The leading cryptocurrencies, Bitcoin ($BTC), Ethereum ($ETH), and Ripple ($XRP) slip to multi-month lows on Thursday, erasing all gains since Donald Trump won the US presidential election in November 2024.

Bitcoin dropped to $60k during the early hours of Friday, while $ETH retested the $1,750 support level, with $XRP also declining to $1.11.

The three leading cryptocurrencies have undergone double-digit corrections, with no signs of a near-term rebound.

Bitcoin revisits the $60k low

Copy link to section

Bitcoin recorded a double-digit loss on Thursday after losing 10% of its value to revisit the $60k level for the first time since November 2024.

The bearish performance resulted in over $350 billion being wiped out from the broader cryptocurrency market within a few hours.

According to CoinGlass, the losses resulted in a $2.62 billion wipeout of leveraged positions. The largest single liquidation occurred on Binance, with an entity losing $12.02 million in the $BTC-USDT pair.

Long traders lost $2.14 billion since Thursday, while short traders suffered a $465 million liquidation during that period.

In line with the liquidations, the derivatives market Open Interest (OI) has dropped to $95.73 billion on Friday, extending a decline since the October 7 peak of $233.50 billion.

Furthermore, the long-to-short ratio is at 0.9594 over the last 24 hours, indicating more short positions compared to the long positions.

A key factor in $BTC’s bearish performance is the declining confidence among institutional investors.

US spot Bitcoin ETFs recorded an outflow of $258 million on Thursday, amounting to more than $500 million so far this month.

The outflow makes it three consecutive months in which outflows exceeded $6 billion.

Until market volatility subsides and leverage is further reduced, Bitcoin is likely to continue trading in line with risk assets rather than behaving as a defensive hedge.

Bitcoin could gain efficiency by tapping $72k

Copy link to section

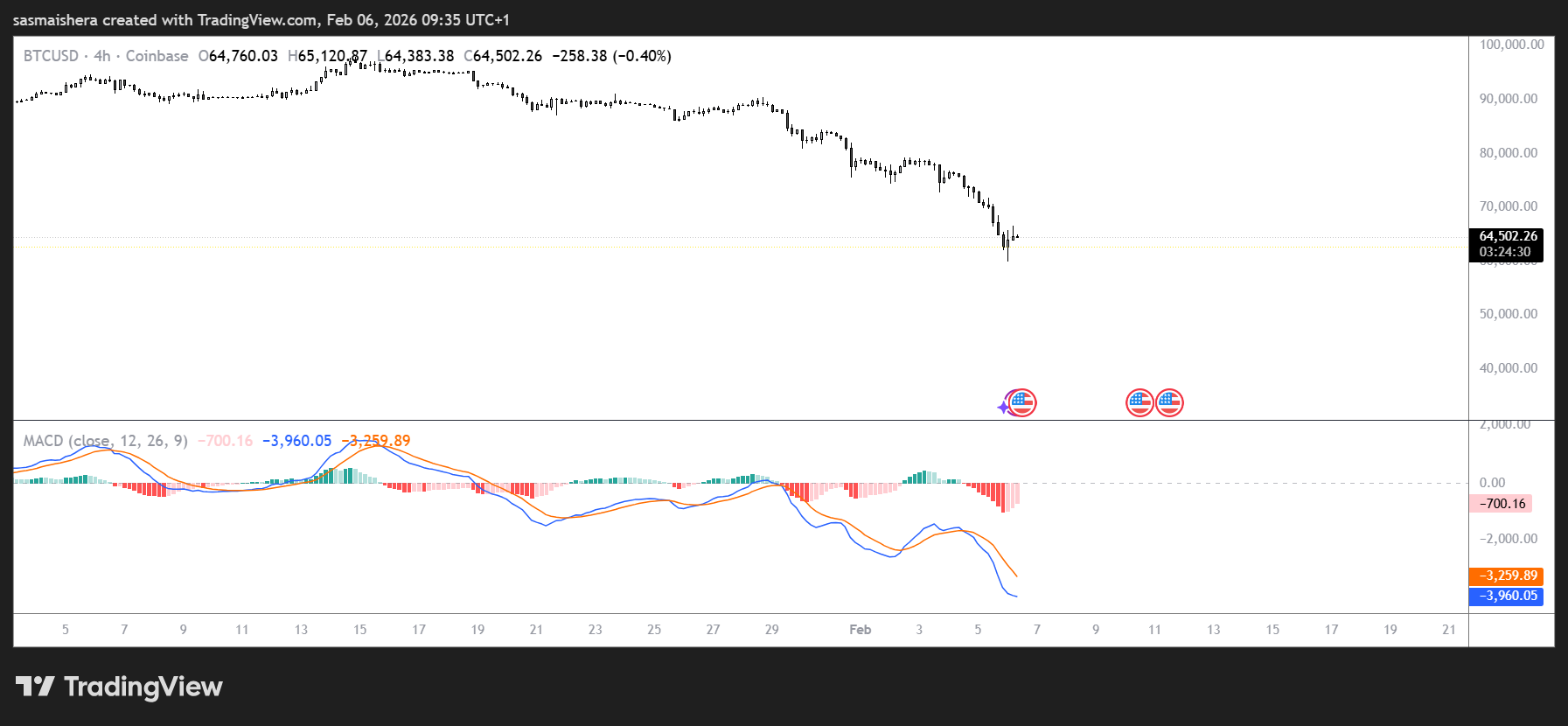

The $BTC/USD 4-hour chart is bearish but inefficient due to the sharp drop recorded on Thursday.

Bitcoin has left an efficiency gap in the $72,900 region, and the bears could grab liquidity at that point before dipping lower.

At press time, Bitcoin is trading above $65,650, down 7.9% in the last 24 hours.

If the market ignores the efficiency level and continues its correction, $BTC could extend the decline toward the weekly support at $54,800.

The Relative Strength Index (RSI) reads 23 on the 4-hour chart, an oversold condition, indicating strong bearish momentum.

Additionally, the Moving Average Convergence Divergence (MACD) indicator showed a bearish crossover since January, which remains intact, further supporting the negative outlook.

However, following this massive correction, Bitcoin could reclaim higher levels in the near term.

If the recovery commences, $BTC could rally towards the $72k EPA level over the next few hours or days.

invezz.com

invezz.com