Whenever Wall Street experts discuss Bitcoin (BTC), they tend to go one of two ways: either they forecast unimaginable future adoption and sky-high valuations, or negate its worth altogether.

GJL Research’s Gordon Johnson – otherwise known as one of the most bearish analysts covering Tesla (NASDAQ: TSLA) stock – appeared to be in the latter category when he took to X on January 20 to reply to the question of why Bitcoin is crashing while Gold is skyrocketing.

In a nutshell, the Wall Street expert stated BTC and other cryptocurrencies have ‘ZERO value,’ while providing four key reasons for why this is the case.

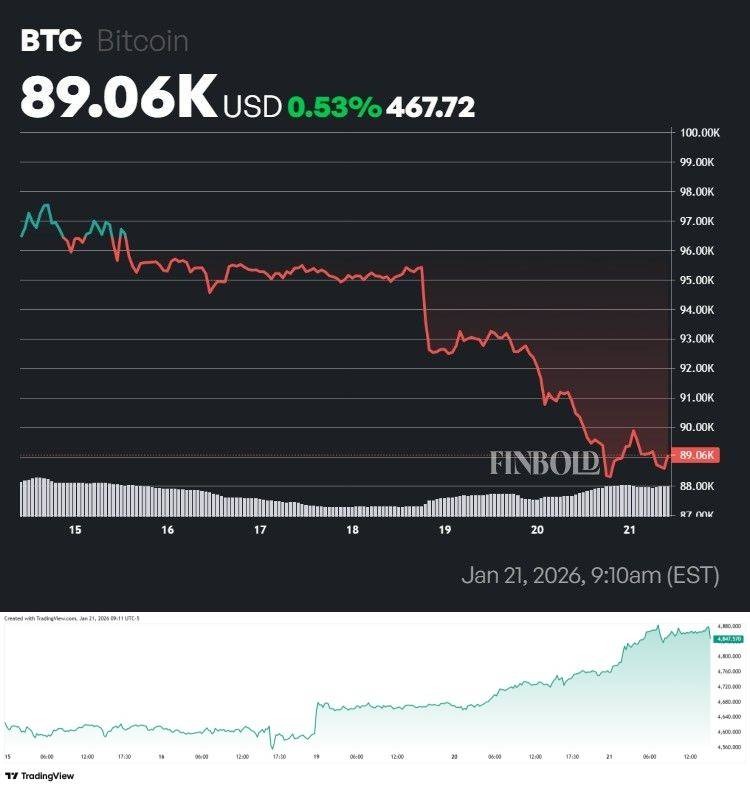

It is noteworthy that both the question and the retort were prompted by the latest developments in both the crypto and commodity markets. On Sunday, January 18, Bitcoin initiated a crash that took it from approximatelly $95,000 to its press time price of about $89,000.

Simultaneously, gold saw a significant rally from roughly $4,550 to its press time levels near $4,860.

Bitcoin is worthless because it is useless

According to Johnson, the first reason why Bitcoin is worthless is a lack of a clear use case for the underlying technology.

Furthermore, the analyst emphasized the relatively recent trend that saw most cryptocurrency use be directed toward easier online gambling – or making predictive trades, as the marketing teams would have it – via platforms like Polymarket.

Though the argument might be strange to many blockchain experts and developers, it is a relatively common sentiment based on the notion that the majority of uses for digital assets have been different – and oft more expensive – ways of doing what the existing digital infrastructure was already accomplishing.

It is, however, worth pointing out that many technology experts, including those with no interest or affinity for cryptocurrencies themselves, believe there are problems in which the implementation of blockchain can be highly beneficial, with digital identity and supply chain management being some frequently-cited examples.

Bitcoin has no value because it can’t be money

Gordon Johnson also opined that Bitcoin and digital assets have no value because they are ‘not a real currency & can’t act as one.’ The Wall Street analyst singled out Bitcoin’s fixed supply as a crucial reason.

It is true that historically, minting and issuing additional currency has been a common economic tool, both before the ‘Gold Standard’ was established in the modern sense, and before it was abandoned, not just in modern times.

CLARITY Act makes it clear cryptocurrencies are securities

Another controversial take given by Johnson as a reason is the claim that ‘all cryptos are unregistered securities.’

While the digital assets sector has been fighting such a notion for years, and seemingly won a major regulatory victory as Ripple Labs – the company behind XRP – settled its long-standing case with the Securities and Exchange Commission (SEC), recent developments brought renewed cause for uncertainty.

Specifically, Cardano’s (ADA) Charles Hoskinson emphasized in a recent broadcast on X that the CLARITY Act – a contentious government bill aimed at providing a clear legal framework for cryptocurrencies in the U.S. – appears to have reset the board, depowering the CFTC, empowering the SEC, and labeling all new projects as ‘securities’ by default.

Cryptocurrencies will fail because ‘private money’ always fails

The Wall Street analyst’s final point might be the simplest. Per Johnson’s X post, ‘private currencies have ALWAYS BEEN DISASTERS.’ Indeed, there have been multiple times in history in which corporations, or minor regional magnates, attempted to issue their own money.

More often than not, such drives led to widespread instability, impoverishment, fraud, and debasement. Similarly, and again, more often than not, the problems such practices caused were resolved by a national authority – whether it be a royal mint, or a central bank – proliferating its own currency and curtailing private issuers.

In North America, for example, the heyday of private money coincided with the age of the snake oil salesman – perhaps an apt mental link given the ubiquity of fraud and ill-advised projects within the cryptocurrency sector.

Still, Bitcoin appears like a poor example of the problem, considering that, unlike many of its peers, it is neither truly issued nor governed by private entities and has, so far, been successful at resisting dominance by various cabals.

Gordon Johnson’s value case for the Gold price rally

Lastly, Gordon Johnson’s explanation for why gold is valuable is why it has been going up while cryptocurrencies have been faltering is, arguably, even more simplistic than the fourth point against cryptocurrencies. As the expert noted:

Gold, on the other hand, doesn’t need a narrative. It has had value for all of recorded history, across every regime, currency, and crisis. That’s the entire argument.

As with the majority of his other points, Johnson’s remark about gold harkens back to the proponents and opponents of gold in equal measure. In a nutshell, gold is valuable because it has always been valuable and, one might add, it has always been valuable because it is shiny and has, historically, been somewhat scarce.

Featured image via Shutterstock

finbold.com

finbold.com