Bitcoin’s price stands at $76,065 on Feb. 4, 2026 at 8 a.m. EST, capping a dramatic 24-hour range between $72,863 and $79,113. Its market capitalization hovered at $1.51 trillion, with $74.04 billion in trading volume keeping the digital pulse fast and furious. But while price action hinted at recovery, the technical picture tells a more tangled tale — one where bears still whisper from the shadows.

Bitcoin Chart Outlook

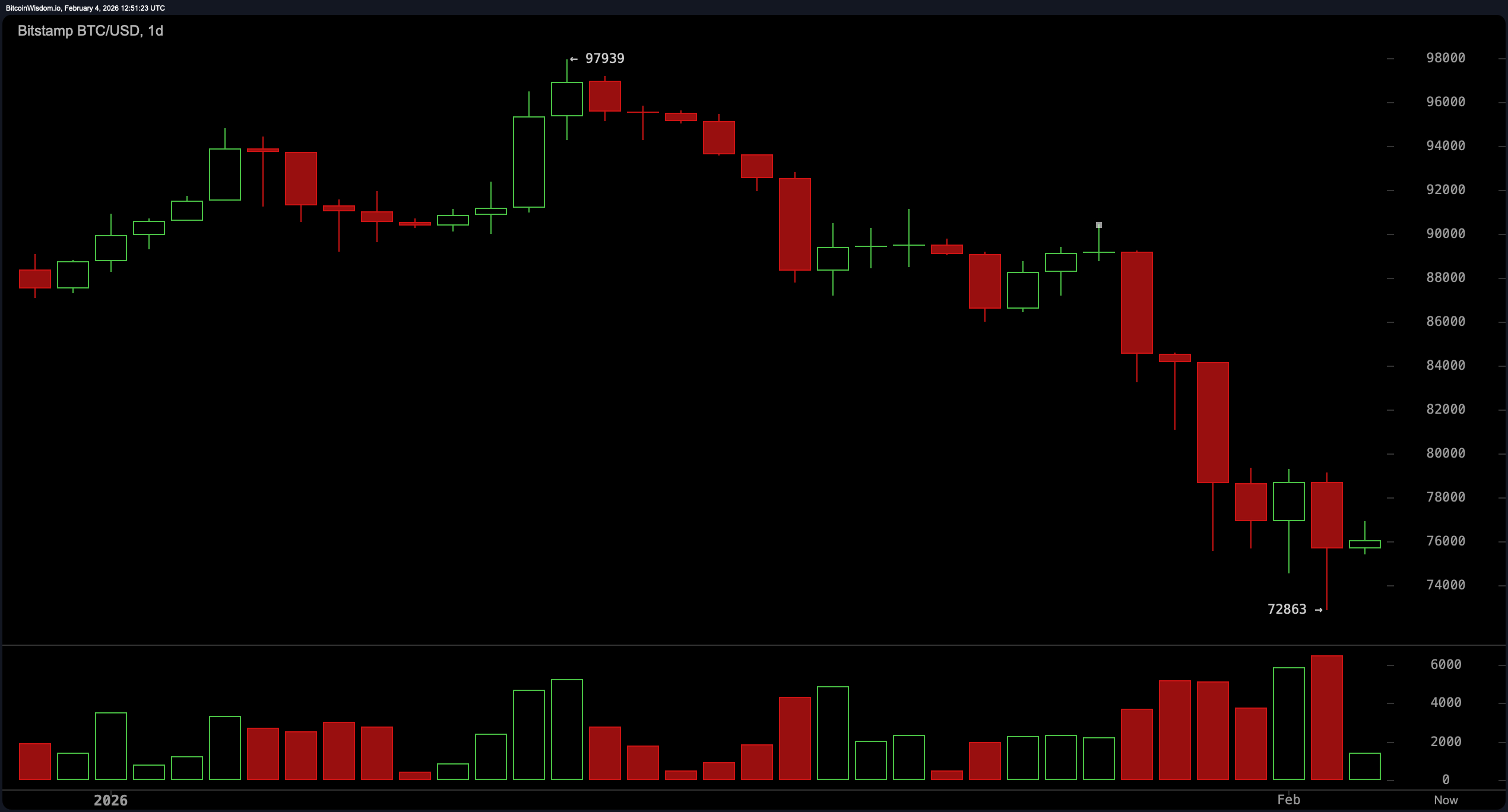

From a daily chart vantage point, bitcoin is strutting down the staircase of lower highs and lower lows, following a peak near $97,900. The descent hasn’t exactly been graceful — think more dramatic exit than controlled retreat — punctuated by a flush of sell volume that resembled capitulation more than composure.

The $72,863 low now stands as the line between breakdown and bottom, with strong structural support clinging desperately to the $72,800–$73,000 zone. Meanwhile, resistance is lounging above at $80,000–$81,000 and again near $88,000–$90,000 — former friends now turned foes.

On the four-hour chart, the market looks like it just took a deep breath. After a sharp liquidation event, price is coiling between $75,500 and $77,000, giving off major “equilibrium after chaos” energy. Long downside wicks near the $73,000 level signal that buyers haven’t ghosted the party just yet. But don’t mistake this sideways saunter for a comeback — the trend remains bearish until price can break above $79,000 and hold court. Support in this timeframe solidifies around $75,000–$75,500, while any stumbles below $72,800 would signal renewed downside risk.

The one-hour chart tells the story of a market stuck in the chop, tiptoeing through stabilization but too shy to call it a trend reversal. Shallow higher lows suggest some buyer interest, though momentum has been suspiciously muted following the bounce off $72,863 — a textbook relief rally if there ever was one. Resistance continues to press down from $77,000–$77,500 and ultimately $79,000, which acts as a psychological tripwire for broader upside aspirations. Immediate support resides between $75,500–$76,000, with $74,000–$74,500 offering a backup cushion.

Oscillators paint an intriguingly split picture, giving technical analysts reason to raise an eyebrow. The relative strength index ( RSI) comes in at 27, flirting with oversold territory, while the stochastic oscillator clocks in at 18 — both suggesting exhaustion in selling pressure. The commodity channel index (CCI) confirms with a reading of −137. Meanwhile, momentum sits at −10,552, still weighed down but implying potential reversal fuel. But let’s not ignore the elephant in the room: the moving average convergence divergence ( MACD) at −3,730 is still flashing caution.

Moving averages are no more forgiving. The exponential moving average (EMA) and simple moving average (SMA) across all standard periods — from 10-day through 200-day — are pointed squarely in the same direction: not up. For example, the 10-day EMA and SMA stand at $80,908 and $82,108 respectively, both towering above current price like skeptical gatekeepers. The 200-day EMA and SMA are even more daunting, at $97,127 and $103,319. The message is clear: momentum needs more than a good haircut to clean this up.

In short, bitcoin’s price may be pausing for breath, but the technicals are still pacing nervously. Until price takes out $79,000 with conviction or breaks below $72,800 in despair, this market remains stuck in purgatory — waiting for a catalyst, a direction, or maybe just a little less drama.

Bull Verdict:

If you’re a market optimist, there’s just enough structure here to raise an eyebrow. The bounce off $72,863, oversold oscillators like the relative strength index ( RSI) and stochastic oscillator, and evidence of base-building across intraday charts suggest the potential for a relief leg higher. A confirmed breakout above $79,000 could spark renewed upside momentum, with targets stretching toward $81,000 and beyond—assuming momentum decides to RSVP.

Bear Verdict:

For the skeptics in the room, bitcoin still hasn’t cleared its technical baggage. The dominant trend remains bearish, all moving averages are unsupportive, and the moving average convergence divergence ( MACD) is still flashing warning lights. Until price can decisively reclaim key resistance zones and reverse the pattern of lower highs, any rally risks becoming just another trap door in disguise.

FAQ

- What is the current bitcoin price on Feb. 4, 2026? bitcoin is trading at $76,065 with a 24-hour range of $72,863 to $79,113.

- Is bitcoin in a bullish or bearish trend right now? bitcoin remains in a short-term consolidation within a broader bearish trend.

- What are key support and resistance levels for bitcoin today?Key support sits at $72,800, while resistance looms near $79,000 and $81,000.

- Are technical indicators suggesting a reversal in bitcoin’s price?Some oscillators hint at oversold conditions, but moving averages still point down.

news.bitcoin.com

news.bitcoin.com