Rewards for holding bitcoin BTC$89,477.17 are not worth the wild ride anymore.

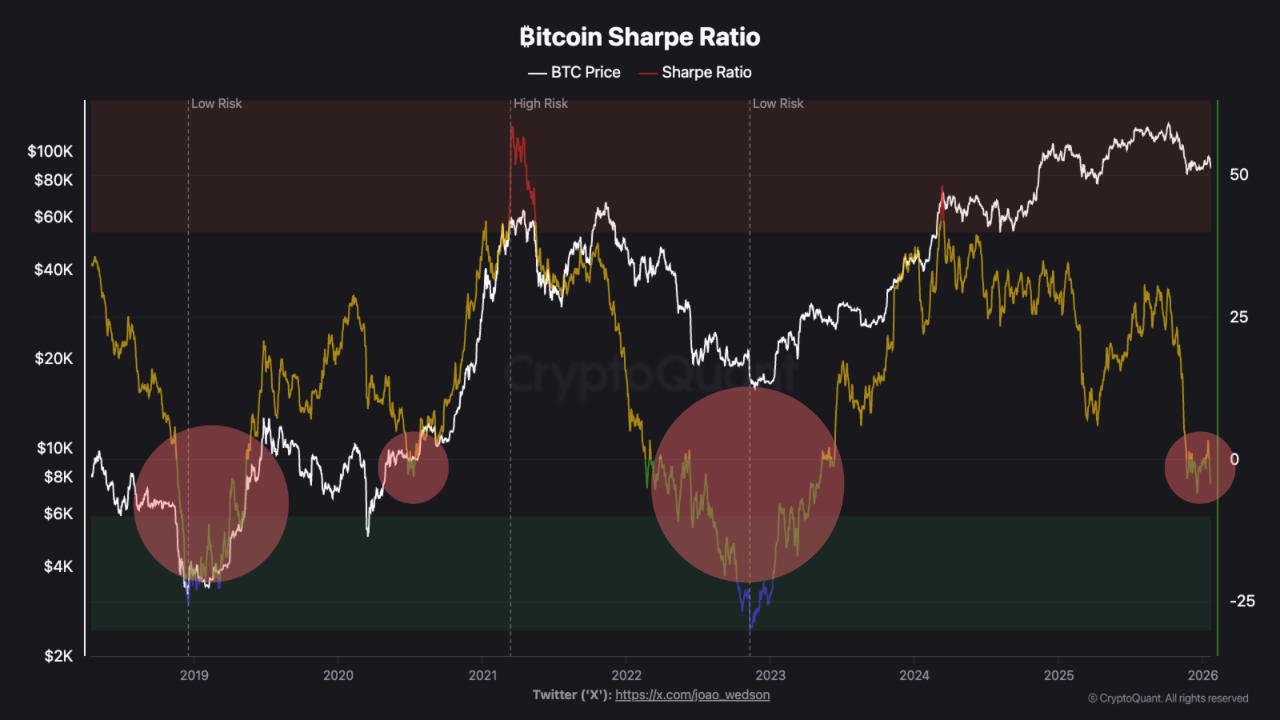

That's the signal from bitcoin's Sharpe Ratio, a tool fund managers use to check if an investment's extra profits (above safe options like U.S. Treasury bills) compensate for volatility risks.

The ratio has turned negative for bitcoin, according to data source CryptoQuant, indicating that returns no longer justify the roller coaster ride. Its reflective of an environment where sharp intraday swings and uneven rebounds have failed to deliver returns. Prices may be well off recent highs, but volatility remains elevated, compressing risk-adjusted returns.

This comes as BTC has pulled back to $90,000 since hitting record highs above $120,000 in early October.

We saw similar negative sharpe ratio readings at the depths of the previous bear markets. Hence, some on social media are viewing the latest negative print as a sign the downtrend in BTC prices is over, and a new bull run may begin soon.

However, the negative reading does not necessarily imply a renewed uptrend. That's because, the Sharpe ratio, which measures risk-adjusted returns, reveals the current state of the market and not future performance.

"The Sharpe Ratio doesn't call bottoms with precision. But it shows when risk-reward has reset to levels that historically precede major moves. We're oversold. The kind that breeds opportunity—lower risk for long-term positioning, not because price can't go lower, but because the risk-adjusted setup favors it," analyst at CryptoQuant said in a blog post.

In late 2018, the ratio stayed negative for months as prices continued remained depressed. A similar pattern emerged in 2022, when the metric remained depressed throughout a prolonged bear market triggered by leverage failures and forced selling.

Basically, the negative sharpe ratio condition can persist long after prices stop falling sharply.

What traders typically watch instead is how the metric behaves after prolonged weakness. A sustained move back toward positive territory often signals improving risk-reward dynamics, where gains begin to outpace volatility, a pattern historically aligned with renewed bull runs.

As of now, there are no signs of renewed bullishness in bitcoin. The cryptocurrency traded near $90,000, close to ending a week marred by unusual see-saw volatility and underperformance against gold, bonds and global technology stocks.

coindesk.com

coindesk.com