- Following the compilation of bear flag patterns, the Bitcoin price is poised for a 20% fall to retest $55,000.

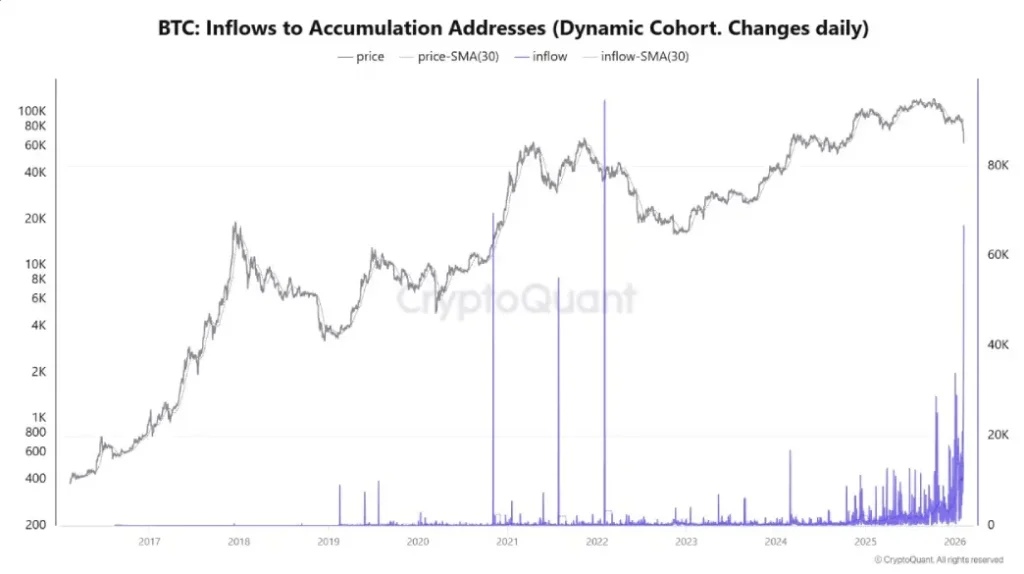

- On February 6, accumulator wallets absorbed 66,940 $BTC in a single day.

- $BTC’s fear and greed index at 9% indicates the market sentiment is in extreme fear.

The pioneer cryptocurrency Bitcoin recorded a low volatility trading during Monday’s U.S. as price attempts to reclaim $70,000. Today’s price action reveals a failed effort from buyers or sellers to drive $BTC’s movement, but the daily candle shows uncertainty with a long-wick rejection from either side. The sluggish price may create concern among retailers but the onchain data shows a strong conviction from whales and institutions as they continue to accumulate more Bitcoin in the current market dip.

Record Whale Inflows vs Choppy Price Action at $70K

Since last week’s low of $59,930, the Bitcoin price has rebound roughly 16% to currently trade around the $70,000 level. The daily chart displays a series of short-bodied and long wick rejection candles emerging around the $70k mark, suggesting a lack of sustainability for either side.

The market sentiment perceives the recent rebound as a temporary relief rally to recoup exhausted bearish momentum. Thus, the retail investors remain cautious as Bitcoin price could witness another round of sell-off.

Despite the potential drawdown, the whale and institutions continued to bag more $BTC. On February 6, some 66,940 $BTC went into accumulator addresses – the largest single-day flow we’ve seen in the current market cycle. Such activity points to large players quietly adding to positions at lower levels, often taking the coins out of exchanges for safe keeping.

In addition, Michael Saylor’s MicroStrategy continued its steady buildup. Between February 2 and 8, it had bought 1,142 $BTC for a value of around $90 million, at an average price of $78,815 per coin. This increased its total stash to 714,644 $BTC acquired overall at about $54.35 billion in the average cost of $76,056 each. With Bitcoin trading around $70,000 recently, the position is showing a paper loss of about $5 billion or around 9%.

Binance’s Secure Asset Fund for Users (SAFU) also increased its Bitcoin reserves. It added 4225 $BTC, with a value almost $300 million based on stablecoin conversions. The fund now holds 10,455 $BTC, or around $734 million at current rates. This step brings it one step closer to achieving its target to reach $1 billion in allocation for Bitcoin as it is at more than 73% completion with an average entry price of around $70,214 per coin and a small unrealized gain under present conditions.

These moves stand out against broader selling pressure from some retail and short-term participants in the volatility.

Bitcoin Price Correction May Plunge Before $55,000 For Major Support

Since last month, the Bitcoin price has dipped from $97,389 to $69,271, registering a loss of 29%. The pullback is majorly fueled by massive long liquidation, macro economic uncertainty and geopolitical tension.

However, from the technical perspective, the coin price gave a decisive breakdown from the key bearish continuation pattern called inverted flag. The chart setup is characterized by a downsloping pole indicating dominant downtrend, followed by a temporary pullback with two slopes to indicate relief rally.

Following the completion of this pattern, the Bitcoin price is chasing its predetermined target.

If the bearish momentum persist, the $BTC price is poised to extend correct another 20% and retest a long-coming support at $54,941.

cryptonewsz.com

cryptonewsz.com