Traders on Polymarket, Myriad, and Kalshi are putting real money behind their expectations for bitcoin’s price trajectory in 2026. Across seven active contracts with over $84 million in volume, the crowd is signaling cautious optimism — with plenty of hedging along the way.

Six-Figure Bitcoin Odds Rise With Time, Prediction Markets Show

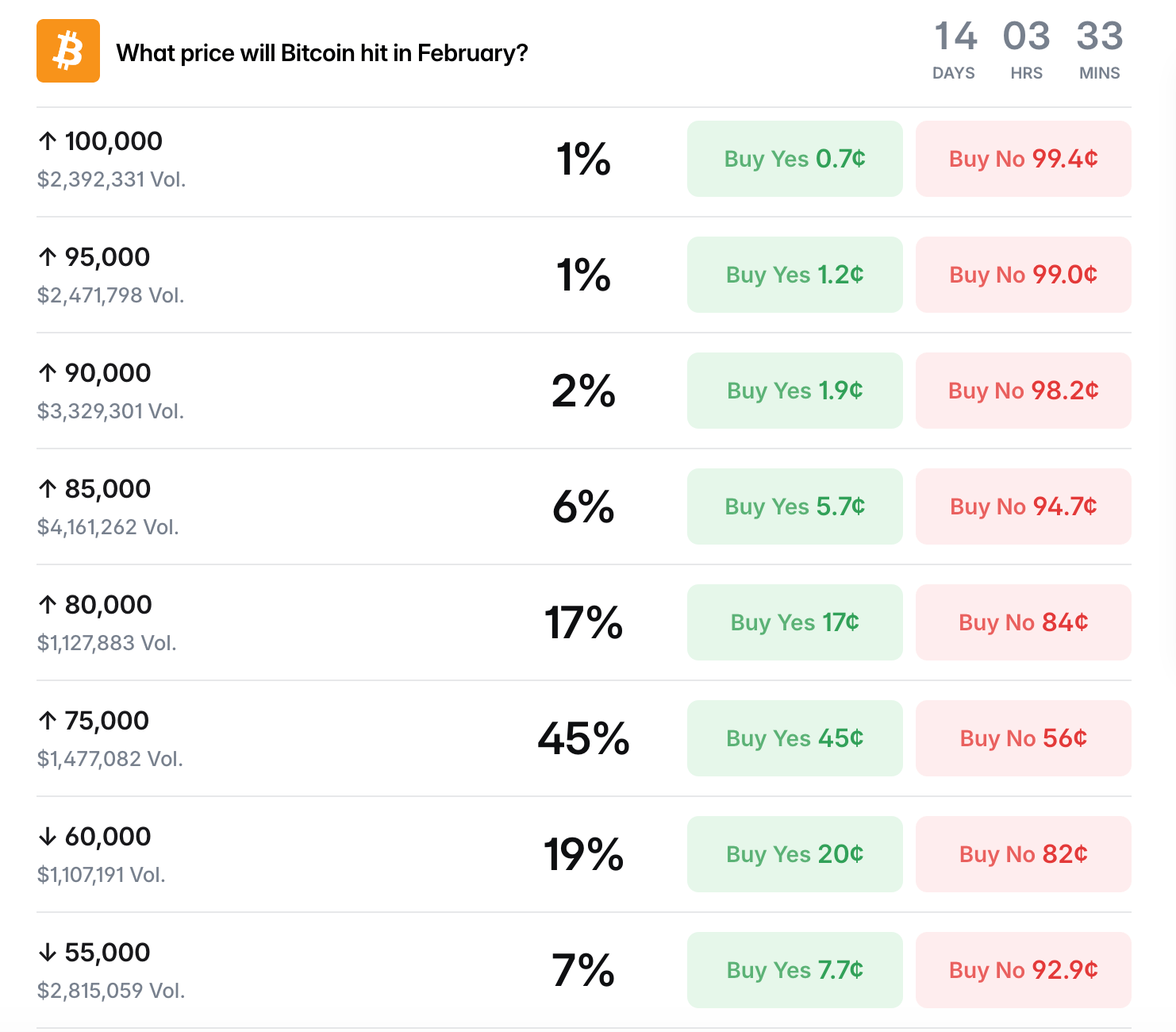

One of the most active contracts on Polymarket asks what price bitcoin will hit in February 2026. The multi-outcome market resolves “Yes” if any one-minute Binance BTC/ USDT candle high reaches a listed level between Feb. 1 and Feb. 29, with total volume near $61 million.

Current pricing places about a 45% implied probability on $75,000 per bitcoin being touched, while $80,000 sits around 17%. Beyond that, confidence fades quickly: $85,000 carries roughly 6% odds, and $90,000 about 2%, with six-figure targets priced near 1% or less.

Volume clusters around psychologically important levels. The $85,000 strike leads activity among upside targets, while $55,000 and $50,000 show significant defensive positioning, suggesting traders are preparing for both extension and retracement scenarios.

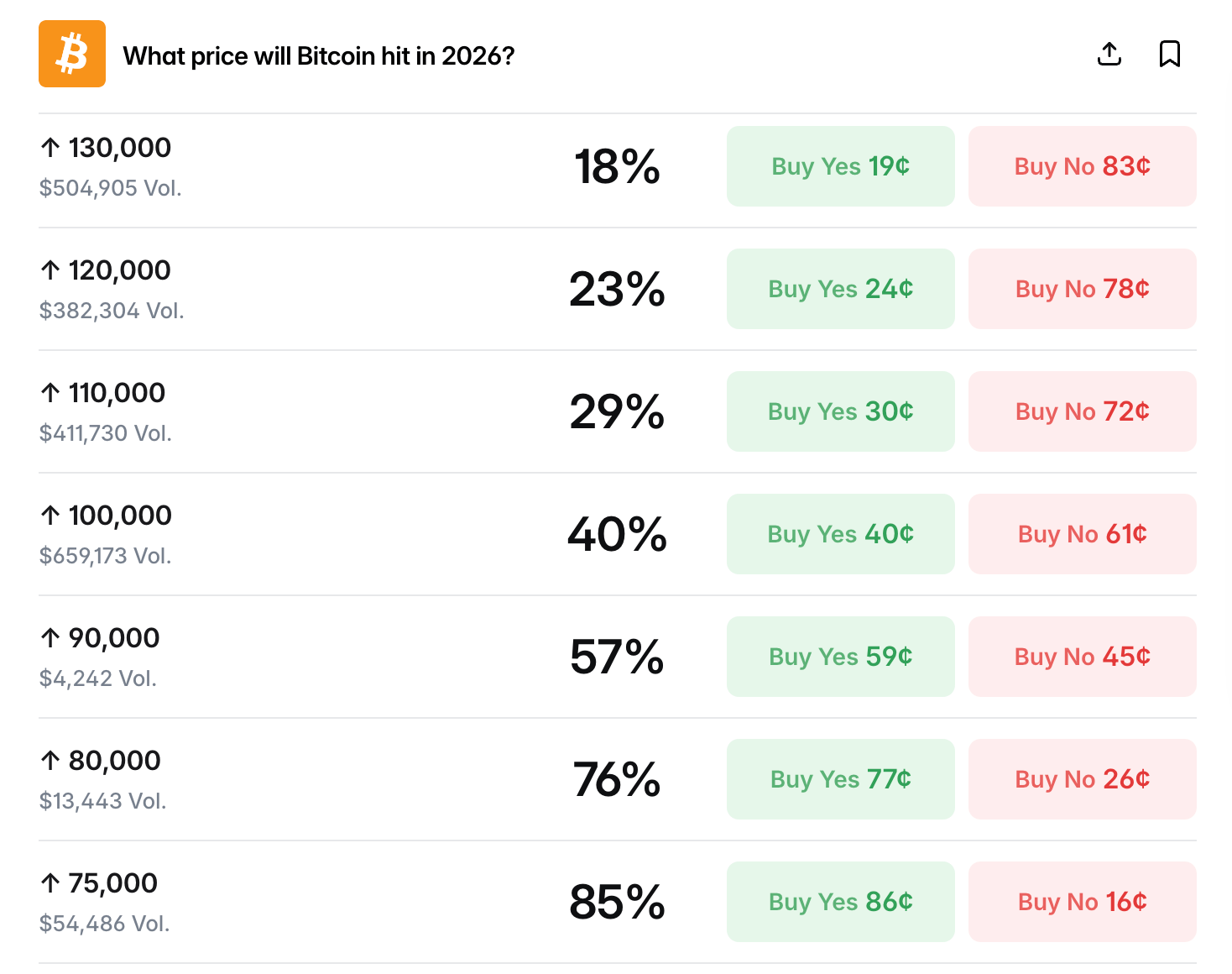

A broader Polymarket contract tracks what price bitcoin will hit at any point before Jan. 1, 2027. Here, the crowd assigns roughly a 40% chance of bitcoin reaching $100,000 in 2026, while $110,000 and above gradually step lower in probability. Long-shot targets like $250,000 hover near 5%.

Interestingly, large trading volume appears at both extremes, including significant activity around $15,000. That pattern suggests hedging behavior rather than pure directional conviction, with traders buying insurance against tail risk.

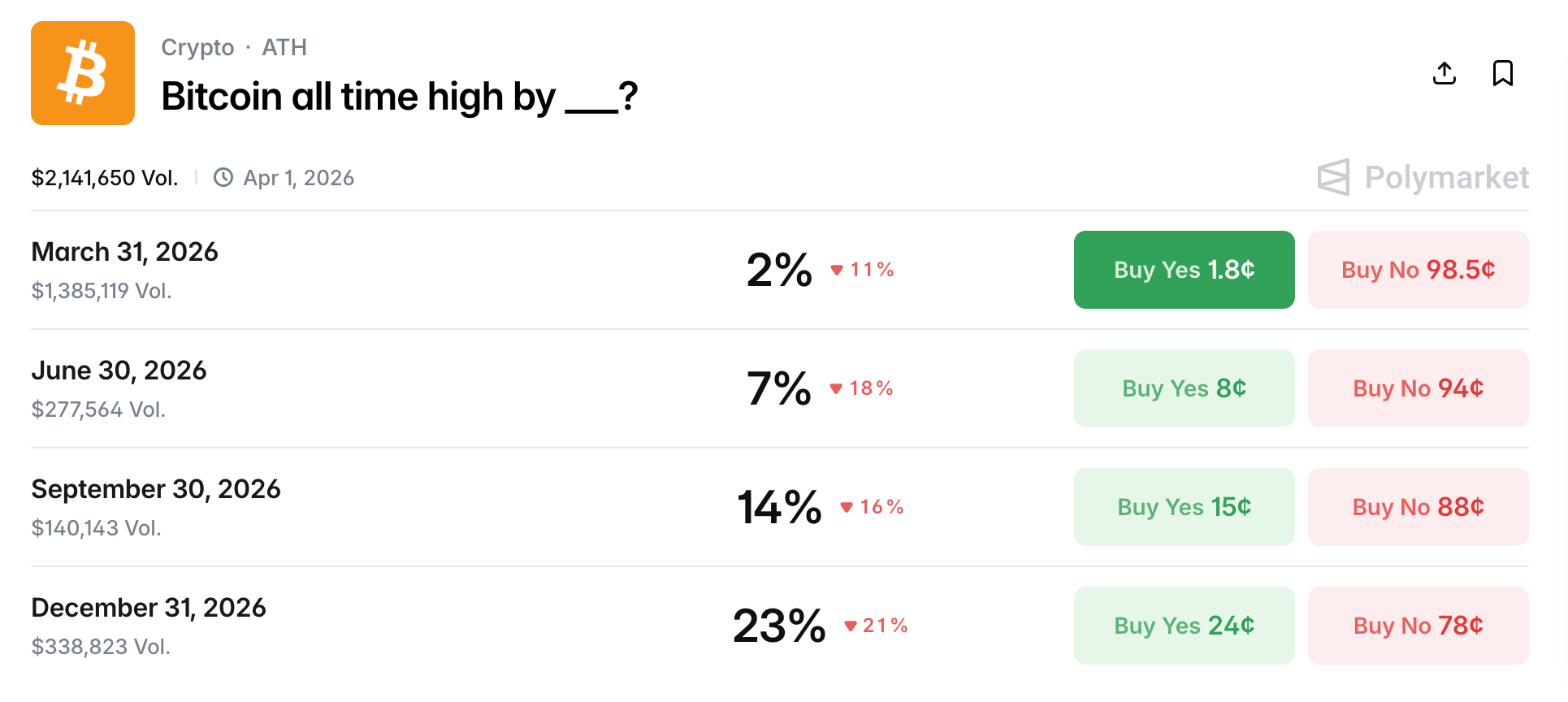

Another Polymarket timeline contract asks whether bitcoin will set a new all-time high by various deadlines in 2026. The odds remain low in the near term: roughly 2% by March and 7% by June. By Dec. 31, however, the implied probability rises to about 23%.

The steady climb in probabilities over time implies traders expect gradual improvement rather than a rapid breakout. Liquidity is concentrated in earlier deadlines, reflecting active short-term positioning even as longer-dated optimism slowly builds.

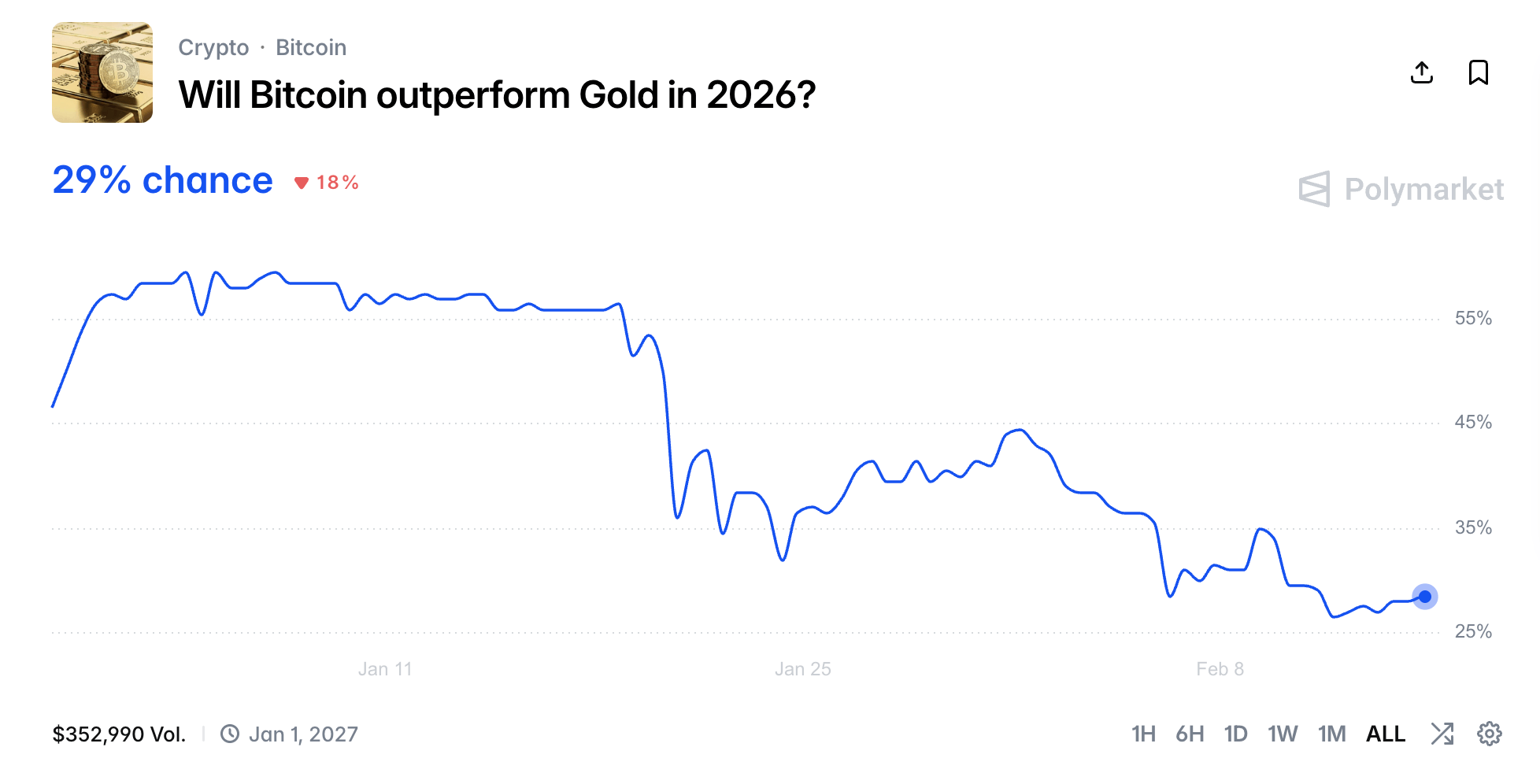

Polymarket also hosts a macro-flavored contract asking whether bitcoin will outperform gold in 2026. The market currently gives bitcoin about a 29% chance of beating gold’s annual percentage return, leaving the metal favored at approximately 72%.

That pricing reflects caution about bitcoin’s volatility and macro conditions. Traders appear to be weighing higher real yields, risk appetite, and historical post-halving patterns, with gold seen as a steadier performer in the coming year.

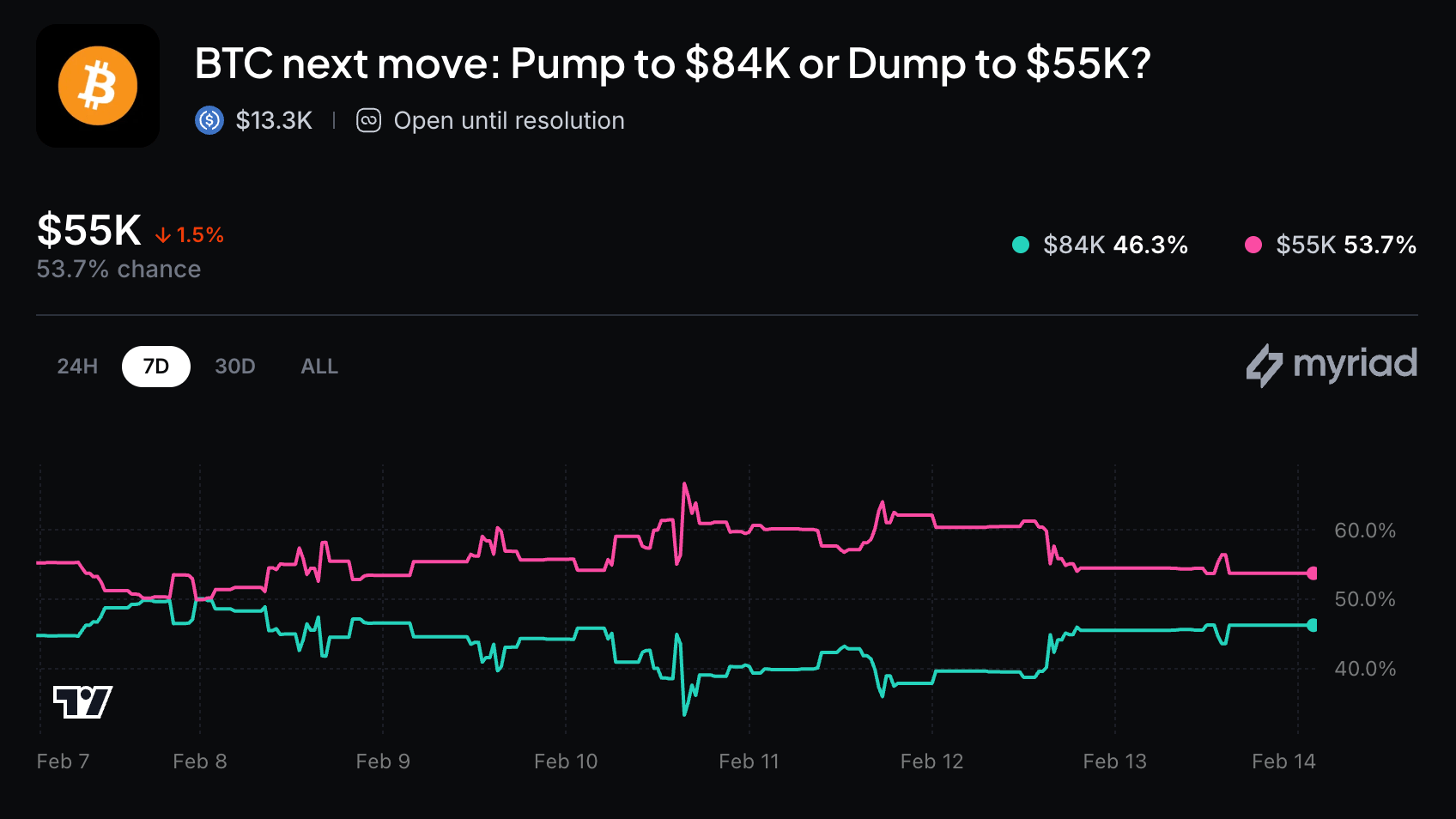

On Myriad, a binary path-dependent market asks which level bitcoin will hit first: $84,000 or $55,000. The contract resolves based on Binance spot pricing, and current odds give $55,000 a slight edge at roughly 54%, compared with about 46% for $84,000.

Volume on Myriad remains much lighter at around $13,000, meaning probabilities could shift quickly if larger participants enter. Even so, the near-even split signals a market balanced between breakout and pullback scenarios.

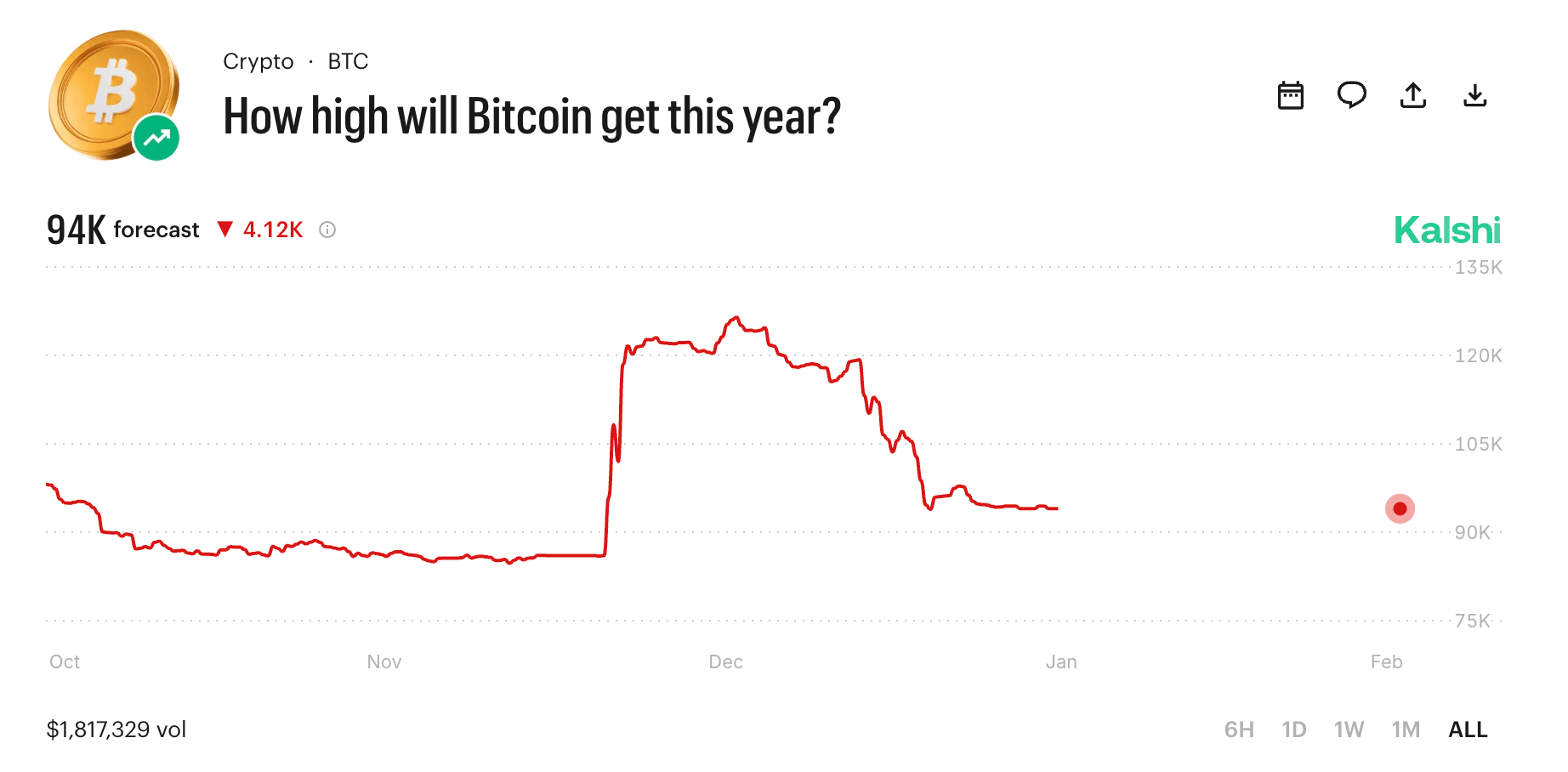

Kalshi, which uses the CF Bitcoin Real-Time Index as its reference, offers annual threshold markets for 2026. Traders assign roughly a 39% chance that bitcoin trades above $99,999.99 this year, with probabilities declining for $110,000 and $120,000 targets.

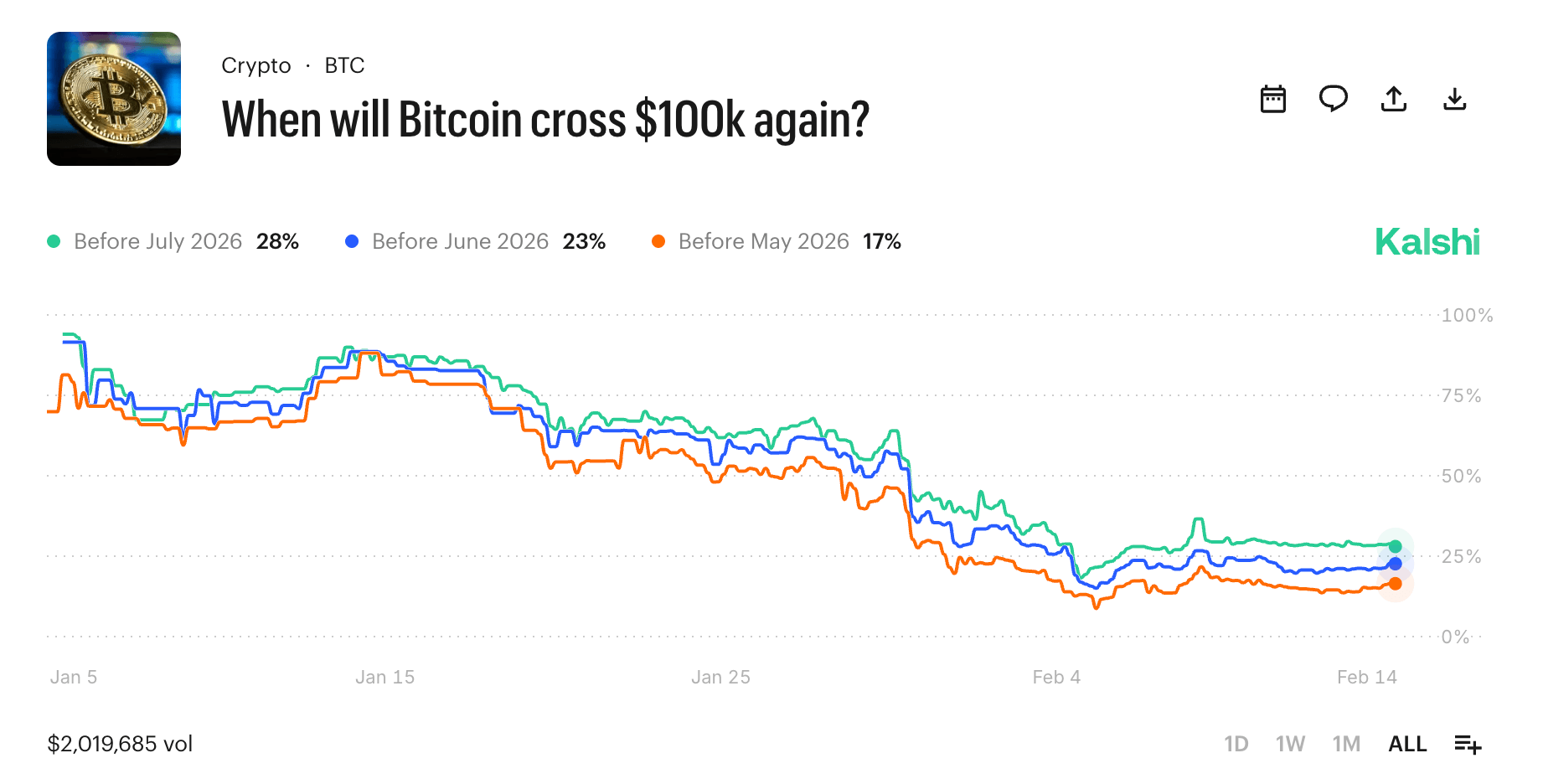

A separate Kalshi contract tracking when bitcoin might cross $100,000 again shows a time-based curve. The implied probability sits near 17% before May, 24% before June, and 29% before July, suggesting gradual confidence as the calendar advances.

Across all seven contracts, the unifying theme is restraint. Traders are not pricing an imminent moonshot, nor are they dismissing upside entirely; instead, the crowd view points to moderate appreciation potential with meaningful downside risk still on the table.

Prediction markets are sentiment snapshots, not guarantees. Yet when millions of dollars are committed across platforms, they offer a revealing look at how traders are collectively mapping bitcoin’s risk-reward profile for 2026 — measured, hedged, and very much in flux.

FAQ ❓

-

What do Polymarket traders expect for bitcoin in February 2026?

The highest implied probability is near $75,000, with sharply lower odds above $80,000. -

What are the chances bitcoin hits $100K in 2026?

Kalshi markets currently imply roughly a 39% chance of crossing $100,000 this year. -

Do traders expect a new all-time high soon?

Near-term odds are low, with higher probabilities assigned to late 2026. -

Is bitcoin favored to outperform gold in 2026?

No, markets currently give gold a clear edge over bitcoin for annual performance.

news.bitcoin.com

news.bitcoin.com