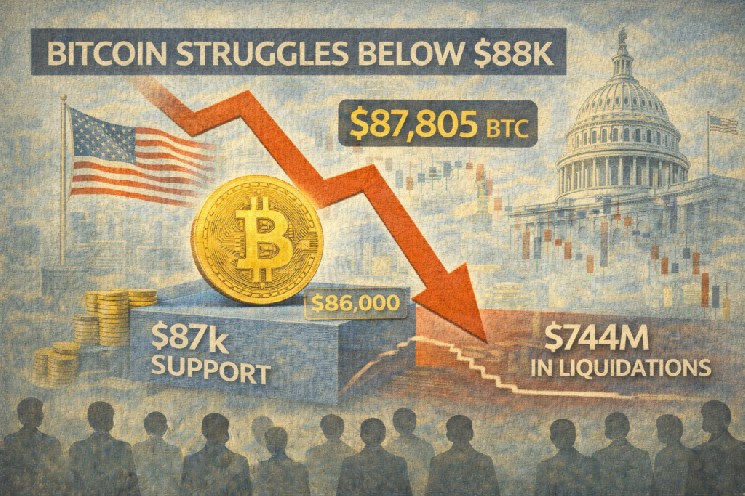

The gains accrued earlier this month have been wiped out as Bitcoin dropped below the $88k level on Monday.

The cryptocurrency market has been bearish over the last three weeks and has begun another week with more losses.

Over $100 billion was wiped out from the crypto market on Sunday as events in the United States affected Bitcoin and other major altcoins.

Possible US government shutdown pushes BTC’s price below $87k

Copy link to section

Bitcoin lost 2% of its value on Sunday and dropped to the $86k level, filling out the Fair Value Gap (FVG) on the 4-hour chart from December 19.

The bearish performance comes amid the rising possibility of another US government shutdown.

The shutdown risks are fueled by funding uncertainty and political deadlock.

There is a legislative friction in Congress, where Democratic lawmakers have threatened to block a Department of Homeland Security funding bill following controversy over federal law enforcement actions.

If another shutdown happens, it will come on the back of the longest government shutdown in US history, which lasted for six weeks.

In addition to that, traders are focusing on the upcoming Fed rate decision.

If there is a government shutdown, it would be hard for the Fed to cut the interest rates as the apex bank would lack the data to make informed decisions.

While Bitcoin has bounced back and is now trading at $87,805, the bearish performance saw $744 million in liquidations of leveraged positions in the last 24 hours, led by $580 million for longs and $164 for shorts.

BTC recovers above $87k after Sunday’s dip

Copy link to section

The BTC/USD 4-hour chart remains extremely bearish as Bitcoin has failed to rally towards the $91,600 resistance.

Instead, it dropped below the $87k support level over the weekend.

At press time, BTC is trading above $87,800. The momentum indicators remain bearish despite the rebound.

If the recovery continues and Bitcoin’s daily candle closes above $87,878, the leading cryptocurrency could extend its recovery toward the nearest resistance level at $90,000.

The Relative Strength Index (RSI) on the daily chart is 39, below the neutral 50 level, indicating bearish momentum.

BTC will remain below $90k if the RSI fails to move past the neutral 50 level.

In addition to that, the Moving Average Convergence Divergence (MACD) showed a bearish crossover last week, and the view remains in place.

Thus, suggesting a bearish market condition.

If the bulls fail to push BTC above the $90k level in the near term, the bearish trend could continue, and BTC could drop below the $85,569 support level, which coincides with the 78.6% Fibonacci retracement region on the daily chart.

On the macro view, Bitcoin’s price action remains choppy, with no clear direction in the near term.

invezz.com

invezz.com