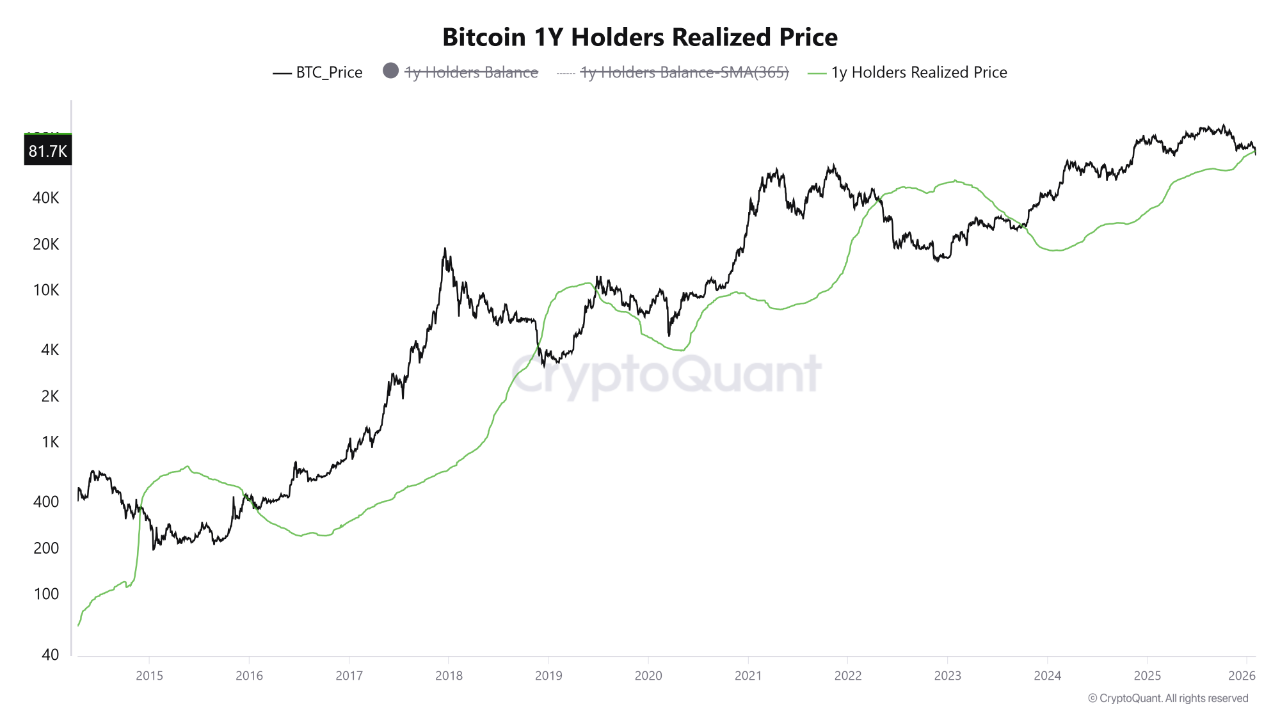

Amid the renewed selling pressure, Bitcoin has now slipped below the realized price of 1-year holders for the first time since September 2023.

For context, Bitcoin entered a new bearish phase over the past week after a brief recovery pushed prices above $90,000 on Jan. 28. The rebound failed to hold, and selling pressure quickly returned. From Jan. 29 onward, Bitcoin recorded four straight intraday losses, driving a sharp 14.42% decline over the period.

On-chain data now shows Bitcoin has fallen below the realized price of 12-18 month holders at $84,462, pushing this key investor group into losses for the first time in over a year. Notably, this development has historically aligned with extended bearish phases.

Key Points

- Bitcoin has fallen 14.42% since Jan. 29 after a failed move above $90,000 last week.

- The price has now dropped below the 12-18 month holders’ realized level of $84,462 for the first time since September 2023.

- A similar breakdown in 2022 preceded a fall from about $42,000 in April 2022 to $15,479 by November 2022, worsened by the Terra collapse in May and the FTX crash in November.

- Accumulation among 12-18 month holders has slowed, with one-year holders selling 37,263 $BTC over 30 days.

- The $84,462 mark now acts as resistance, with rallies likely to struggle until Bitcoin reclaims this level with stronger buying momentum.

Price Falls Below the 12-18 Month Holders’ Cost Basis

Pseudonymous analyst Crazy Block highlighted this trend in a recent CryptoQuant analysis. According to him, Bitcoin has dropped below the realized price of holders who acquired coins between 12 and 18 months ago.

This group represents medium-term investors whose cost basis often indicates cycle stability and long-term conviction. Specifically, their realized price currently stands at $84,462, while Bitcoin trades far below that level at $78,275.

This marks the first time since September 2023 that Bitcoin has slipped under this specific realized price threshold. After breaking above it in late 2023, Bitcoin remained consistently higher until the latest sell-off. With the price now below this level, the entire cohort has moved into unrealized losses.

Historical Context Points to Deeper Bearish Phases

Crazy Block noted that previous instances where Bitcoin broke and stayed below this cost basis typically led to extended bearish regimes. The most notable instance occurred during the 2022 bear market.

In mid-2022, Bitcoin lost this same support zone and went on to plunge from about $42,000 in April 2022 to $15,479 by November 2022. However, this collapse played out alongside major market shocks, including the Terra ecosystem failure in May 2022 and the FTX exchange collapse in November 2022.

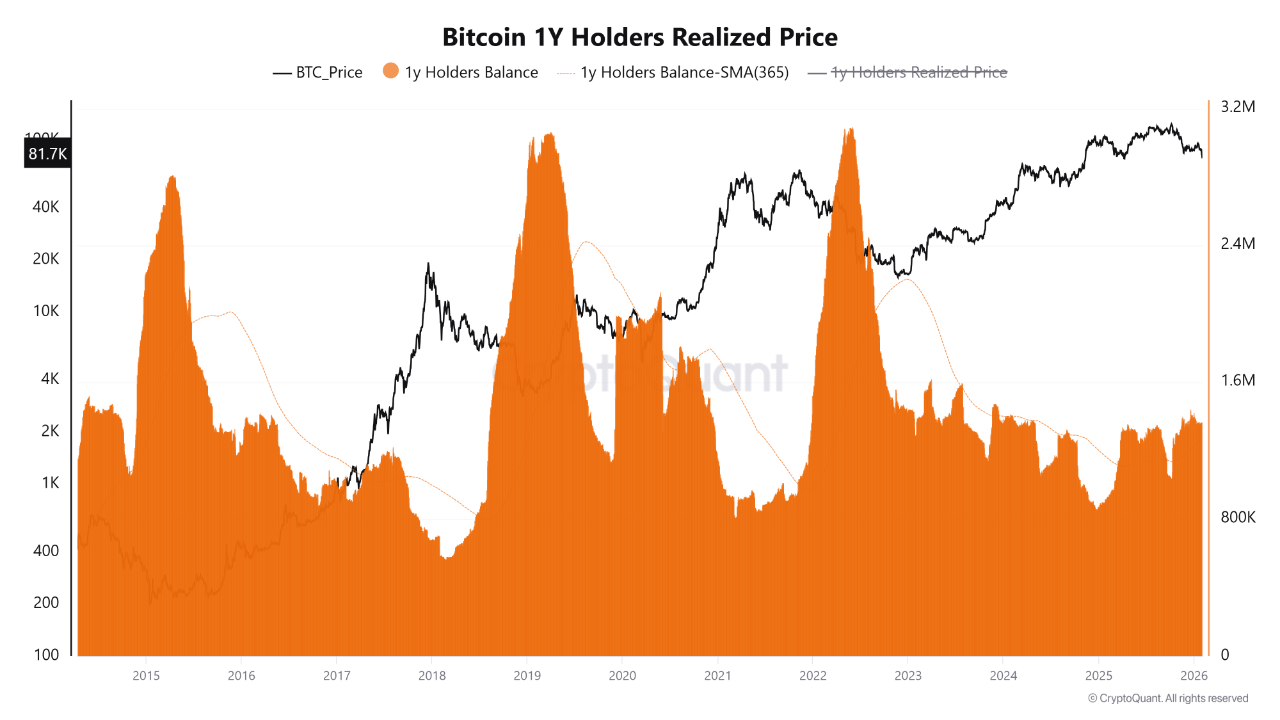

Accumulation Slows as Conviction Weakens

Meanwhile, supply data shows that the 12-18 month holder group still controls a large portion of Bitcoin’s circulating supply, and their 30-day balance change remains positive.

However, the pace of accumulation has slowed noticeably. According to Crazy Block, this indicates a drop in marginal conviction. Notably, this pattern often comes before wider distribution phases in previous cycles.

At the same time, one-year holders have begun trimming exposure. Over the past 30 days, this group offloaded 37,263 $BTC, reducing their total balance to 1.354 million $BTC.

Realized Price Turns into Overhead Resistance

Now, the realized price for the 12-18 month cohort has remained relatively flat near $84,462, confirming it has now flipped to resistance. Historically, when Bitcoin trades below a stable or rising realized cost basis, relief rallies often fail as investors look to exit positions near breakeven levels.

Crazy Block emphasized that the combination of negative unrealized profits, slowing balance growth, and price staying below realized cost has consistently aligned with prolonged bearish phases.

Until Bitcoin decisively reclaims this level with renewed accumulation strength, the market structure could continue to favor consolidation, fragile rebounds, and heightened downside risk instead of a confirmed recovery.

What Next for Bitcoin?

Meanwhile, CryptoQuant CEO Ki Young Ju recently stressed that Bitcoin has continued to witness a lack of fresh capital inflows. He explained that Realized Cap has flattened, indicating that new money has stopped entering the market.

Bitcoin is dropping as selling pressure persists, with no fresh capital coming in.

Realized Cap has flatlined, meaning no fresh capital. When market cap falls in that environment, it's not a bull market.

Early holders are sitting on big unrealized gains thanks to ETFs and MSTR… https://t.co/OnnzQMy6Ra pic.twitter.com/J0yTtCTQjr

— Ki Young Ju (@ki_young_ju) February 1, 2026

As the Bitcoin market cap falls in such an environment, the conditions no longer resemble a bull market. He added that early holders have taken profits since early last year after ETF-driven demand and Strategy purchases pushed Bitcoin near $100,000.

Downside pressure has increased as those inflows dry up. While Ju noted that he does not expect a 70% crash like previous cycles unless Michael Saylor sells aggressively, he expects a broad sideways consolidation as the bear market develops.

Market veteran Michaël van de Poppe observed that Bitcoin historically follows gold after major peaks and suggested that once Bitcoin reclaims the $88,000 level, Ethereum typically gains strength as well. Van de Poppe said he does not expect new all-time highs for gold and silver during 2026, and this could ultimately redirect capital flows back into crypto.

thecryptobasic.com

thecryptobasic.com