Since the weekend's slump, the bitcoin $BTC$76,090.37 price has been constrained between $70,000 and $79,999 for five straight days. That's a remarkably long time for a range in which the largest cryptocurrency has spent a relatively short span of time.

In fact, bitcoin has spent about 35 days within that $10,000 bucket. Compared with other increments, it's one of the least developed, underscoring how quickly the price has tended to move through rather than build sustained support or resistance.

The longer the price spends in a given range, the more opportunity there has been for positions to be built, which can later translate into stronger support. What this means is the price is more likely to consolidate in this range or, potentially, make another move toward the lower end near before establishing a more durable base.

During the tariff driven volatility last April, bitcoin held below $80,000 for just a few weeks before rebounding. Similarly, when it reached a then all-time high near $73,000 in March 2024, it spent only a short period at those levels before declining.

Perhaps the clearest example of how quickly bitcoin has moved through this range occurred in November 2024 following Donald Trump’s presidential election victory. The price accelerated from roughly $68,000 to $100,000 in a matter of weeks, leaving little opportunity for consolidation between $70,000 and $80,000.

It's notable that Strategy (MSTR), the largest corporate holder of bitcoin, has only once bought bitcoin within this range. On Nov. 11, 2024, the company purchased 27,200 $BTC for approximately $2 billion at an average price of $74,463.

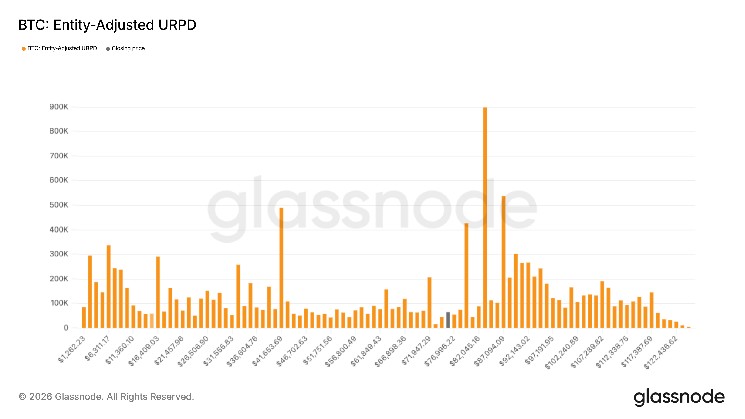

Consider a chart that shows the prices at which bitcoin last moved within a specific price bucket. Each column represents the amount of bitcoin transferred at that price.

The data clearly shows a lack of supply between $70,000 and $80,000, suggesting that this zone remains structurally thin.

coindesk.com

coindesk.com