing at prevailing prices. That kind of drain can keep price heavy even when social feeds stay full of “buy zone” confidence.

It also gives dip buyers a new confirmation tool, flow stabilization, because capitulation often shows up as outflows slowing, flattening, and eventually reversing.

Rates and inflation shape the opportunity cost

A lot of the next chapter of Bitcoin depends on macroeconomic conditions that feel unglamorous: yields, inflation prints, and how investors price risk across the board.

The Federal Reserve held its target range at 3.50% to 3.75% in late January. Inflation has also been easing, with US inflation at 2.4% in January, a data point that feeds rate cut expectations and shift risk appetite.

Cross-market proxies help frame that mood. The S&P 500 proxy SPY gives a read on broad risk appetite, long-duration Treasuries via TLT reflect the rate backdrop, and gold through GLD captures the defensive bid.

When those markets lean toward safety and yield, Bitcoin drawdowns often feel heavier, and when the mood shifts toward easing conditions, dip buying tends to find more oxygen.

Options markets are pricing a wide lane

The viral table feels calm on the page, and the options market tends to speak in wider ranges. On Unusual Whales, Bitcoin options show an implied move of about 6.66% into Feb. 20, with implied volatility around 0.5656.

High implied moves affect behavior in obvious ways. Dip buyers want clean levels and fast confirmation. Hedgers stay active when uncertainty stays elevated.

Short-term swings become part of the baseline, which can turn the minus 50% line into a waypoint rather than a floor.

That loops back to the long drawdown record from iShares, because big recoveries often came with messy paths and long timelines.

A drawdown strategy lives or dies on whether the buyer can handle the path, not simply the endpoint.

Three lanes for the next chapter, with levels people can watch

The cleanest way to frame the near term is as conditional lanes, each tied to signals anyone can track.

- In a grinding base case, Bitcoin holds the low to mid $60,000s, the market churns, ETF outflows slow toward flat, and volatility cools. The flow tape becomes the tell here, because shrinking 30-day outflows usually signal fading sell pressure.

- In a liquidity turns friendly case, inflation keeps easing, rate cut expectations firm up, and risk appetite improves across markets. ETF flows flip positive and stay positive, which can pull bitcoin back toward the prior highs.

- In a deeper capitulation case, outflows continue, macro turns risk off, and bitcoin slides through the minus-50 % line toward the $50,000 zone, with pressure that can extend to deeper drawdown levels.

The buy zone meme offers a simple story, and the market offers conditions. The useful version of this chart sits next to the real-time scoreboard, the ETF flow tape, the rates backdrop, and the uncertainty gauge.

That is the real human-interest angle in this cycle: the emotional urge for a clean rule and the institutional mechanics that now shape how that rule plays out in real time.

Strategic dollar cost averaging and market timing

Historically, this part of the cycle is a great time to buy Bitcoin. However, as I've stated multiple times in my analysis over the last 8 months, “this time is different.”

We can legitimately question the four-year cycle theory; we have 6% of the supply held by US ETF funds, and corporate treasuries have exploded.

This is not the same Bitcoin market as 2012, 2016, 2020, or even 2024.

Personally, I'm too emotional a trader, so I stopped trying to time the market years ago.

One methodology that removes the risk involved with trying to time the market is the strategic DCA.

You purchase $BTC every day, but send slightly more $BTC to exchanges than the daily buy. That leaves a surplus of cash that grows over time. Then, when Bitcoin falls to a price that looks cheap, you have some funds available to buy the dip. You've already allocated those funds to Bitcoin; you just haven't pulled the trigger until a dip. That way, you get the benefit of DCA smoothing, augmented by heavier allocations during drawdowns.

Historically, Bitcoin rarely stays below a previous cycle's all-time high for long. At $68,000, we're right on the money for 2021. In 2022, Bitcoin dipped below the 2017 all-time high for around 30 days before starting its three-year climb to $126,000.

Again, none of this is designed to be individual investment advice, and there is risk involved with any investment. However, this article touches on some of the things Bitcoin investors should consider when deciding when, if, and how to increase their Bitcoin allocations in their portfolios, in my opinion.

cryptoslate.com

cryptoslate.com