Crypto markets started the week on the back foot, with Bitcoin, Ethereum, and major altcoins extending a steep sell-off on Monday to multi-month lows.

The slide reflected eroding investor confidence and a surge in forced liquidations across exchanges. After days of heightened volatility, the downturn showed little sign of abating. As prices pushed lower, traders retreated to the sidelines, exacerbating losses across the market.

Key Points

- Bitcoin and Ethereum both fell to multi-month lows as selling pressure intensified across major tokens.

- The total cryptocurrency market lost roughly 4.4% of its value in the past 24 hours.

- Bitcoin slid below $75,000, extending weekly losses by more than 14%.

- Ethereum dropped nearly 10% in a single session, deepening a week-long decline of about 23%.

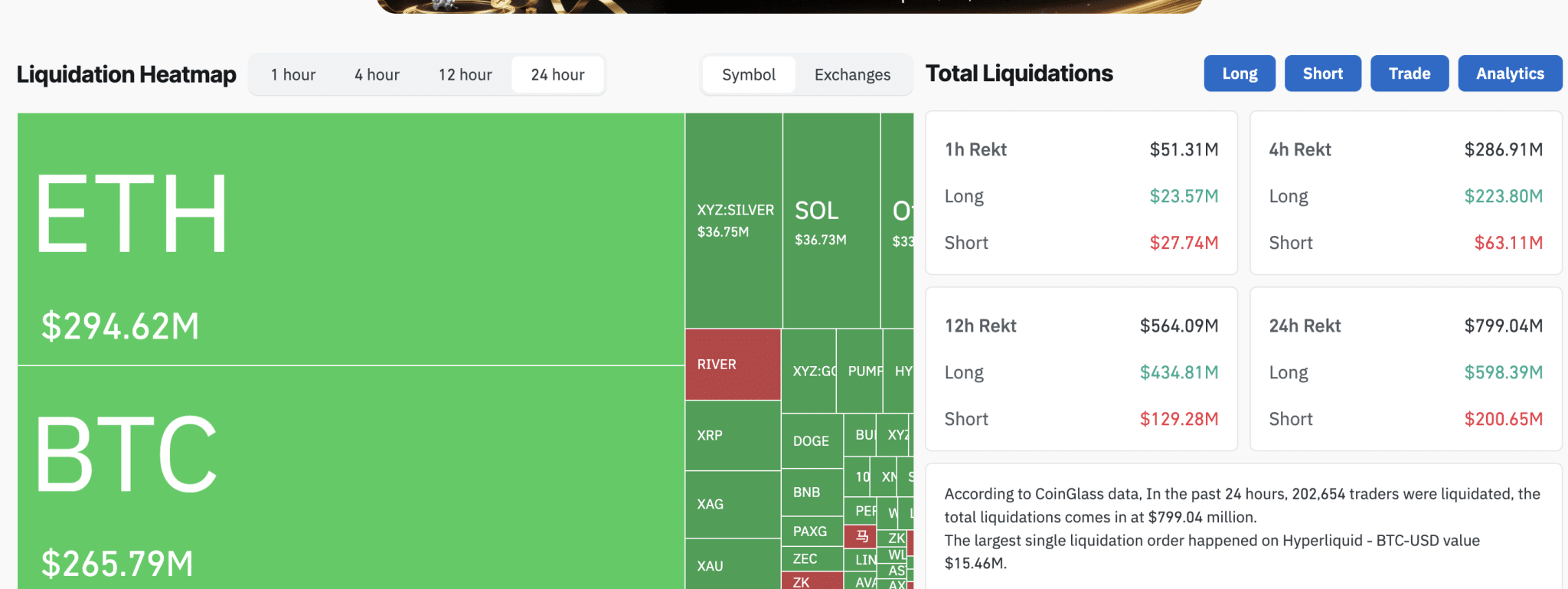

- Roughly $800 million in leveraged crypto positions were liquidated in the past day.

- Long positions accounted for more than three-quarters of total liquidations, underscoring a rapid unwind of bullish bets.

Bitcoin and Ethereum Lead the Sell-Off

Bitcoin led the move lower, slipping below the $75,000 mark during the session. According to CoinGecko, the largest cryptocurrency fell 4.7% over the past 24 hours to around $74,900, its lowest price in roughly nine months. BTC has now declined more than 14% over the past week and sits about 40% below its October peak of $126,080.

Meanwhile, Ethereum recorded even steeper losses. CoinGecko data shows ETH sliding nearly 10% in a single day to about $2,190. Consequently, weekly losses stand close to 23%, leaving the second-largest cryptocurrency roughly 55% below its August high, when prices neared $5,000.

Together, the sharp declines in Bitcoin and Ethereum set a broadly negative tone, curbing any meaningful recovery attempts across the digital asset market.

Altcoins Turn Lower

Selling pressure quickly spread beyond the leading tokens. XRP fell more than 7% to approximately $1.54, while Solana declined about 6.6% to near $98. Dogecoin also weakened, slipping over 4% to trade around $0.10.

With losses widespread, total cryptocurrency market capitalization fell roughly 4.4% over the past 24 hours. The breadth of the decline suggests investors reduced risk exposure across the board rather than rotating into alternative assets, underscoring a market-wide retreat from risk.

Liquidations Accelerate in Derivatives Markets

The downturn triggered significant losses among leveraged traders. Data from CoinGlass shows that approximately $800 million in crypto futures positions were liquidated over the past day, with long positions accounting for about $578 million of the total.

Specifically, Ethereum futures accounted for the largest share of forced liquidations, at roughly $278 million, followed closely by Bitcoin at around $254 million. This scale of liquidations illustrates how quickly bullish positioning unraveled, further pressuring already fragile markets.

Macro Headwinds Weigh on Sentiment

The crypto sell-off unfolded amid broader macroeconomic uncertainty. Over the past week, investors have been grappling with political risks in the United States, including concerns over a government shutdown. Indeed, those fears materialized early Saturday when a partial shutdown began.

At the same time, skepticism has grown around valuations linked to artificial intelligence investments, with market participants increasingly questioning whether enthusiasm in the sector has outpaced underlying fundamentals.

Together, these factors reinforced a risk-off environment that spilled over into cryptocurrencies and other speculative assets.

ETF Outflows Signal Risk-Off Shift

Investor caution was also evident in fund flows. Data from Farside Investors shows that nearly $1.5 billion exited U.S. spot Bitcoin exchange-traded funds over the past week, while Ethereum-focused ETFs recorded outflows of about $327 million.

Sustained withdrawals from crypto ETFs suggest investors have been actively reducing exposure amid elevated volatility. ETF flows often mirror broader sentiment, and the latest data points to a defensive shift.

Precious Metals Offer Mixed Signals

While cryptocurrencies struggled, traditional safe-haven assets attracted attention last week. Gold and silver climbed to record highs amid growing risk aversion. However, both metals reversed sharply by the end of the week.

Notably, silver experienced particularly heavy selling, plunging more than 31% during Friday’s U.S. trading session. This abrupt reversal highlights how quickly sentiment can shift across asset classes during periods of heightened uncertainty.

In conclusion, Monday’s sell-off underscores the fragile state of crypto markets amid leveraged positioning and broader economic headwinds. With volatility still elevated, traders remain cautious as they assess whether prices can find a stable footing in the days ahead.

thecryptobasic.com

thecryptobasic.com