Positive internal factors such as ETFs and DATs fail to fully explain why capital has continued to flow out of the market since mid-last year. The correlation between Bitcoin and US software stocks offers a new perspective.

Recent data highlights how private credit has come to dominate the crypto market.

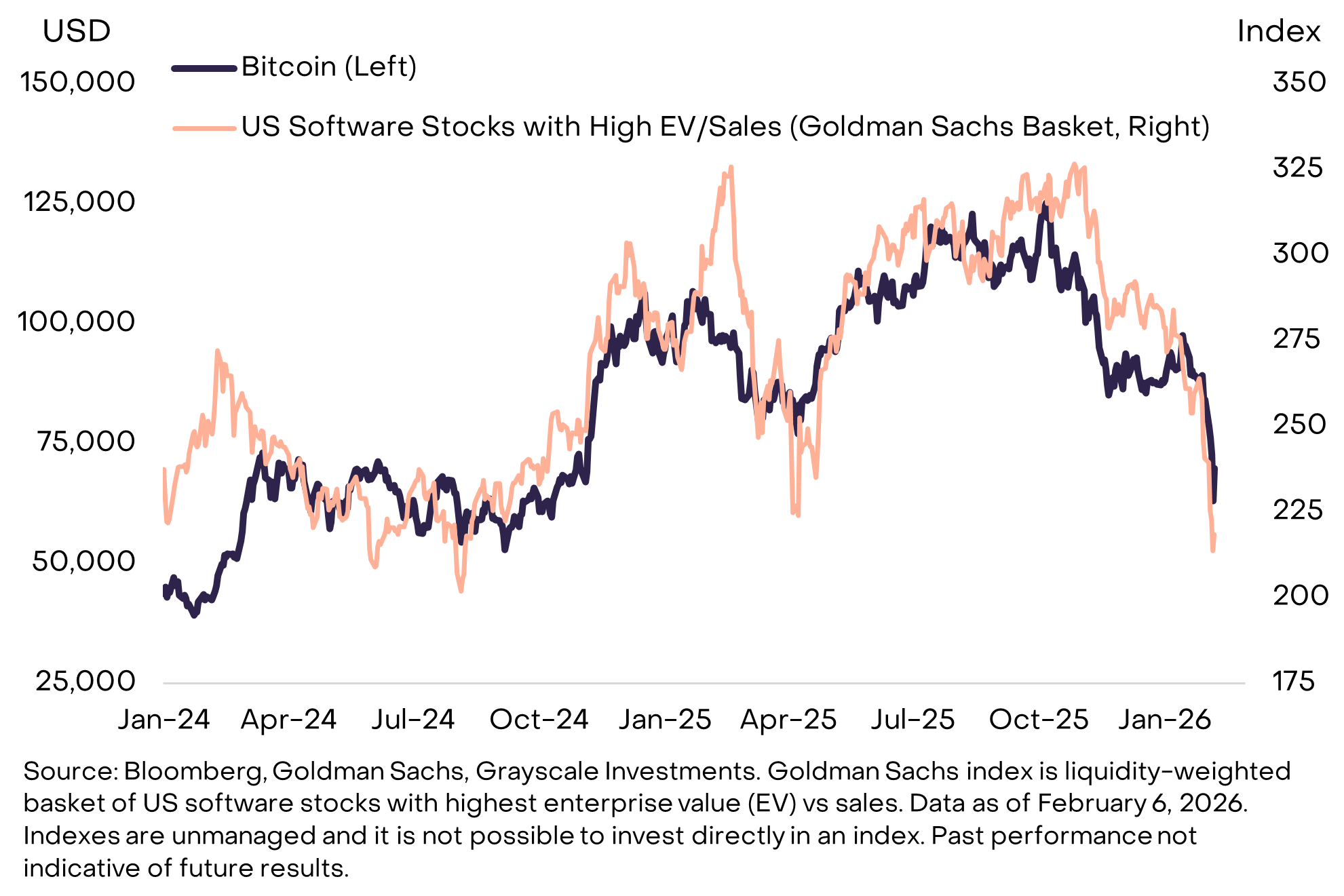

A Strong Correlation Between Bitcoin And US Software Stocks

According to a Grayscale report, recent Bitcoin price movements have closely tracked high-growth software stocks. This behavior shows that $BTC is trading more like a growth asset than “digital gold.”

Grayscale’s chart shows tight synchronization between US software stocks and Bitcoin from early 2024 to the present. This correlation implies that the same underlying forces have driven both markets over the past two years.

“The fact that Bitcoin moved in lockstep with software stocks during the latest sell-off suggests the drawdown likely had more to do with broad derisking of growth-oriented portfolios rather than problems unique to crypto,” Grayscale stated.

Identifying this shared driver helps explain the recent crypto downturn and supports a clearer assessment of recovery potential.

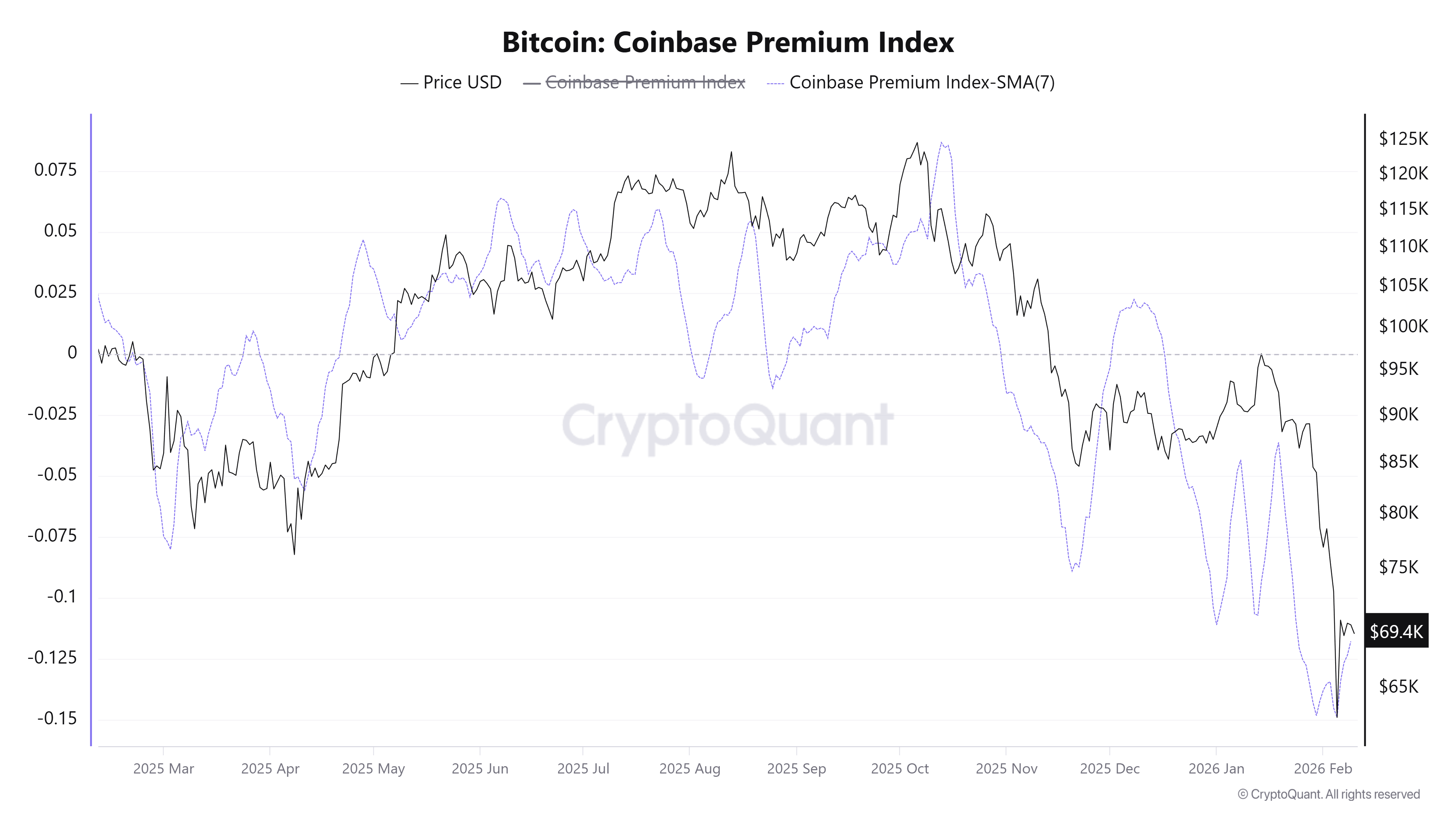

Grayscale attributes selling pressure primarily to US investors. This trend appears in Bitcoin trading at a discount on Coinbase compared with Binance.

In addition, US-listed Bitcoin ETPs have recorded net outflows of roughly $318 million since early February. These outflows have added further pressure to prices.

Why private credit sits at the core of the issue

Other reports point to a deeper cause. The $3 trillion private credit industry now faces new risks driven by AI development.

Private credit refers to non-bank lending. Large funds such as Blue Owl (OWL), Ares (ARES), Apollo (APO), KKR, and TPG typically manage these loans.

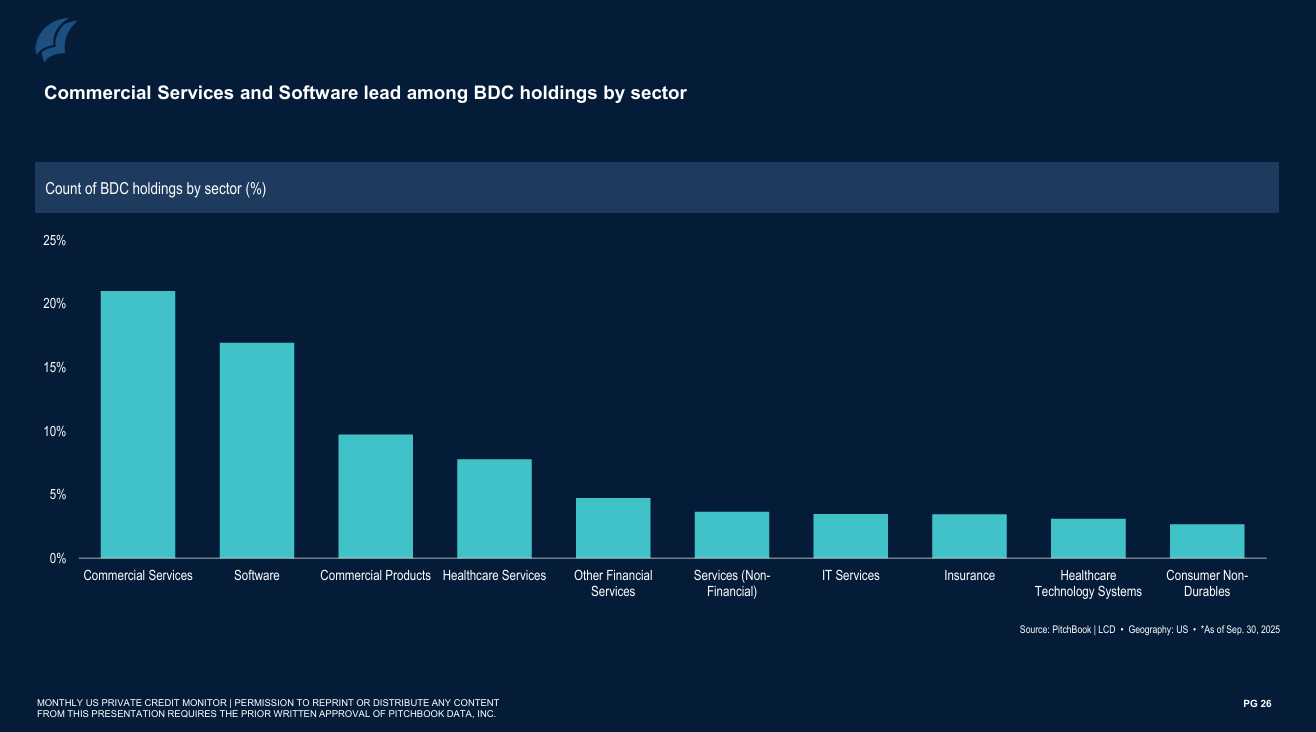

These funds lend to private companies or capital-intensive businesses, often at higher interest rates than banks. Software represents a significant share of these loans. PitchBook data shows that software accounts for about 17% of BDC investments by deal count, second only to commercial services.

Data also indicates that the correlation between software stocks and Bitcoin has persisted for more than five years. This pattern is not new. It supports the view that private credit flows have materially influenced the crypto market. Funds appear to treat Bitcoin and altcoins as if they were software companies.

“$BTC is behaving like a high beta tech asset, driven by liquidity, growth expectations, and valuation cycles within the software market. This is how smart capital truly sees Bitcoin. That also means the AI sector has direct points of conflict with Bitcoin, something very few are talking about,” commented Joao Wedson, founder of Alphractal.

Concerns have intensified around AI. Models such as Anthropic’s Claude Opus 4.6 and automated coding tools may replace or reduce demand for traditional software. Investors fear software companies could lose customers. Recurring revenues may fall. Loan defaults could follow.

UBS has warned that private credit default rates in the US could surge to as high as 13%.

“It is still too early to say when exactly AI disruption plays out at scale, but we believe that the trend is set to accelerate this year,” UBS strategists said.

When private credit comes under stress, capital conditions tighten. They cut new lending, demand early repayment, or sell assets. These actions hurt software stock performance and spill over into the crypto market.

Dan, Head of Research at Coinbureau, a crypto education firm, argues that private credit pressure has been in place since mid-2025. This stress explains why $BTC began to decouple from liquidity around that time.

“Bitcoin has a strong correlation to software stocks, but what is the shared cause? It’s private credit, which is heavily involved in crypto and software, and has experienced stress since mid-2025, hence why $BTC decoupled from liquidity in mid-2025,” Dan said.

These analyst views clarify a driver that many investors may have overlooked. This factor has weighed on the crypto market in recent months. It also highlights a broader risk associated with private credit defaults and offers a different perspective on how AI advances may negatively affect the crypto market.

The post Why Bitcoin Is Trading Like a Tech Stock — Not Digital Gold appeared first on BeInCrypto.

beincrypto.com

beincrypto.com