Crypto traders are leaning bullish while simultaneously chasing downside protection ahead of Friday's bitcoin $BTC$88,841.00 options deadline worth billions of dollars.

Bitcoin options worth $8.5 billion will expire on Deribit at 8:00 UTC on Friday, the world's largest crypto exchange by trading volume and open positions. These figures represent the U.S. dollar notional value of active options contracts at press time, with each contract corresponding to one $BTC or one ETH.

Since the 2020 COVID crash, options market has expanded rapidly as institutions ramped up risk hedging and yield strategies. Options are derivative contracts that let you pay a fee today for a future choice on crypto: buy it cheap through a call option or sell it high though puts at a price locked in now. A call buyer is implicitly bullish on the market while a put buyer is bearish looking to hedge downside risks.

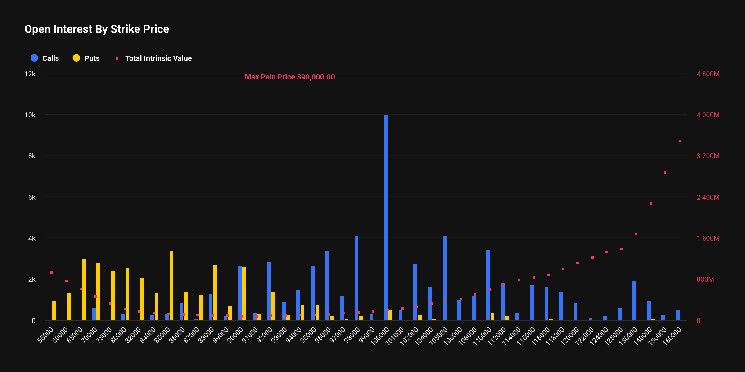

Traders are positioned bullishly ahead of the expiry, the ratio of the number of active or open puts to calls shows.

"The put-call ratio for this expiry stands at 0.56, indicating that overall positioning into month-end remains skewed toward [bullish] calls," Sidrah Fariq, the global head of retail sales and business development at derivatives exchange Deribit, told CoinDesk in a Telegram chat.

The bullish bias shows that traders were expecting a strong price action in January. Bitcoin, however, has gained only 2% this month, CoinDesk data show.

The performance may improve by the month end if Wednesday's Fed rate decision signals more fiat liquidity easing ahead. Like technology stocks, bitcoin tends to benefit from low interest rates and easing.

However, some traders are snapping up put options ahead of the meeting, looking to hedge potential downside risks ahead of the Fed.

"Recent flow shows heavy use of put diagonal calendar spreads, alongside concentrated downside activity in Jan 30 strikes, with notable interest in 88k and 85k Bitcoin puts over the last 24 hours," Fariq said.

"With markets largely expecting the Federal Reserve to hold interest rates, traders appear to be hedging against near-term volatility around macro events, rather than positioning for a policy-driven sell-off," she explained.

Friday's event will also see ether options worth $1.3 billion expire alongside their bitcoin counterparts.

Monthly and quarterly options expiries often spark short-term swings, but big lasting effects look unlikely, as options market remain tiny next to spot trading. Bitcoin's impending $8.5 billion expiry, for instance, is under 1% of its $1.7 trillion market, too small for long-term shakes.

coindesk.com

coindesk.com