Metaplanet reported explosive revenue and profit growth for FY2025 as it expanded its bitcoin treasury to 35,102 $BTC, despite booking a sizable unrealized valuation loss.

Metaplanet Revenue Surges 738% on Bitcoin Strategy

Japan-listed bitcoin treasury firm Metaplanet delivered breakout financial results for fiscal year 2025, fueled by its expanding bitcoin-focused business model.

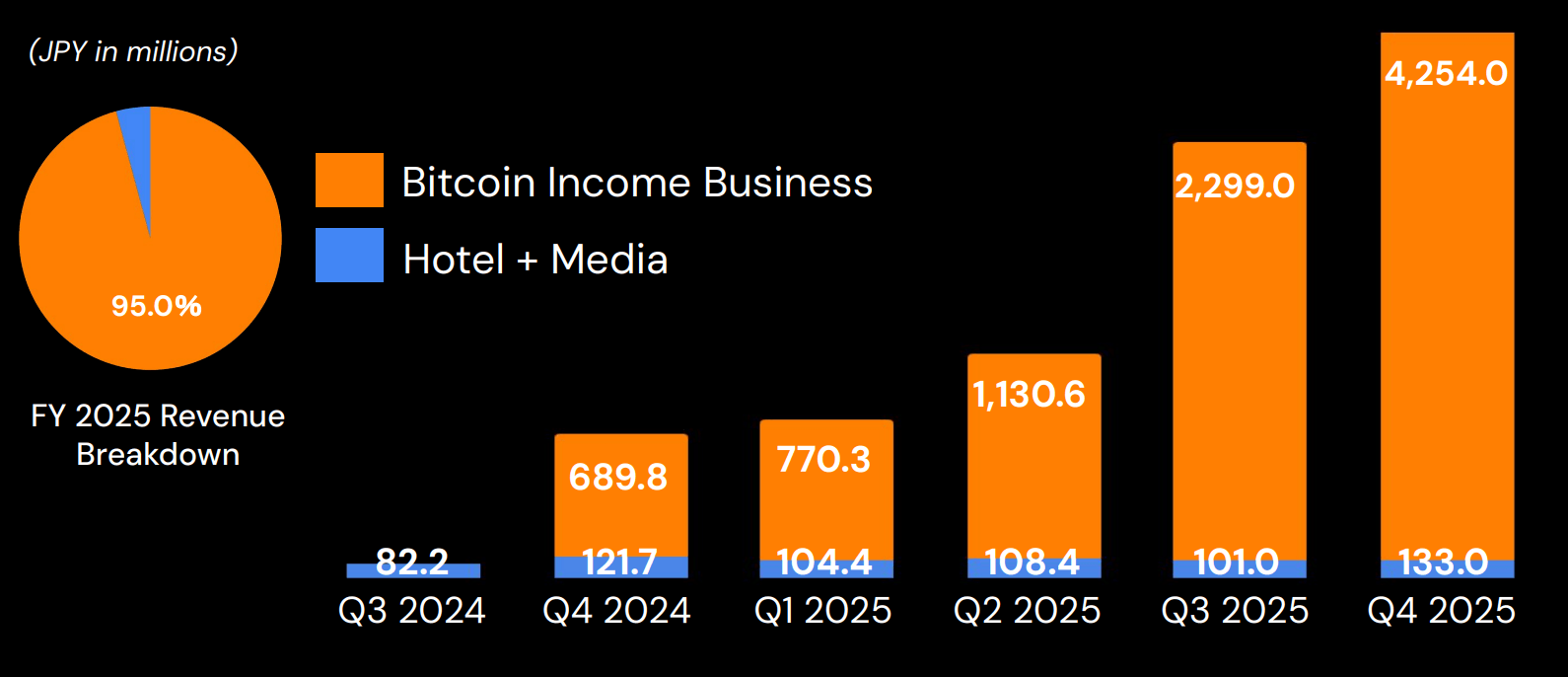

The company reported revenue of approximately $59.4 million (¥8.905 billion), up 738% year-over-year, alongside operating profit of $41.9 million (¥6.287 billion), marking a 1,694% annual increase. Both figures exceeded its initial forecasts of $45.4 million (¥6.8 billion) in revenue and $31.3 million (¥4.7 billion) in operating income.

Growth accelerated from the third quarter onward, driven primarily by premium income generated through bitcoin options transactions. Metaplanet said its bitcoin income business, launched in Q4 2024, has become its core revenue engine and is expected to remain central to profit expansion.

As of December 31, 2025, Metaplanet held 35,102 $BTC, up sharply from 1,762 $BTC a year earlier, making it the fourth-largest public company holder of bitcoin globally. However, the firm recorded an unrealized bitcoin valuation loss of approximately $681.9 million (¥102.2 billion) amid market volatility.

The company emphasized that unrealized revaluation gains or losses are excluded from “core profit,” with management focusing instead on realized cash flow performance. Future premium income will be used to fund dividends on perpetual preferred stock and acquire additional bitcoin.

Metaplanet’s proprietary $BTC Yield, which measures the change in bitcoin holdings per fully diluted share rose 568.26% year-to-date in 2025. The firm reported a $BTC gain of 10,013 coins during the year, representing $924.5 million (¥138.518 billion) in value at a reference price of $92,300 (¥13,833,836) per $BTC.

Capital raising efforts accelerated as well. Cumulative capital raised reached $3.45 billion (¥517.2 billion) by the end of 2025, up from $66.7 million (¥10.0 billion) in 2024. Shareholders increased to 216,500 by year-end 2025, compared to 47,200 a year earlier.

Despite volatility, Metaplanet appears committed to scaling its bitcoin-centric treasury model.

FAQ 🇯🇵

-

How much revenue did Metaplanet generate in 2025?

$59.4 million (¥8.905 billion), up 738% year-over-year. -

How much bitcoin does Metaplanet hold?

35,102 $BTC as of December 31, 2025. -

Did the company record losses?

Yes, an unrealized $681.9 million (¥102.2 billion) valuation loss. -

What is $BTC Yield?

A metric tracking bitcoin holdings growth per fully diluted share.

news.bitcoin.com

news.bitcoin.com