Bitcoin has shifted into a corrective leg following its recent pullback, but from a market-structure perspective, the broader trend remains constructive.

Price action is behaving more like a controlled retracement than a breakdown, fitting neatly within a higher-timeframe setup that historically precedes continuation.

Bitcoin Profits Have Declined

From a trader’s lens, the recent drawdown looks less like panic selling and more like weak hands being flushed out. Short-term sellers appear to be stepping aside, while larger and more patient participants are quietly repositioning.

This rotation often marks the transition from late-cycle distribution into early accumulation, creating the conditions for a volatility expansion to the upside once liquidity rebuilds.

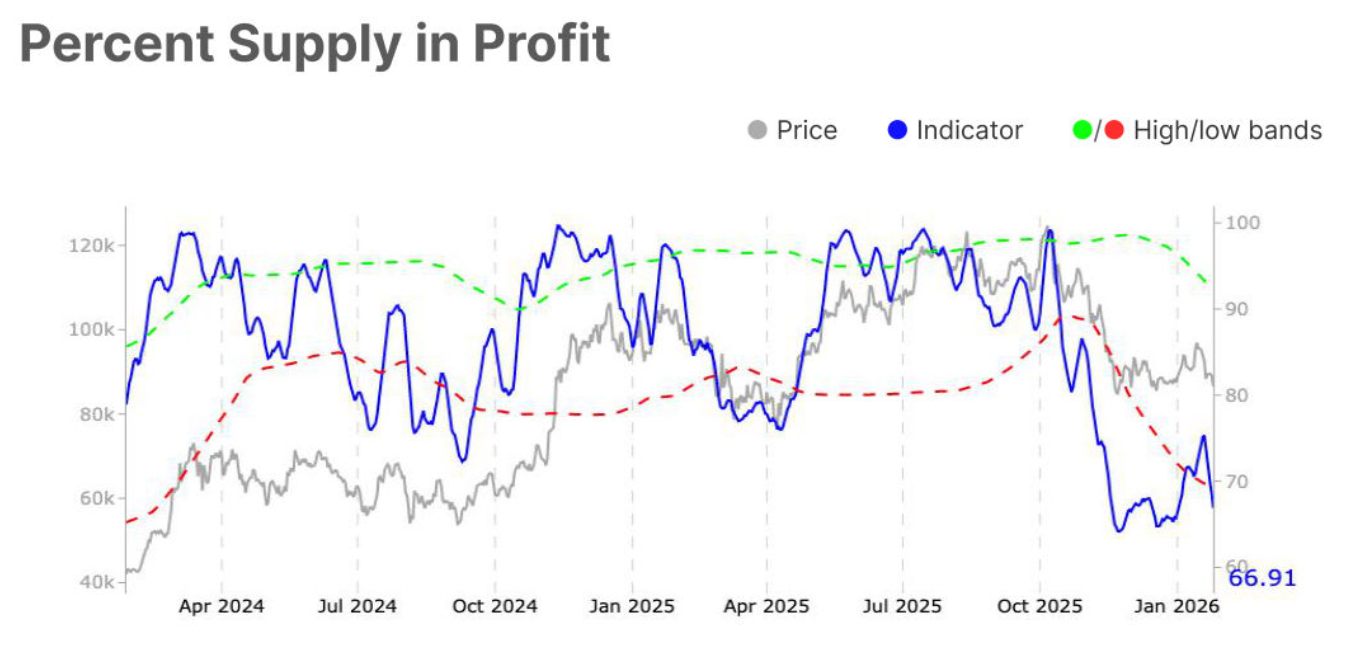

On-chain data reinforces this narrative. Network-wide profitability has compressed meaningfully, with the share of Bitcoin supply in profit dropping from 75.3% to 66.9%. This move pushed profitability below the lower historical threshold around 69.1%, a zone that has repeatedly coincided with local price stabilization.

When a growing percentage of holders sit underwater, sell pressure typically dries up, as the incentive to exit at unfavorable prices diminishes.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Historically, dips below this lower profit band have acted as a reset mechanism, allowing price to form a base before the next impulsive leg higher. Although a brief, short-term bearish phase recently disrupted this pattern, current price levels are significantly lower than prior peaks.

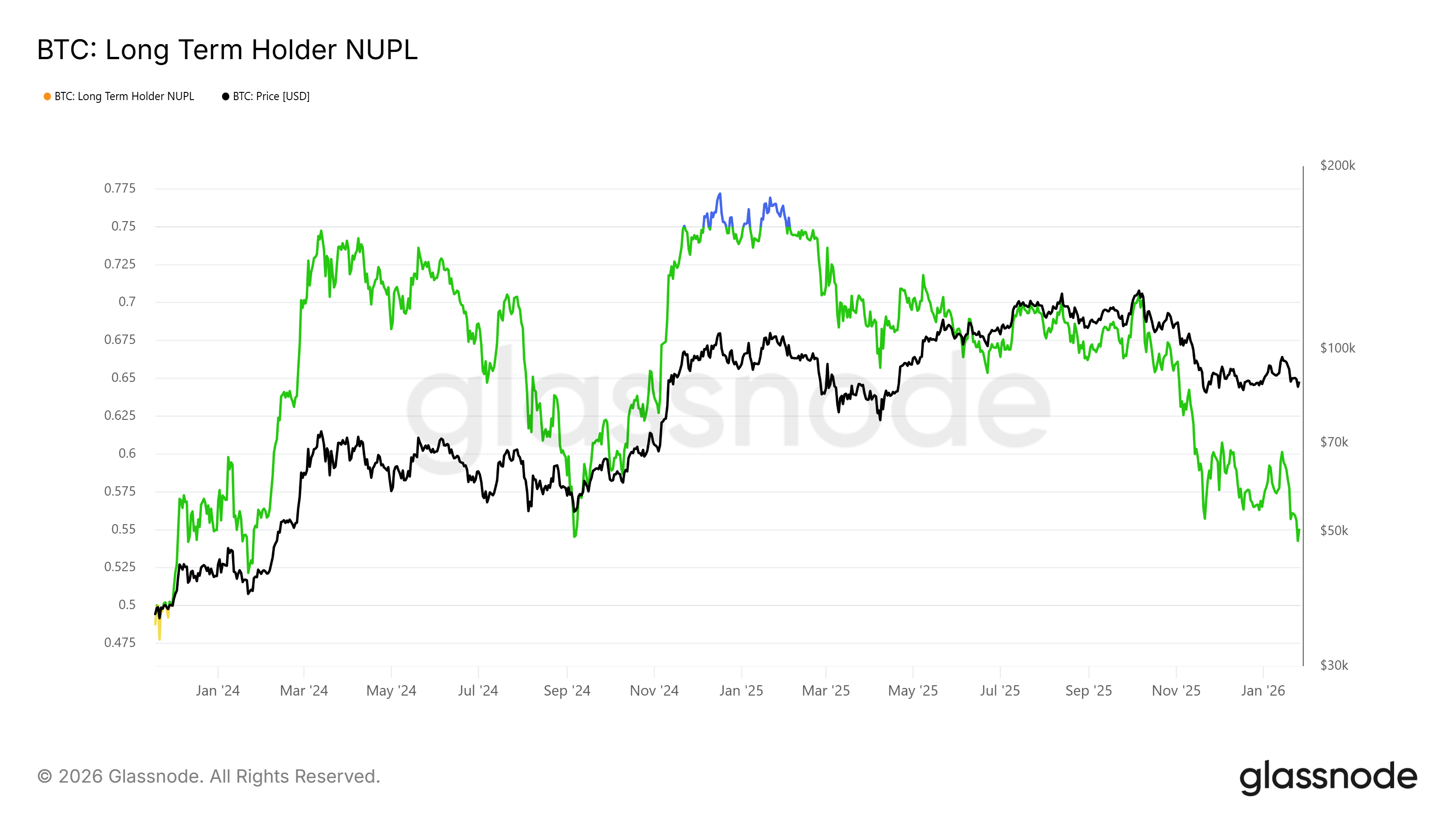

Long-term holder behavior further strengthens the bullish case. The Long-Term Holder Net Unrealized Profit/Loss (LTH NUPL) metric shows profits compressing toward levels that have historically altered holder behavior.

When LTH NUPL drops below 0.60, long-term participants typically slow or halt distribution, choosing instead to wait for improved conditions. In previous cycles, this shift has marked the early stages of renewed accumulation and reduced sell-side pressure, allowing price to recover methodically.

BTC Price Is Ambitious

From a technical standpoint, Bitcoin price remains inside an ascending broadening wedge. Price recently bounced from the lower boundary of this structure and is now trading near $88,475. The immediate task for bulls is to clear $89,241 and reclaim the psychological $90,000 level. Acceptance above $90,000 would signal improving short-term momentum and confirm strength within the pattern.

A confirmed breakout from the wedge opens the door for higher objectives. A move toward $98,000 is likely the first major milestone, followed by a healthy consolidation pullback toward $95,000 to establish support. This base would be critical before any sustained push toward the $100,000 mark.

However, downside risk cannot be ignored. If selling pressure resurfaces or macro conditions worsen, a failure to hold current levels could send Bitcoin below $87,210. In that scenario, a deeper retrace toward $84,698 becomes likely, invalidating the bullish setup and postponing the breakout thesis.

The post Bitcoin Price’s Rise To $100,000 Will Warrant A Pit-Stop At This Level appeared first on BeInCrypto.

beincrypto.com

beincrypto.com