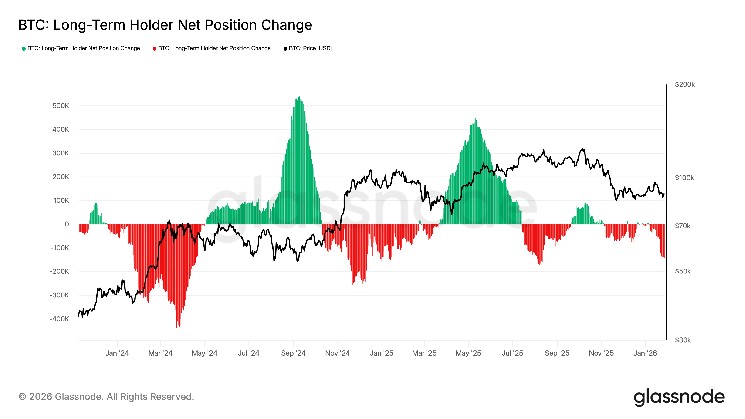

Long term holders of bitcoin $BTC$88,841.00 are again selling the largest cryptocurrency, with distribution now at the fastest pace in five months. Last year's action front-ran a market top that occurred, as many had expected, in October.

In the past 30 days, investors who've held bitcoin for at least 155 days — a cohort typically viewed as the most conviction-driven market participants — have sold roughly 143,000 $BTC, according to Glassnode data.

Bitcoin's price is lagging behind broader financial assets, including metals such as gold and silver, which are trading at or near record highs. The discrepancy points to stress in the crypto market and raises the risk of further downside or an extended consolidation.

Their actions mirror the prior distribution peak in August, when around 170,000 $BTC was sold over a 30-day period. At the time, the price was trading above $120,000 and bitcoin hit a record high two months later, reinforcing a narrative that the holders were selling into strength

The October peak was predicted by a theory that the $BTC price follows a four-year cycle related to the periodic halving of rewards paid to bitcoin miners. The last 50% reduction took place in April 2024. Historically, each cycle has tended to see a peak in the fourth quarter followed by a prolonged drawdown and consolidation phase.

At the time, nearly the entire long-term holder supply, some 15 million coins, was in profit. After a sharp 36% drawdown from the October high through late November, there was a brief period from late December into early January when long-term holders shifted back to net accumulation.

This temporarily eased selling pressure and helped stabilize price action, with bitcoin jumping to as high as $97,000 and roughly 2 million of the coins are now sitting at a loss. Still, this group of investors currently owns about 14.5 million $BTC, underscoring that long-term reductions remains a key headwind for price.

coindesk.com

coindesk.com