While most of the Crypto Twitter space was trying to make sense of what's going on with Bitcoin, Michael Saylor put on his sunglasses, suited up in orange and dropped two words: "Be cool." Well, very much in the style of the Strategy (MSTR) boss.

That post, full of attitude and missing any background information, popped up right when the leading cryptocurrency delivered a 299% liquidation imbalance in favor of longs.

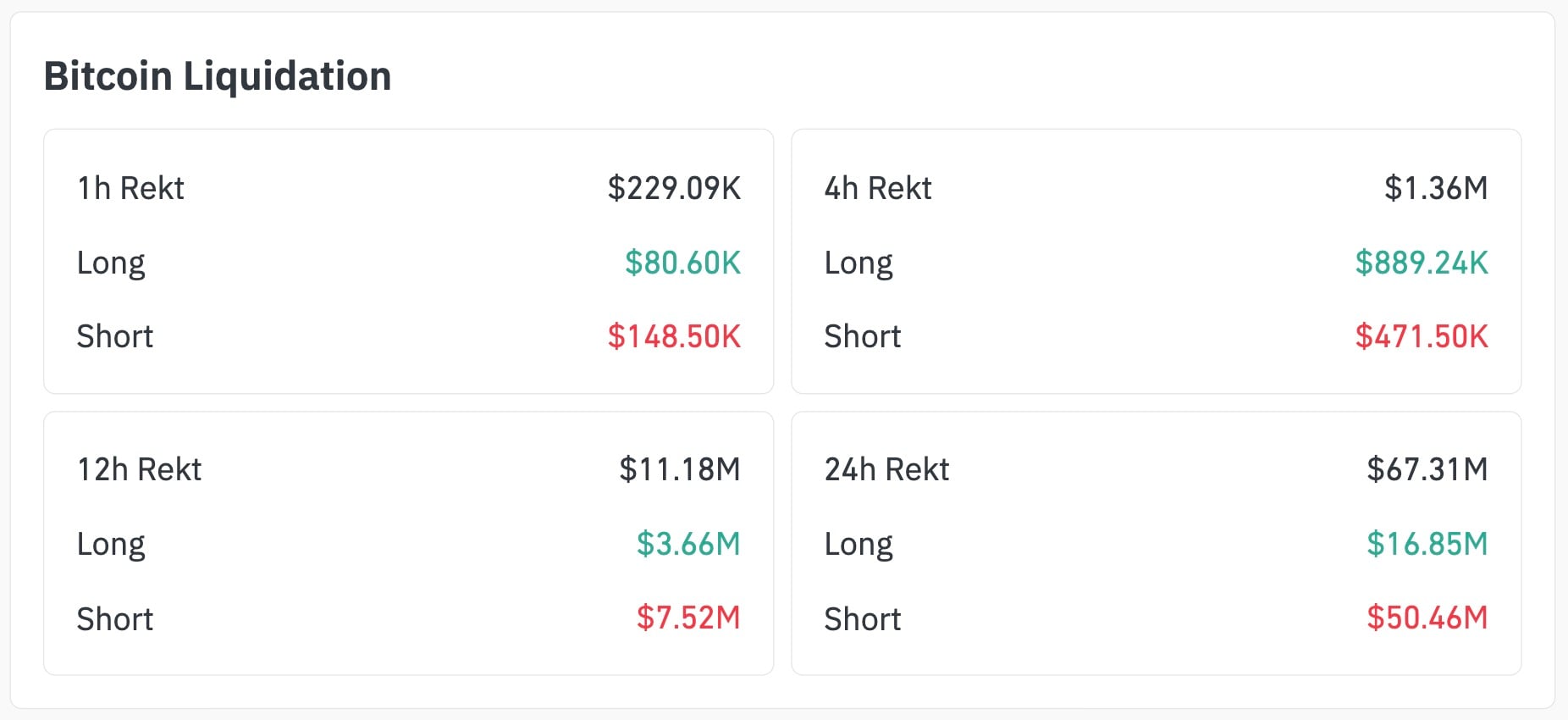

According to CoinGlass, in only the last 24 hours, $67.31 million in positions have gotten "rekt" — $50.46 million from shorts, compared to just $16.85 million from longs.

₿e Cool pic.twitter.com/ZcSR8Lxt4g

— Michael Saylor (@saylor) January 27, 2026

Saylor's post might look like a meme, but it came at the right time, just as bears got flushed from the derivatives market. Bitcoin itself is sitting at $88,140, looking like nothing happened, but actually hiding one of the most intense short squeezes we have seen this month.

The 12-hour liquidation imbalance is also 2-to-1 against shorts. The four-hour ratio is almost 190%. And in the past hour alone, $148,500 in shorts were liquidated compared to $80,600 in longs.

Taking a wider outlook on the BTC price chart makes a whipsaw pattern evident: a quick recovery near $87,000 and a rise that led to a bunch of short stops being triggered around $88,000 thanks to thin liquidity and the overleveraged confidence of short sellers.

Did Saylor come out ahead with his tweet?

Probably not. He has been around Bitcoin long enough to know when the tide is turning. There has been no movement in price, but there has been a $50 million hit to bears, so now the "liquidation tail" is wagging the "price dog."

Shorts have been trying to fade every local high since BTC failed to reclaim $90,000. But today's flush just gave bulls a new lease on life.

If this imbalance keeps going for the next 12 hours, Bitcoin's next surge might not come from buyers but from sellers who have bet the wrong way. Again.

u.today

u.today