-

Marathon Digital moved 1,318 Bitcoin worth $87 million to major institutional crypto service platforms recently.

-

Transfers were sent to Two Prime, BitGo, and Galaxy Digital within a short ten-hour window period.

-

Marathon still holds 52,850 $BTC, keeping its position among the world’s largest corporate Bitcoin holders today.

Bitcoin miner Marathon Digital Holdings has transferred nearly $87 million worth of Bitcoin to major crypto service firms, sparking concerns about fresh selling pressure.

The move comes as Bitcoin trades around $64,800 after a sharp drop, adding to fears that miners may be increasing sell-offs.

Marathon Digital Bitcoin Transfer Signals Possible Selling

On February 6, Marathon Digital Holdings moved a total of 1,318 $BTC valued near $87 million to institutional platforms, including Two Prime, BitGo, and Galaxy Digital.

These are well-known institutional platforms that provide custody, trading, and liquidity services. When a mining company sends coins to such firms, it often signals preparation for structured selling, collateral use, or treasury rebalancing.

Miner & Whale Continue to Sell Bitcoin

One major pressure is coming from Bitcoin miners. The average mining cost has risen above $87,000, while Bitcoin trades near $65,402, forcing many miners to sell at a loss. CryptoQuant data shows miner reserves have dropped to 1.806 million $BTC, confirming rising sell-offs.

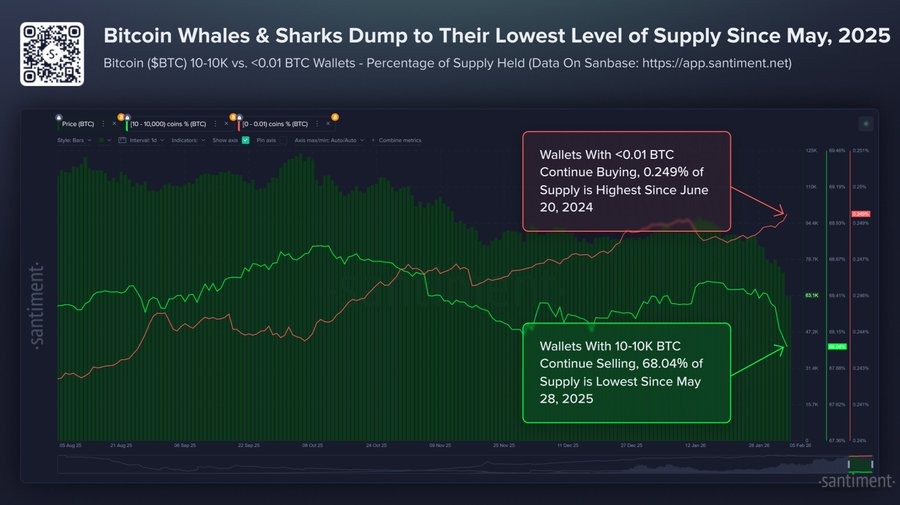

Meanwhile, selling is not limited to miners. Santiment data reveals that Bitcoin whales and large holders are also reducing positions.

Wallets holding between 10 and 10,000 $BTC now control just 68.04% of total supply, a nine-month low. These large holders have sold about 81,068 $BTC in the last eight days alone.

coinpedia.org

coinpedia.org