Bitcoin just briefly went below $90,000 as traders panic-sell risk assets amid a meltdown in Japan’s government bond market, while U.S. President Donald Trump increases tariff threats against Europe. This is CoinDesk's markets liveblog. This liveblog will be updated regularly. Scroll down for the latest.

Francisco Memoria, CoinDesk reporter (4:12pm UTC):

The sell-off is also bringing down crypto-linked equities. Coinbase (COIN) shares are down 3.79% to $232.01, while CleanSpark (CLSK), a bitcoin miner, dropped 3.07%.

Ether treasury companies SharpLink Gaming (SBET) and Bitmine Immersion Technologies (BMNR) led the declines, each down more than 7%.

Bitcoin treasury giant Strategy (MSTR) wasn’t spared, falling 6.78% to $161.94. Galaxy Digital (GLXY), which provides financial services tied to digital assets, lost 1.87%. Among the top performers was CoinDesk’s parent company Bullish (BLSH), down 0.1%.

Krisztian Sandor, CoinDesk markets reporter (4:15 UTC):

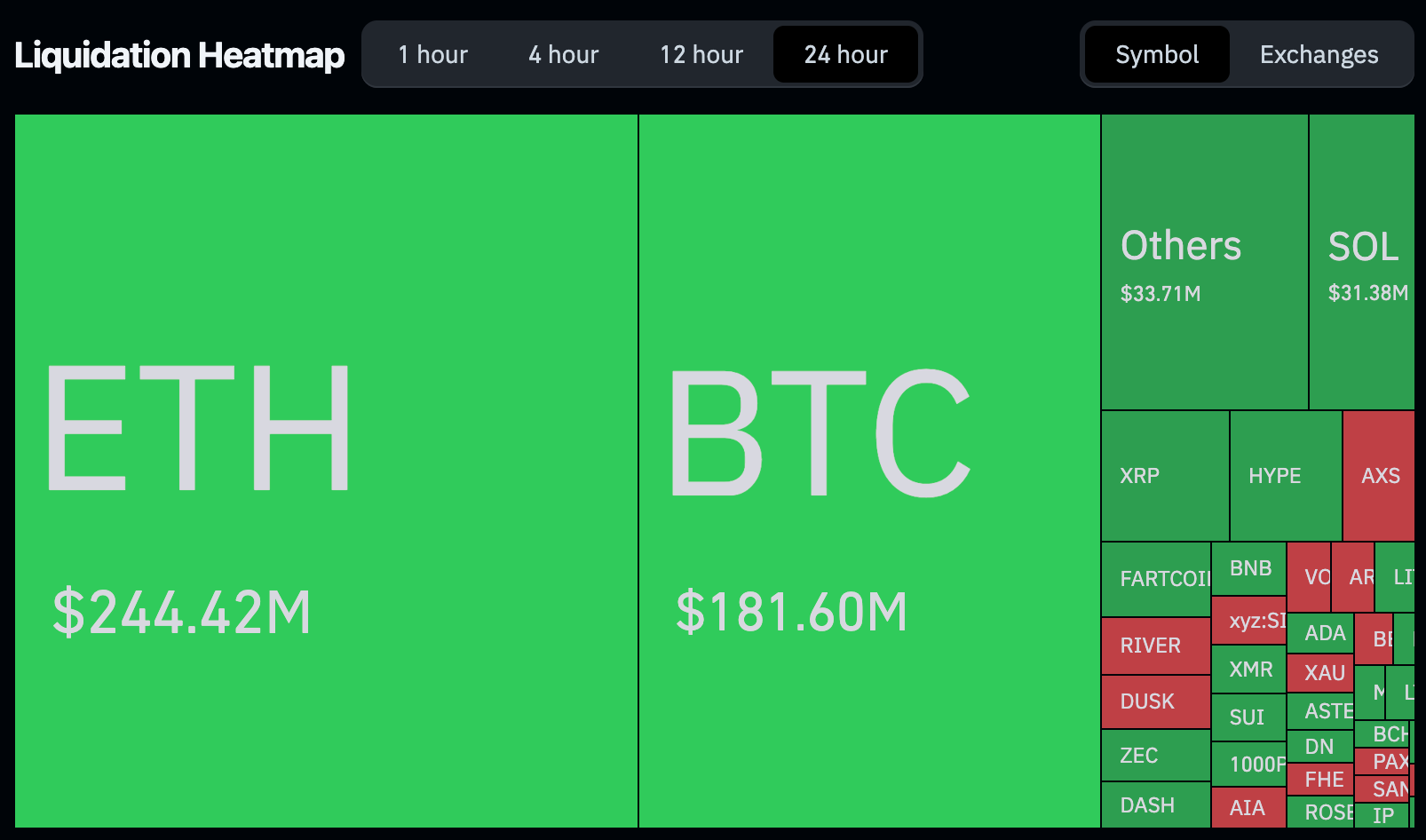

Amid the chaos $486 million in longs were liquidated so far on Tuesday across all assets, trailing Monday's $637 million, per Coinglass. Marking the worst two-day streak for longs this year.

Gold (and silver) bugs have their day again (Steve Alpher, CoinDesk markets Senior Editor, 4:20 UTC)

"What’s happening with silver is about to happen with bitcoin, only in reverse," wrote Peter Schiff as silver soared more than 7% to above $95 per ounce. "Silver’s spectacular rise will usher in Bitcoin’s catastrophic collapse. Don’t say I didn’t warn you."

"9 years ago CNBC's Tim Seymour called Bill Fleckenstein 'pathetic' for being long gold (then $1,400) and saying Japan's bond market would crack ... Today gold is $4,700 and Japan's bond market has just cracked," wrote Quoth the Raven.

"Gold correlating with JGB yield ... bitcoin correlating with JGB price," wrote ZeroHedge.

coindesk.com

coindesk.com