Bitcoin dropped to about $82.9K as long liquidations surged, even while funding stayed positive. Meanwhile, a long term cycle chart framed the pullback as part of a broader uptrend.

Long liquidations spike as Bitcoin slips to $82.9K while funding stays positive

CryptoQuant data shared by Axel Adler Jr showed a sharp jump in forced long closures over the past 24 hours as Bitcoin fell to about $82.9K.

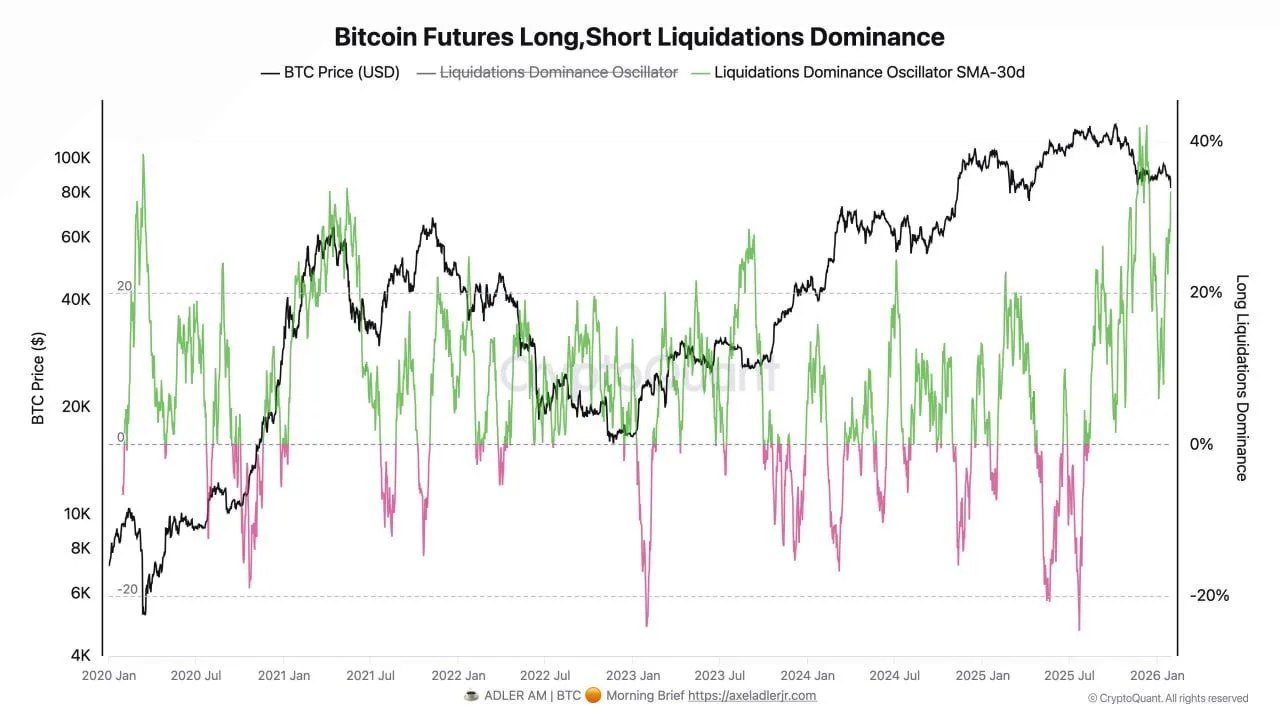

Bitcoin Futures Long,Short Liquidations Dominance: Source: CryptoQuant, Adler AM (Axel Adler Jr)

The liquidation burst hit an extreme zone on the “Bitcoin Futures Long,Short Liquidations Dominance” series, signaling that leveraged long positions absorbed most of the stress during the drop. The move reflected rapid deleveraging in derivatives as price slid from recent levels.

At the same time, funding rates remained in positive territory, which suggested traders still paid to keep long exposure. The combination of heavy long liquidations and positive funding pointed to an unwind that had not fully cleared positioning pressure at the time of the reading.

Long-term cycle model points to renewed upside phase for Bitcoin

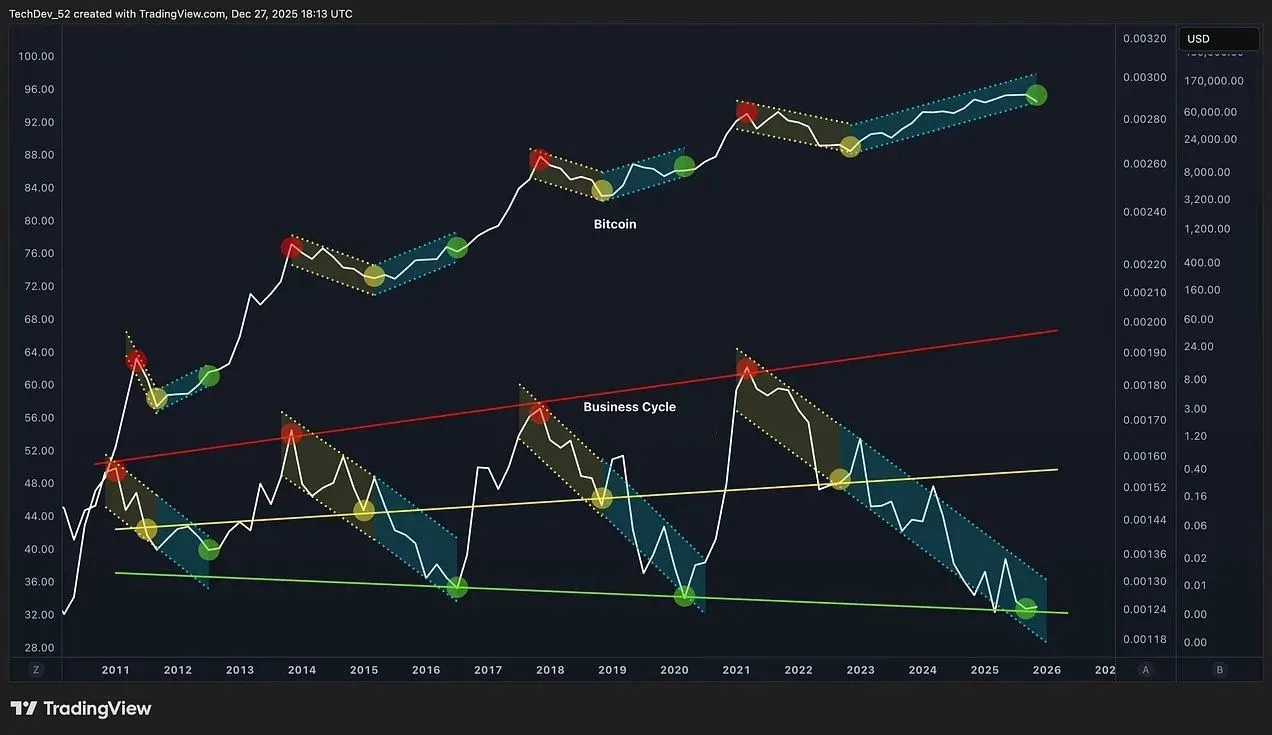

A long-term cycle chart shared by Trending Bitcoin shows Bitcoin tracking a repeating expansion pattern across multiple market cycles, with price advancing inside rising channels while the underlying business-cycle metric resets at higher lows.

Bitcoin Long-Term Cycle Model: Source: TradingView, Trending Bitcoin

The model maps prior cycle peaks and pullbacks since 2011 and places the current structure in the latter stage of an expansion leg. Historically, similar alignments preceded steep upside extensions after consolidation phases resolved higher. In this view, recent volatility fits within a broader upward trajectory rather than signaling a cycle break.

At the same time, the business-cycle line trends upward from a long-term base, suggesting momentum conditions are rebuilding rather than rolling over. If the historical rhythm holds, the chart implies scope for accelerated price discovery ahead as Bitcoin remains within its long-term ascending channel.