Bitcoin, the digital darling of financial disruption, clocked in at a price of $88,199 on Wednesday, Jan. 21, 2026. The crypto asset’s market cap stood at a formidable $1.77 trillion, backed by a 24-hour trading volume of $58.07 billion. With an intraday range stretching from $87,777 to a high-flying $91,201, bitcoin flirted with both danger and opportunity — the kind of volatility that gets chart-watchers reaching for their Fibonacci tools before their coffee.

Bitcoin Chart Outlook

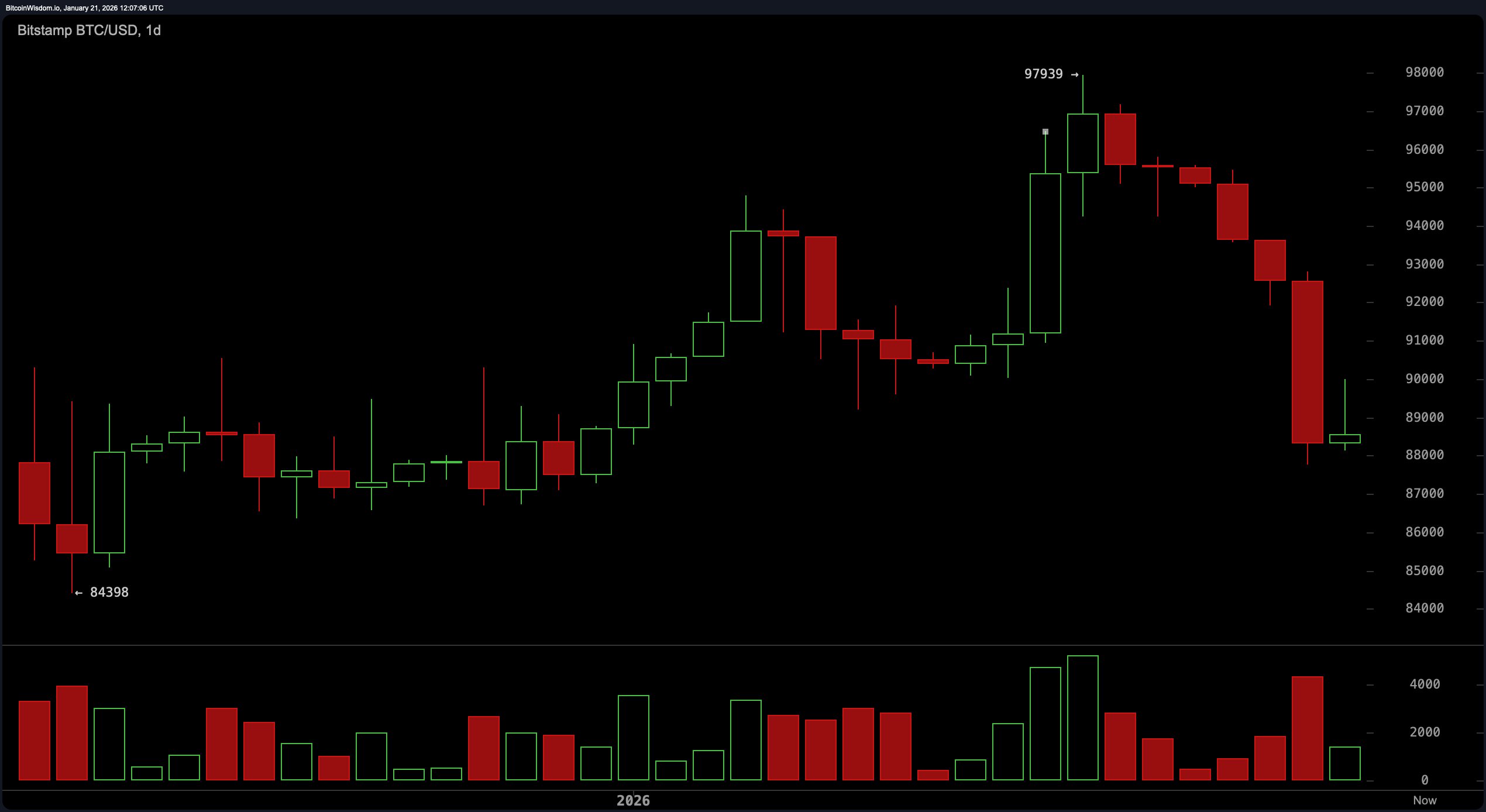

On the daily chart, bitcoin has clearly exited its parabolic sprint and taken a detour into a sobering correction phase. A recent peak around $97,939 is now a distant memory as the price settled closer to $88,000, where a long lower wick signals potential support amid seller exhaustion.

The uptick in volume on a sharp red candle hints at panic-driven liquidation, not strategic exits. Bearish engulfing patterns on this timeframe are throwing shade on bullish hopes, but the long tail suggests dip-buyers are still lurking. If the price consolidates with narrowing candles above this support and declining volume, a return to the $92,000–$94,000 resistance region remains plausible.

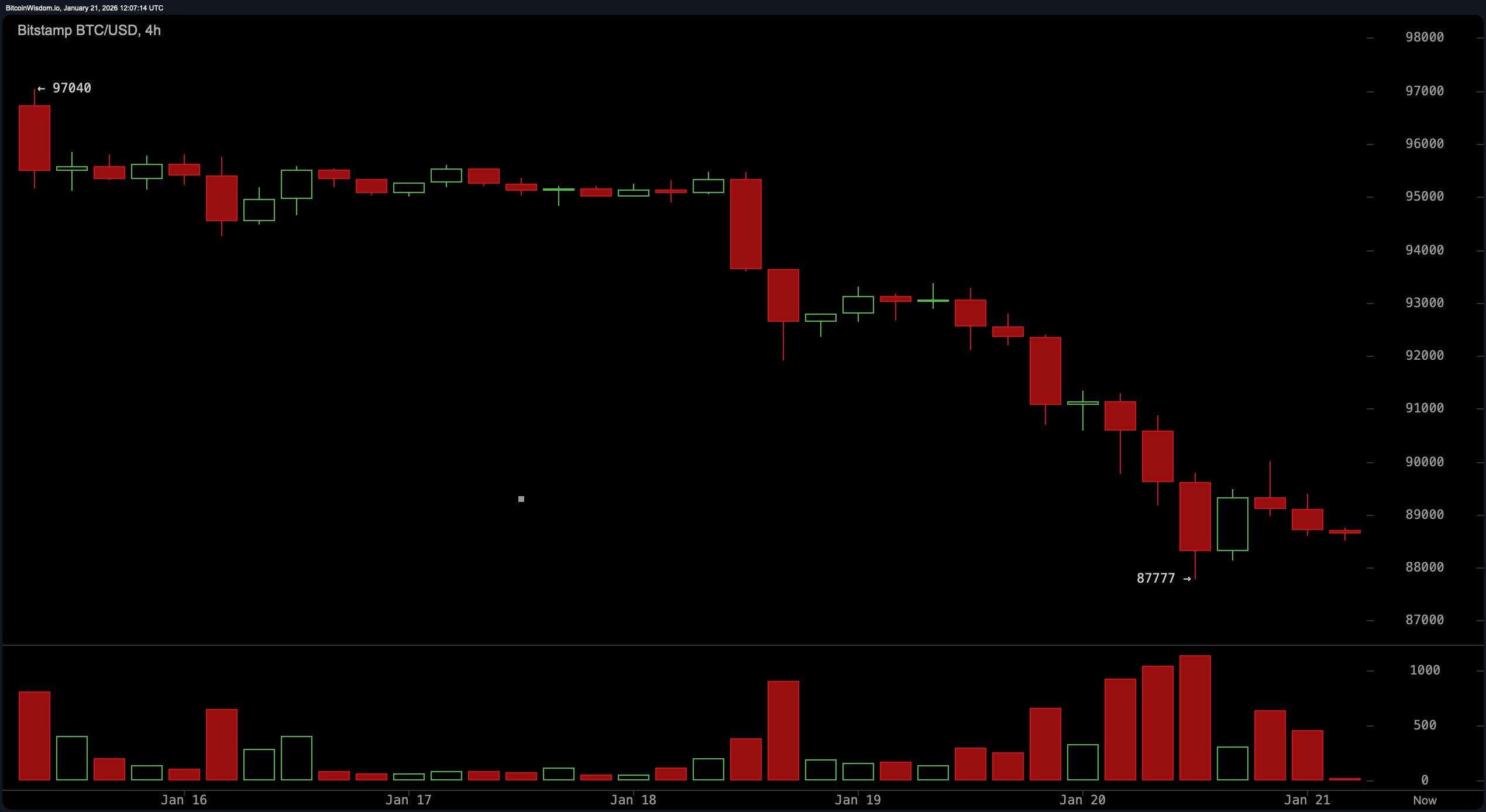

The four-hour chart tells a more somber tale, complete with textbook lower highs and lower lows—classic symptoms of a bearish grip. A temporary reprieve emerged at the $87,777 mark, yet red volume bars assert dominant selling pressure. Still, the recent fade in bearish momentum may offer temporary respite if a double bottom or a higher low above $88,500 forms. Any decisive move above $90,000 could target $91,500–$92,000, but without a strong reclaim, a retreat toward $87,000 remains on the table. The chart is whispering caution louder than a Wall Street analyst during earnings season.

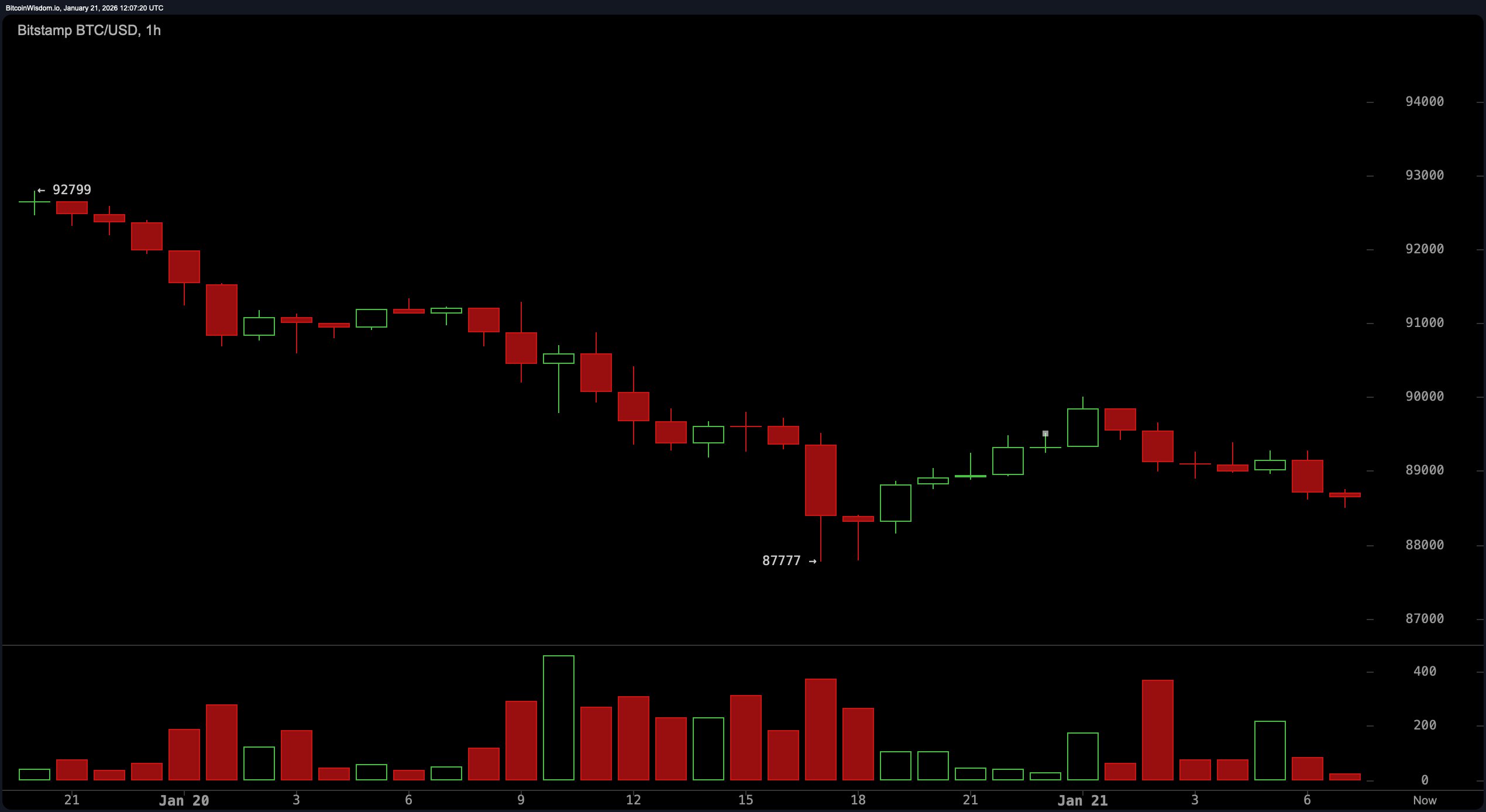

Zooming in to the one-hour timeframe, the market appears to be writing a suspenseful script, coiling into a descending triangle or perhaps a classic bear flag. The bounce from $87,777 lacked the celebratory volume needed to spark real confidence. Green candles appeared, sure — but without the volume to throw a party, they’re just noise. If $88,000 holds and price cracks through $89,000 with momentum, a quick push to the $90,000–$91,000 region is conceivable. But if bitcoin breaks south of $88,000 with conviction, targets between $85,500 and $86,000 come sharply into focus.

The oscillators on Wednesday are also showing their poker faces. The relative strength index ( RSI) holds at 41, the stochastic oscillator at 17, and the commodity channel index (CCI) deep in negative territory at −112 — all signaling neutrality. The average directional index (ADX) sits at 30, indicating a trend with some muscle, though not yet a powerlift. The awesome oscillator echoes neutrality, while the momentum indicator and the moving average convergence divergence ( MACD) level flash warnings with negative readings, hinting at latent bearish undertones. In this environment, momentum traders should mind the exits — and maybe double-check their stop losses.

The moving averages? They’re not here to comfort anyone. All tracked moving averages — including exponential moving average (EMA) and simple moving average (SMA) over 10, 20, 30, 50, 100, and 200 periods — are stacked against bullish narratives. The 10-period EMA at $91,912 and the 10-period SMA at $93,289 are both trading well above current price, reinforcing downside pressure. The 200-period EMA and SMA stretch as far as $99,126 and $105,535, respectively, giving bitcoin bulls a very long road ahead if they hope to reclaim dominance. For now, the trend is not their friend — it’s their probation officer.

Bull Verdict:

If $88,000 holds firm and bitcoin musters enough volume to breach $89,000, momentum could shift toward the $90,000–$94,000 resistance corridor. This setup would align with a bounce from critical daily support and short-term exhaustion in selling pressure, offering traders a textbook recovery play. But without follow-through, it’s just another head fake in a volatile market — so bullish optimism must be paired with tactical discipline.

Bear Verdict:

The structure remains precariously tilted toward further downside, with every major moving average towering above the current price like bearish sentinels. Should bitcoin crack below $88,000 with volume, the next stop could be the $85,500–$86,000 range, confirming a breakdown from current consolidation patterns. Until key resistance levels are decisively reclaimed, the bears keep the upper hand — smug and chart-compliant.

FAQ 🐂 🐻

- What is the current price of bitcoin? Bitcoin is trading at $88,199 as of Jan. 21, 2026, at 7:30 a.m. EST.

- What key support level should traders watch?The $88,000 level is acting as critical short-term support.

- Where is the next major resistance for bitcoin?Resistance is building around the $90,000 to $94,000 range.

- Is bitcoin in a bullish or bearish trend right now?Current indicators point to a bearish trend with weak recovery signals.

news.bitcoin.com

news.bitcoin.com