Bitcoin price today trades near $82,853 after breaking below the ascending trendline that has supported the 2026 rally. The move comes as a rare cross-asset liquidation event swept through crypto markets, triggered by a 35 percent collapse in silver prices that forced $142 million in tokenized metals positions to unwind before spilling into $BTC and ETH.

Silver Crash Creates Unusual Liquidation Hierarchy

The past 24 hours produced a rare event in crypto markets. Tokenized silver futures led liquidations at $142 million, surpassing both Ethereum at $139 million and Bitcoin at $82 million. A total of 129,117 traders were liquidated with combined losses reaching $543.9 million.

The shakeout began when silver reversed sharply from its rally, with hedge funds cutting bullish positions to a 23 month low. CME Group raised margin requirements on gold and silver futures by up to 50 percent, forcing leveraged traders to either add capital or exit positions.

The largest single liquidation occurred on Hyperliquid, where an $18.1 million silver position was forcibly closed. The cascade effect pulled Bitcoin lower as risk sentiment deteriorated across all macro-linked assets trading on crypto rails.

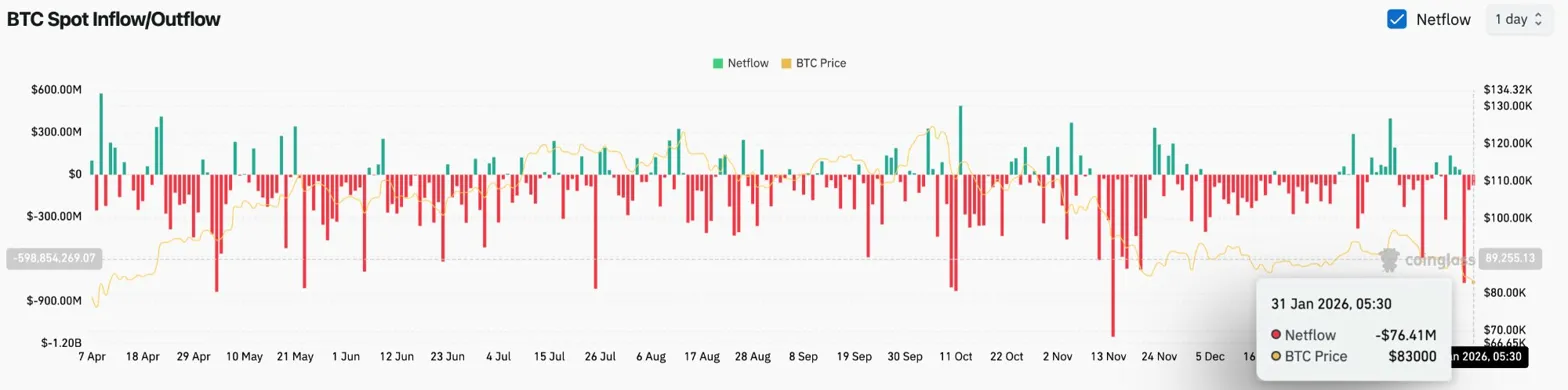

Spot Outflows Accelerate As Price Breaks Structure

Coinglass data shows $76.41 million in spot outflows on January 31, extending the distribution pattern that has defined the past week. The selling pressure from spot markets combines with derivatives liquidations to create dual pressure on price.

The timing of outflows coincides with the trendline breakdown, suggesting that holders are reducing exposure as technical structure deteriorates. When spot selling accelerates during a breakdown, it confirms conviction from sellers rather than temporary repositioning.

Ascending Trendline Breaks After Two Month Hold

On the daily chart, Bitcoin has broken below the ascending trendline drawn from the December lows near $78,000. This trendline supported price through multiple tests in January, including bounces from $85,000 and $87,000.

Price now trades well below all four major EMAs. The 20 day EMA sits at $88,586, the 50 day at $90,412, the 100 day at $94,046, and the 200 day at $97,997. The Supertrend indicator remains bearish at $91,180.

The breakdown below trendline support shifts the structure from consolidation to continuation lower. The January 30 session low at $82,420 marks immediate support, with the December low near $78,000 representing the next major demand zone.

Intraday Chart Shows Short Term Stabilization

On the 30 minute chart, Bitcoin shows early signs of stabilization after the breakdown. An ascending trendline from the January 30 low at $81,000 has formed, with price making higher lows through the session.

The Parabolic SAR sits at $83,389, marking immediate resistance for any recovery attempt. RSI has climbed to 36.52 from oversold levels, suggesting the immediate selling pressure may be easing.

However, the broader structure remains bearish. Each bounce attempt over the past two days has been sold into, with the $84,000 level rejecting multiple recovery attempts. Until price reclaims the Parabolic SAR level and holds above $84,000, the bias remains toward the downside.

Outlook: Will Bitcoin Go Up?

The trend remains firmly bearish while price trades below the broken trendline and EMA cluster.

- Bullish case: A daily close above $88,586 would reclaim the 20 day EMA and signal that the trendline breakdown was a false move. That scenario requires a shift in macro sentiment and improving spot flows.

- Bearish case: A close below $81,000 would confirm the breakdown and target the December low at $78,000. With cross-asset liquidations still unwinding and spot outflows persisting, that scenario carries higher probability.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com